Essential Bits and Bobs:

- Polymarket punters are convinced there’s a 72% chance our dear Bitcoin will take a nosedive to $65,000, which is rather like predicting rain in London – bound to happen sooner or later.

- We’re witnessing an intriguing game of musical chairs as capital twirls from the spot market into infrastructure ventures, particularly those nifty Bitcoin Layer 2 solutions that promise to untangle the scalability mess.

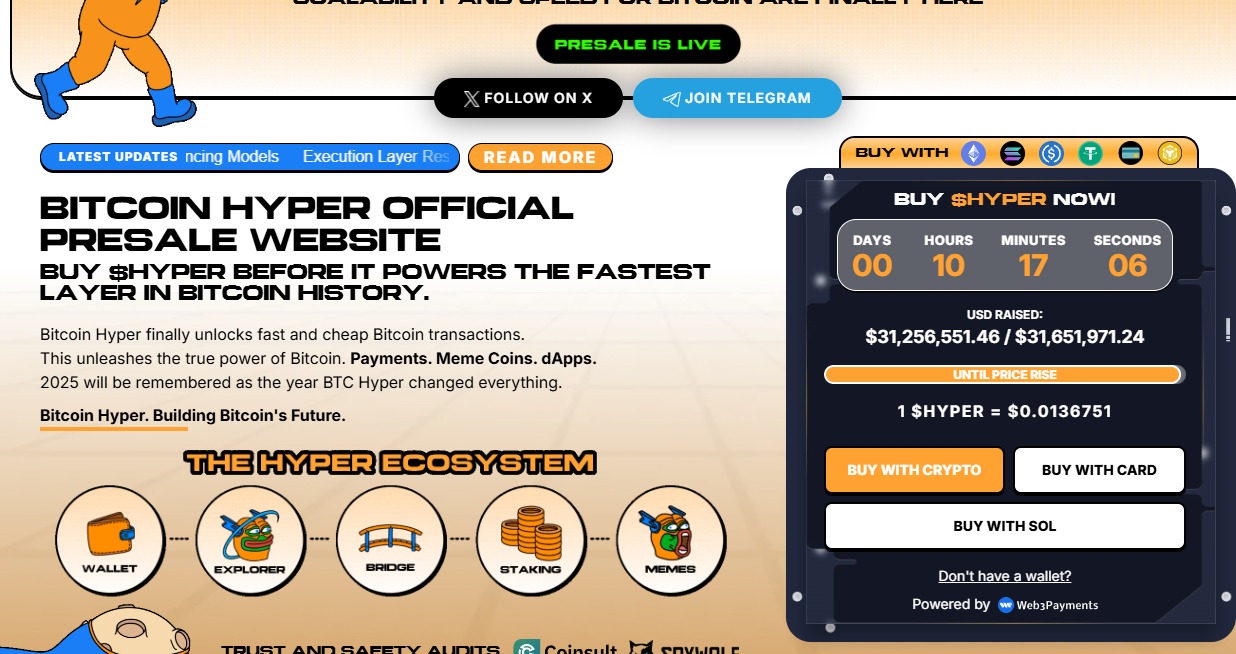

- Bitcoin Hyper ($HYPER), not to be outdone, has gallantly raised over $31.2 million by touting the first SVM-integrated L2, which aims to bring Solana’s lightning speed to Bitcoin’s rather sluggish dance floor.

- Whale watchers confirm that the big fish are swimming in with their nets full, despite the wider market looking a tad wobbly.

Ah, prediction markets are acting like the proverbial canary in the coal mine for Bitcoin enthusiasts.

Data from Polymarket currently suggests there’s a 72% likelihood that our beloved cryptocurrency will revisit the $65K support level before making its next heroic leap upwards.

This shift in sentiment is reminiscent of a cat suddenly deciding it detests water, with traders now hedging against potential economic squalls and ETF flows resembling a snail in molasses. The bullish crowd has been temporarily sent packing, as evidenced by the onslaught of ‘Yes’ shares traded, indicating liquidity providers are preparing for a grand flush of over-leveraged longs.

But don’t let the doom and gloom get you down, dear reader; look beyond the immediate price fluctuations and witness a delightful divergence.

While our retail friends wring their hands over short-term charts, the savvy investors are cheerfully migrating towards the infrastructure being erected atop the network. And what tells us this? Oh, just the buzz surrounding Bitcoin Hyper ($HYPER), a project gallantly addressing the network’s scalability conundrum. As Bitcoin treads water, it appears the clever money is chasing after innovation rather than merely accumulating coins.

This split – bearish on price yet bullish on utility – is a sign of a market growing up faster than a child prodigy. Investors have moved beyond just hoarding ‘digital gold‘; they’re funding the very tracks that could transform that gold into something programmable, capable of dazzling feats.

The influx of liquidity into Layer 2 solutions hints that while we brace ourselves for a potential $65K reappearance, the long-term vision remains fixated on remedying Bitcoin’s transactional hiccups.

If you’re interested, $HYPER is available right here.

Bitcoin Hyper: Speeding Up the Bitcoin Network with SVM Integration

The narrative that’s steering capital away from the tumultuous spot markets and towards infrastructure is straightforward: Bitcoin simply must scale. For ages, the network has grappled with the ‘trilemma’, putting security and decentralization on a pedestal while speed languished in the background.

