![]()

Micron Technology… a name whispered now with a certain… fervor. The stock, it seems, refuses to succumb to the gravity that pulls down all earthly things. A climb of 239% in the last year, and still, it ascends! Another 50% gained merely months into the current cycle. One begins to suspect a defiance of natural law, a mocking of the very principles of cyclicality upon which we base our fragile hopes.

The current rally… it is not merely a matter of supply and demand, though those forces certainly play their part. It is a fever dream, fueled by the insatiable hunger of data centers, the ceaseless chatter of smartphones, the quiet desperation of personal computers. A world demanding more memory, more storage, more… something to fill the void. And Micron, it seems, is positioned to answer that desperate call.

Let us delve, then, into the labyrinth of catalysts that might propel this semiconductor stock even higher. For within this relentless climb, there lies a question that haunts the discerning investor: is this a sustainable ascent, or a prelude to a catastrophic fall?

The Weight of Expectation

The demand for memory chips… it has become a monstrous thing, exceeding supply to a degree that borders on the unsettling. The undersupply, of course, has driven prices upwards, a predictable consequence. Gartner predicts a 47% increase in DRAM prices – DRAM, the very foundation of modern computation – and nearly 80% of Micron’s revenue is tied to this volatile commodity. A dangerous dependency, one might argue, but a profitable one, at least for the moment.

DRAM, that tireless worker, enhancing the power of data centers, smartphones, and PCs. It allows these devices to read and write data with a speed that borders on the miraculous. And yet, even this miracle is subject to the whims of the market. Meanwhile, NAND flash memory, the storage of our digital souls, is also experiencing a surge in demand. TrendForce anticipates a 55-60% jump in contract prices, a figure that speaks volumes about the growing desperation for storage capacity. The relentless march of artificial intelligence, of course, is the primary driver, demanding ever more compute and storage memory chips. It is a cycle of insatiable appetite, a digital ouroboros consuming its own tail.

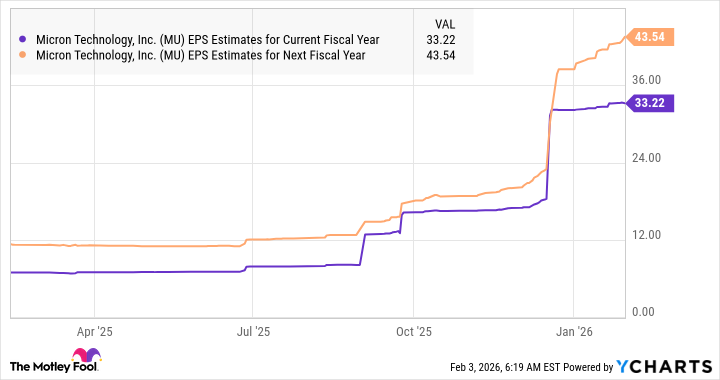

Micron posted $8.29 per share in earnings last fiscal year. Now, projections suggest a leap to over $43.54 within two years. A fivefold increase! The numbers, they tantalize, they beckon… but can they be trusted? The valuation, it suggests that the company’s growth potential is not yet fully reflected in the stock price. A dangerous complacency, perhaps? Or a rational assessment of the inherent risks?

The Fragility of Ascent

The stock has enriched investors, undoubtedly. But it trades at a mere 13 times forward earnings, half that of the Nasdaq-100. A bargain, some might cry. A warning sign, others will whisper. For in the world of finance, nothing is truly cheap. Everything carries a hidden cost, a latent risk. Let us indulge in a hypothetical exercise. If Micron were to trade at 20 times earnings by the end of next fiscal year, with earnings of $43.54 per share, the stock price would soar to $871. Almost double its current level. A tantalizing prospect, to be sure. But what if the earnings projections prove to be… optimistic? What if the market turns sour? The abyss, it always waits.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- XRP’s $2 Woes: Bulls in Despair, Bears in Charge! 💸🐻

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Noble’s Slide and a Fund’s Quiet Recalibration

2026-02-06 12:12