The name Palantir. Sounds like something out of Tolkien, doesn’t it? A seeing stone. Fitting, in a way. They don’t deal in magic, of course. Just data. Mountains of it. And they’ve built a business turning that data into something…useful. Or dangerous, depending on who’s asking. For years, they were whispers in the corridors of power, a favorite of the Department of Defense. Now? They’re showing up everywhere, promising to make corporations efficient. Efficiency. A cold word. Like a steel trap.

They call it Artificial Intelligence. AI. The latest craze. Everyone’s chasing the phantom of automated profit. Palantir wasn’t born in this rush, though. They were digging in the dirt before the gold rush even started. They built their platform, AIP, to handle the messy, complicated stuff. Ontologies, they call the maps they create. Detailed layouts of a company’s data, zooming in on every little transaction, every whispered secret. It’s like an autopsy of a business, laid bare for anyone with the key.

The market, naturally, is salivating. Analysts are tossing around numbers in the trillions. A total addressable market. TAM. It’s a seductive phrase, isn’t it? Like a siren’s call. But numbers are just shadows. It’s what those shadows conceal that matters.

The Acceleration

The latest earnings report? A knockout, they said. Revenue up 56%. U.S. private sector sales soaring. It’s a pretty picture. But growth isn’t always what it seems. Hypergrowth companies often burn cash, sacrificing profit for expansion. Palantir isn’t playing that game. They’re profitable. Generating real money. $1.6 billion in net income. That’s not a whisper, that’s a shout. They’re building something that lasts, not just a bubble waiting to burst.

They’re still scratching the surface, of course. That expanding TAM is a vast ocean, and Palantir is still a small boat. But they’ve got a compass, and a crew that knows how to navigate the storms.

The Price of Seeing

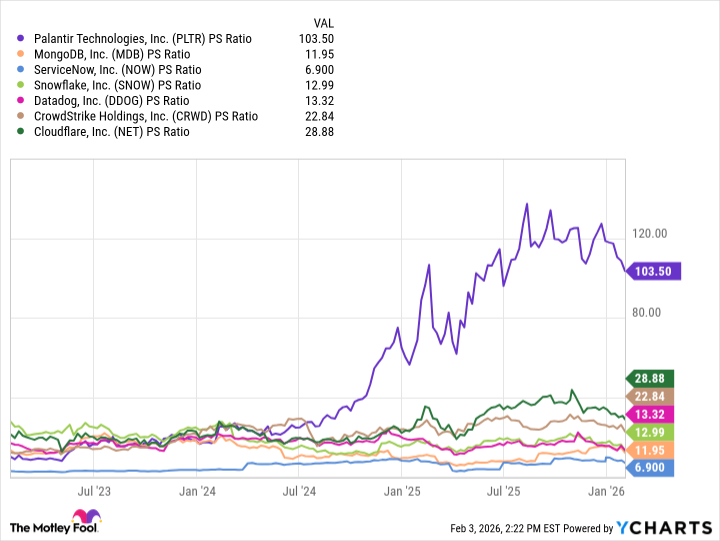

Here’s where things get interesting. The valuation. It’s…ambitious. A price-to-sales ratio of 103. Unparalleled, they say. It’s like paying a king’s ransom for a glimpse into the future. Investors are willing to pay a premium for growth, for profitability. Palantir delivers on both fronts. But it’s a risky bet. A high-wire act with no safety net.

Smart money doesn’t go all in. They spread their bets. Dollar-cost averaging, they call it. A fancy way of saying “don’t put all your eggs in one basket.” It’s a sensible strategy. A slow burn, rather than a spectacular explosion.

Palantir isn’t one of the “Magnificent Seven,” the usual suspects in big tech. They’re something different. A shadowy operator, working behind the scenes. But they’re a force to be reckoned with. A compelling opportunity, if you’re willing to look beyond the hype, and see the shadows for what they are. A business built on data, algorithms, and the unsettling power of knowing too much.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- XRP’s $2 Woes: Bulls in Despair, Bears in Charge! 💸🐻

- PLURIBUS’ Best Moments Are Also Its Smallest

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

2026-02-06 17:22