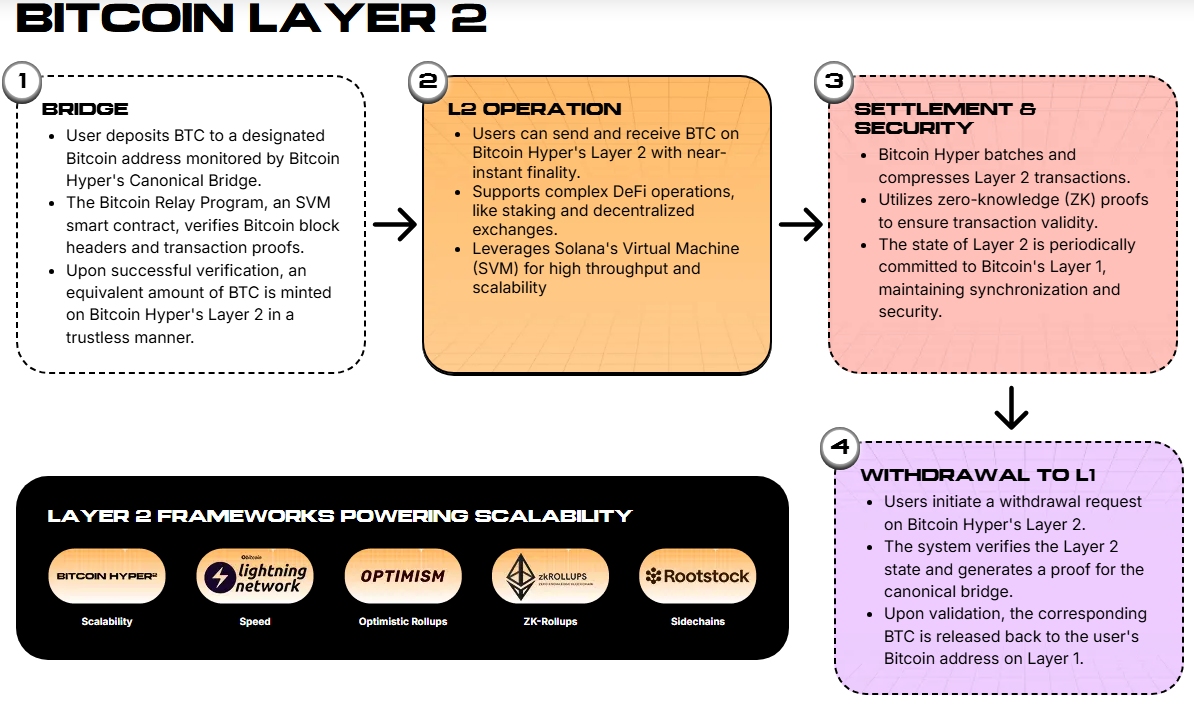

Enter Bitcoin Hyper ($HYPER), attempting to shatter this impasse by integrating the Solana Virtual Machine (SVM) as a Layer 2 execution environment. This clever bit of architecture allows transactions to be processed with the same sub-second finality we’ve come to expect from Solana, all while keeping one eye firmly planted on Bitcoin’s immutable ledger.

Why should you care? Because it essentially transforms the world’s most secure asset into a high-performance machine.

Through a decentralized canonical bridge, Bitcoin Hyper allows users to whisk their $BTC into a speedy environment suitable for DeFi, gaming, and complex smart contracts – realms previously ruled by Ethereum and Solana. The project’s modular strategy (separating settlement on Bitcoin L1 from execution on SVM L2) mirrors successful scaling frameworks seen elsewhere but applies them to the grandest pool of liquidity in crypto.

For developers, the inclusion of Rust-based smart contracts via the SVM opens the proverbial floodgates to port existing Solana dApps into a Bitcoin-centric landscape. This nifty trick reduces migration friction and theoretically unlocks trillions of dollars lying dormant in $BTC.

The market’s interest isn’t mere fantasy; it reflects a wager that Bitcoin’s destiny lies in becoming a programmable currency rather than just a stagnant store of value.

And yes, $HYPER is available right here.

Presale Bonanza: Capitalization Soars Past $31.2 Million

While prediction markets cast a shadow over Bitcoin’s spot price, on-chain metrics for Bitcoin Hyper paint a rather different picture.

According to the latest presale data, the project has successfully amassed over $31.2 million, a figure that stands out like a peacock at a pigeon party, especially given the overall market’s chill. Tokens are currently priced at a delightful $0.0136751, a valuation early backers seem quite eager to support, considering the scarcity of SVM-compatible competitors in the Bitcoin Layer 2 realm.

A notable whale pump worth $500K leads the parade, but the real magic comes from regular folks taking FOMO to exhilarating new heights.

This particular whale activity often acts as a harbinger for retail enthusiasm, as larger players tend to position themselves before major milestones or exchange unveilings.

The timing is impeccable, as these cash inflows coincide with the broader market’s anxiety about a downturn to $65K, suggesting an astute hedging strategy: utilizing infrastructure presales to cushion potential volatility in major assets.

Beyond the raw capital injection, the project’s staking incentives are keeping supply locked up tighter than a drum. Bitcoin Hyper offers immediate staking for presale participants with a competitive APY, designed to encourage holding through a 7-day vesting period post-TGE.

This aligns with the behavior of these whales, who seem more keen on accumulating yield than flipping for a quick profit. As the presale continues to soak up liquidity, the widening gap between Bitcoin’s shaky price movement and the demand for its Layer 2 infrastructure is shaping up to be the defining trend of this cycle.

Don’t miss out-snatch up your $HYPER today!

Disclaimer: The content provided herein is purely for informative purposes and does not constitute financial advice. Cryptocurrency investments, including presales and derivatives, carry considerable risk. Always do your own homework before diving in.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- TON PREDICTION. TON cryptocurrency

- Trump Did Back Ben Affleck’s Batman, And Brett Ratner Financed The SnyderVerse

2026-02-05 16:39