The pronouncements of analysts are often best regarded with a degree of skepticism. Yet, the name of Daniel Ives carries a certain weight, not because he possesses foresight, but because he consistently articulates what is already apparent to anyone bothering to observe the flow of capital. He identifies trends, not predicts them. His recent affirmation of Palantir Technologies, a company that has enjoyed a substantial increase in valuation over the past three years, is a case in point. The suggestion of a further 46% gain within the next twelve months is less a prediction than a reflection of current market enthusiasm.

Ives, it seems, is willing to overlook short-term instabilities, a habit common to those who profit from the long game. Last year’s anxieties regarding tariffs proved largely unfounded, largely because political expediency superseded economic logic. Those who heeded his advice – or, more accurately, who simply continued to hold their positions – were rewarded. This is not brilliance; it is a recognition of inertia. Markets rarely deviate wildly from established trajectories.

An Analyst’s Favorite

Palantir, a company dealing in data aggregation and analysis, has long been a favored subject of Ives’s commentary. It is a business that, on the surface, appears to offer genuine utility. The company provides software allowing clients to sift through vast quantities of information, identify patterns, and make – theoretically – more informed decisions. Its recent earnings reports, consistently positive, have fueled the current market optimism. The company’s Artificial Intelligence Platform (AIP) is presented as a key driver, capitalizing on the current, and largely unsubstantiated, fervor surrounding artificial intelligence.

The Illusion of Value

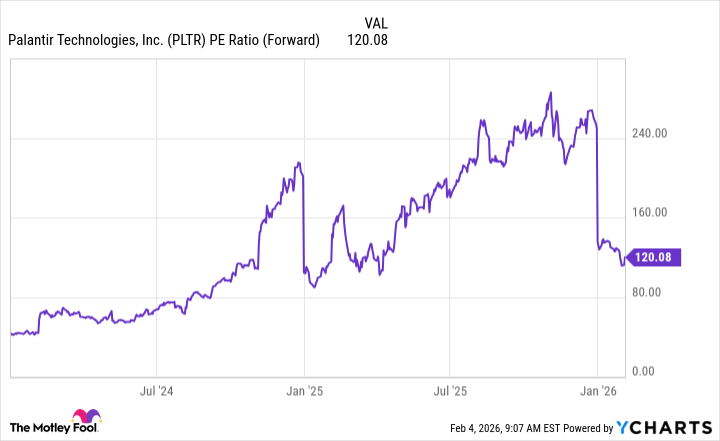

The primary concern, as always, is valuation. Palantir’s stock, while having retreated somewhat from its peak, remains expensive by conventional metrics. The usual defenses – growth potential, market leadership – are trotted out. However, these arguments often rely on projections that are, at best, optimistic. The claim that current valuations are justified by future earnings is a familiar refrain, one that history suggests should be treated with caution. It’s a gamble, presented as analysis.

A sober assessment requires consideration of a company’s track record, the robustness of its products, and the broader economic climate. Palantir, undeniably, possesses a degree of momentum. Whether that momentum will translate into sustained growth – and justify the current price – remains to be seen. For those inclined to speculate, it offers a potential reward. However, for the discerning investor, a degree of skepticism is not merely prudent; it is essential. The AI boom, like all booms, will eventually encounter gravity. And when it does, valuations will adjust accordingly. The question is not whether Palantir is a good company, but whether its price adequately reflects the inherent risks – and the inevitable realities – of the market.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Noble’s Slide and a Fund’s Quiet Recalibration

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Tainted Grail: The Fall of Avalon Expansion Sanctuary of Sarras Revealed for Next Week

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

2026-02-06 13:23