The stock market, dear reader, is a curious beast. For a century, it has, on average, gifted investors a modest 7% annual return – a figure achieved, naturally, after accounting for the vulgar necessities of inflation and the reinvestment of dividends. But the last few years have been…unconventional. A veritable frenzy, fueled by the intoxicating promise of artificial intelligence. It appears, however, that some amongst us have mistaken enthusiasm for foresight.

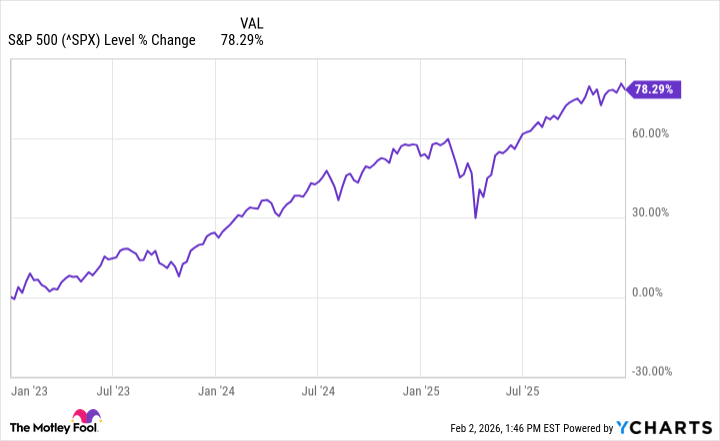

Between 2023 and 2025, the S&P 500 ascended a rather precipitous 78%. One might be tempted to believe this ascent will continue indefinitely. But as I’ve always maintained, to expect perpetual motion in the financial world is to misunderstand its fundamental nature – a charming delusion, perhaps, but a delusion nonetheless.

Let us delve, shall we, into the less-discussed aspects of the current market mood. The numbers, while flattering, tell only half the story. It is the why behind the numbers that truly intrigues – or, in this case, causes a certain degree of elegant concern. The question is not merely if the market will fall, but when it will remember its manners.

A Warning Echoed from the Past

Analysts are forever babbling about price-to-earnings ratios, forward projections, and other such pedestrian metrics. Useful, certainly, in a limited sense. But they are akin to judging a portrait by the cost of the canvas. They fail to account for the grand sweep of history, the cyclical rhythms of excess and correction.

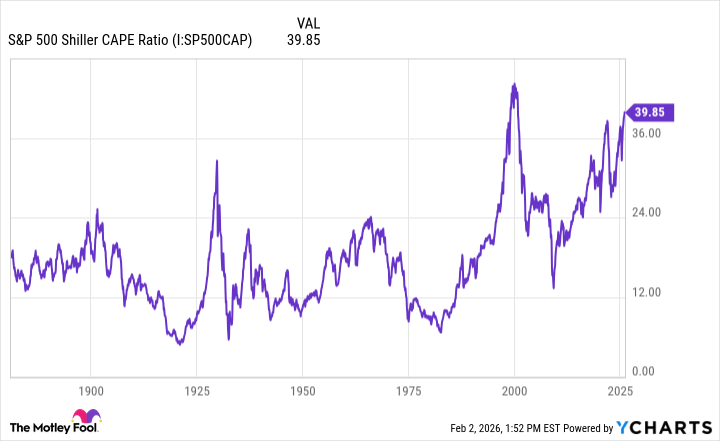

A far more insightful figure is the cyclically adjusted price-to-earnings (CAPE) ratio. It smooths out the bumps, normalizes the anomalies, and provides a longer-term perspective. It is, in essence, a form of financial aestheticism – a pursuit of timeless beauty amidst the ephemeral fluctuations of the market.

Currently, the CAPE ratio hovers just below 40. A level, it must be noted, that has been breached only twice before. The first instance, in the reckless exuberance of the late 1920s, culminated in a crash of spectacular proportions – and the subsequent descent into the Great Depression. One might say it was a rather unfortunate display of financial judgment.

More recently, in the dot-com bubble of the late 1990s, the CAPE ratio soared to an unprecedented 44. Investors, captivated by the promise of the internet, abandoned all reason. The inevitable burst, of course, left many with nothing but shattered illusions – and a rather expensive lesson in humility.

The Specter of 2026

History, therefore, suggests that a correction is due. But to predict the future with absolute certainty is the mark of a fool – or a particularly optimistic accountant. I see distinctions between the present moment and those past episodes. The dot-com bubble was fueled by speculation, by companies with more ambition than substance. They promised revolution without a plan, a rather common failing, I assure you.

The current AI revolution, while certainly accompanied by a degree of irrational exuberance, is grounded in something more substantial. The “Magnificent Seven” – those titans of technology – are not merely dreaming of the future; they are actively building it. They are monetizing AI across a vast range of industries, from silicon chips to cloud computing. And they are spending, rather lavishly, to ensure their continued dominance. Over $500 billion on infrastructure alone this year. It is a spectacle, really.

Therefore, while a complete collapse seems unlikely, a brief pullback is certainly plausible. The market, like a pampered socialite, occasionally requires a moment of bracing reality. To expect perpetual ascent is to misunderstand its capricious nature.

With that in mind, I suggest a prudent course of action for the discerning investor:

- Trim your exposure to those unprofitable, speculative stocks – the ones you hope will become multibaggers someday. They will be the first to suffer when the music stops.

- Hold on to those blue-chip stocks with durable, resilient business models. They are the bedrock of any sensible portfolio.

- And, most importantly, stockpile cash. Liquidity, dear reader, is the ultimate luxury. It allows you to capitalize on opportunities – and to avoid disasters.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- TON PREDICTION. TON cryptocurrency

- Top Actors Of Color Who Were Snubbed At The Oscars

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

2026-02-05 12:33