So, Archer Aviation. (ACHR 3.47%). Down 26% since hitting the New York Stock Exchange. Twenty-six percent! It’s like they tried to lose money. And all these retail investors… honestly, it’s a little pathetic. A bunch of people getting excited about a flying machine that doesn’t, you know, actually fly anywhere consistently. But now BlackRock (BLK +0.57%) is piling in? Eight point one percent? What is that about?

Apparently, BlackRock just decided to increase its stake. Which, fine. They’re a big firm, they do what they do. But it’s the why that bothers me. They filed a 13G. A 13G! It’s like saying, “Hey, we own a chunk of this thing, but don’t expect us to actually do anything about it.” It’s the financial equivalent of a shrug. They’re not trying to influence anything. They just… bought more shares. It’s passive. Completely passive. Like watching paint dry, but with slightly more risk.

Now, everyone’s saying Archer is an “asymmetric investment.” Asymmetric! What does that even mean? It means it could go up a lot, or it could go to zero. Which, let’s be honest, is true of most of these speculative things. They’re dangling this “disruptive aviation” nonsense in front of people. The upside is “massive.” The downside is, well, everything. And BlackRock is betting on this? It’s like they’re playing a very expensive lottery ticket.

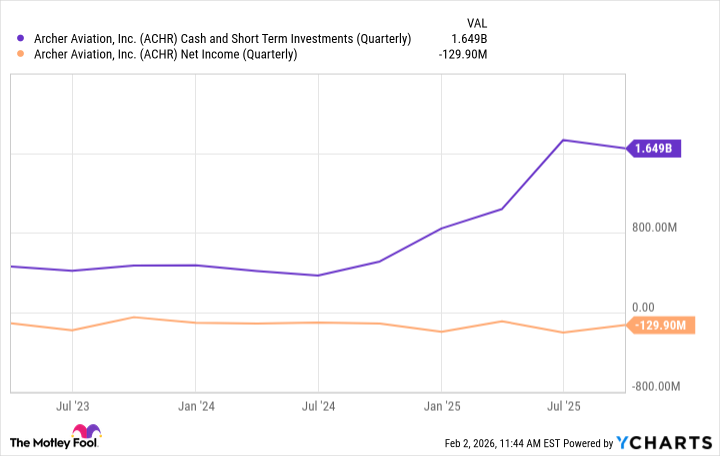

They’ve got attention from Palantir, Nvidia, United Airlines, Stellantis, even the government. High-profile companies. Great. So they’re all throwing money at something that hasn’t proven it can reliably get off the ground. It’s a support group for a failing business model. And they have $1.6 billion in liquidity. Which is good, I guess, if you’re trying to delay the inevitable. It’s like rearranging the deck chairs on the Titanic.

The consensus price target is $12. Seventy-one percent upside. Please. These analysts… they just pull numbers out of thin air. It’s all headlines and narratives. Archer is trading on hype, not results. And BlackRock is buying into this? It’s infuriating! It’s like they’re rewarding bad behavior.

Look, I’m not saying it’s going to crash and burn. But it’s a speculative play. A late-stage start-up. The upside is there, sure, but so is the very real possibility of losing everything. Don’t follow BlackRock blindly. They have different priorities. They can afford to lose a few billion. You probably can’t. A position in Archer should be reserved for people who enjoy the thrill of potential disaster. Or are just incredibly bored. Frankly, I’m starting to think they are just bored.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- Top Actors Of Color Who Were Snubbed At The Oscars

- TON PREDICTION. TON cryptocurrency

- Trump Did Back Ben Affleck’s Batman, And Brett Ratner Financed The SnyderVerse

2026-02-05 15:32