Okay, so everyone’s talking about AI stocks. Like it’s some kind of magic bean. Double digits, triple digits… it’s exhausting. And the hype? Don’t even get me started. It’s all “innovation” and “efficiency.” Like suddenly everyone cares about those things. But here’s the thing: companies are spending money. Lots of it. And they expect… something. Growth, obviously. But the assumption that spending automatically equals results? That’s where I draw the line. It’s just… presumptuous.

Now, Microsoft. They’re in this AI thing. Big time. And Wall Street is predicting a 46% jump in the next year. 46%! It feels… aggressive. But, and this is a big but, the stock is… reasonably priced. Which is practically unheard of these days. It’s like finding a parking spot in Manhattan. Almost suspicious.

An Early… Participant

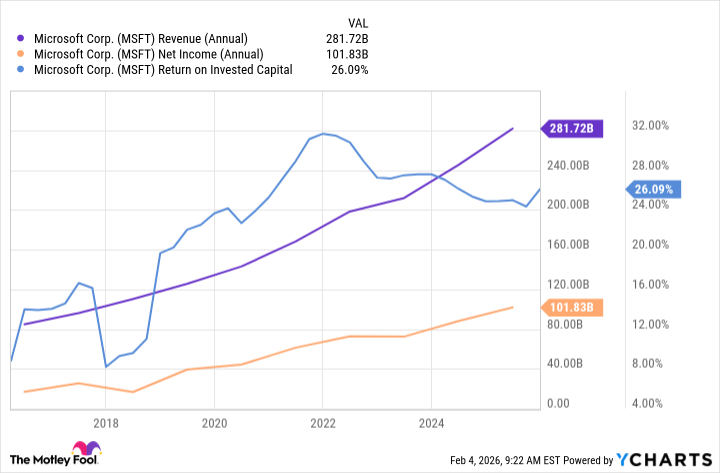

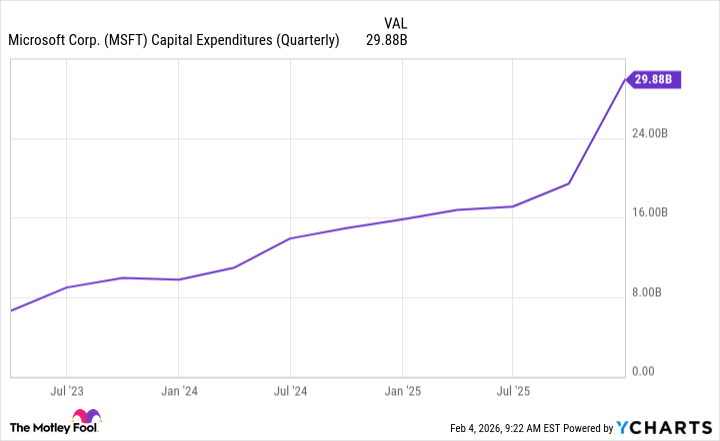

Microsoft’s been dabbling in AI before it was cool, which, let’s be honest, is just annoying. Like they’re trying to corner the market on… progress. They do cloud stuff, software, gaming, advertising… the whole shebang. They throw money at things, and usually, something sticks. Return on invested capital. They love that metric. It’s like a badge of honor. “See? We spent money, and we got more money back!” Groundbreaking. But here’s the kicker: they’re spending even more money now. A lot more. And they expect… you guessed it… more back.

The stock went down recently. A ten percent drop after an earnings report. They beat expectations! Beat them! But investors were…disappointed. Disappointed! Apparently, the spending wasn’t translating into enough growth. It’s like ordering a large pizza and getting a medium. You’re not necessarily angry, just… let down. They’re building out AI infrastructure. More servers, more chips, more everything. And all for… what? To power those graphics processing units. GPUs. It sounds so… technical. And expensive.

Spending vs. Growth. It’s a Thing.

Apparently, some investors expected more cloud growth. More! Like they’re entitled to it. The CFO, Amy Hood, explained that if they’d used all the AI chips for the cloud, growth would have been stronger. But they didn’t. They spread them around. Across all their businesses. It’s like having a limited-edition bottle of wine and sharing it with your extended family. It’s just… illogical. They’re balancing needs. Balancing! As if that’s some kind of virtue. It’s a business. Focus on the thing that’s actually making money!

They’re making long-term decisions. That’s what they say. Long-term. As if that justifies everything. It’s an excuse. It’s like saying, “I’ll clean the garage… eventually.” It’s cheap right now, though. 24 times forward earnings. The cheapest it’s been in three years. Which is… something. It’s like finding a decent bagel on a Sunday morning. A small victory.

A Company That’s… Still Around

They’ve proven they can spend money and get more money back. Historically. That ROIC thing again. It’s a pattern. A habit. And they expect that to continue. With AI. Of course. The AI market is going to be in the trillions. Trillions! It’s just… a lot of money. It’s enough to make you suspicious. But the stock could still go up. Even if Wall Street is wrong. Which, let’s be honest, they usually are. It’s not about predicting the future. It’s about… finding something that’s not completely broken. And Microsoft… well, they’re still around.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- Noble’s Slide and a Fund’s Quiet Recalibration

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- PLURIBUS’ Best Moments Are Also Its Smallest

2026-02-06 02:53