One hears that Starbucks (SBUX 0.96%) shares are up a paltry 13.7% this year. Frankly, one has seen more thrilling rallies in a game of croquet. Wall Street, it seems, was briefly amused by their latest earnings report – growing same-store sales and a 5% bump in revenue. A mere 128 new coffeehouses globally. Good heavens. It’s the most triumphant report since someone of actual competence took the reins, though one suspects even that’s a generous assessment.

I, naturally, hold a few shares. A speculative flutter, really. But despite this minor uptick, I shan’t be adding to the position. Statistics, however hopeful, are simply that – numbers. And one particular number is proving decidedly tiresome. A turnaround could occur, of course. But one isn’t holding one’s breath. There’s a distinct lack of fizz.

The Starbucks Predicament

The share price is up, yes. But down a rather alarming 24% from its peak in July 2021. One recalls those days with a shudder. Back then, Starbucks was positively brimming with…something. Two-year U.S. revenue growth of 16%. Two-year same-store sales up 10%. A million new Starbucks Rewards members. A veritable explosion of enthusiasm. And in China? A surge of 45%! Net earnings of $1.15 billion. A positively vulgar display of prosperity.

Last quarter, however? A mere $293.3 million in net income. A 75% decrease. A catastrophe, darling. They attribute much of this to their deal in China – turning over operations to Boyu Capital. Apparently, they’re handing over up to 60% of the retail operation. One doesn’t quite see it as a silver lining, frankly. The notion that Starbucks was poised to tap into the burgeoning Chinese middle class was, admittedly, appealing. But selling off a majority stake for a mere $4 billion? One suspects Mr. Niccol believes his 8,000-store China presence is worth a scant $6.7 billion, plus a few hopeful licensing fees. A rather desperate maneuver, wouldn’t you agree?

They’re ceding all store operating expenses to Boyu Capital, naturally. Saving $39 million a month by not bothering with upkeep. One wonders if these stores will be in good hands. Boyu Capital is a large private equity firm, certainly. But their experience with global brand consumer and retail investments appears…limited. It’s reminiscent of a particularly ill-advised gamble at the casino.

McDonald’s, one recalls, owns very few of its stores directly. But that’s McDonald’s. And this is…well, this is Starbucks. One sincerely hopes it doesn’t prove to be a regrettable error.

The Dividend Hunter’s Disqualification

They now boast 35.5 million active Starbucks Rewards members, which is a slight improvement on the 24 million at the peak. And their U.S. store count has risen to 16,911 – a 10% increase. All very commendable, naturally. But let’s not get carried away.

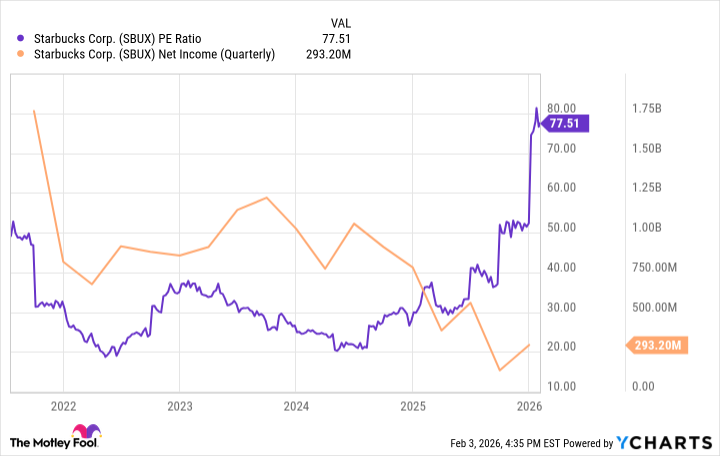

Look at the price-to-earnings ratio. Good heavens, it’s positively alarming.

A P/E ratio of nearly 78? The share price has fallen 24%, yet net income has plummeted far more dramatically. It’s rather like watching a perfectly good soufflé collapse. Compared to the S&P 500 average of 29.5? Utterly preposterous. Starbucks is priced as if this miraculous turnaround is already a fait accompli. One simply doesn’t like being at such a disadvantage. I might, in fact, be considering a discreet exit. It’s all rather tiresome, really. One prefers investments that offer a bit more…certainty. And a decent dividend, naturally.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Noble’s Slide and a Fund’s Quiet Recalibration

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- XRP’s $2 Woes: Bulls in Despair, Bears in Charge! 💸🐻

- Tainted Grail: The Fall of Avalon Expansion Sanctuary of Sarras Revealed for Next Week

2026-02-06 02:33