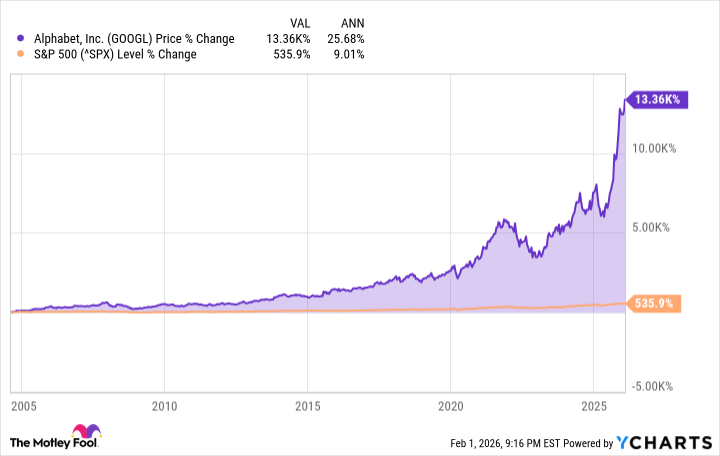

Alphabet Inc. (GOOGL) has, over the past 21 years, demonstrated substantial capital appreciation. A period characterized by a confluence of favorable macroeconomic conditions and the nascent expansion of the digital advertising ecosystem. While past performance is not indicative of future results, a retrospective analysis provides a baseline for assessing potential future trajectories.

Projected Returns: A Conservative Assessment

Current market enthusiasm appears to price in continued, aggressive growth. However, extrapolating historical returns—exceeding 25% annually—into the next two decades requires significant qualification. A more prudent approach involves modeling a reduced growth rate, acknowledging the challenges inherent in scaling a $4 trillion enterprise. We posit a 15% compound annual growth rate (CAGR) as a plausible, though not guaranteed, scenario.

The following table illustrates the potential growth of a $1,000 investment, assuming a consistent 15% CAGR:

| Years Invested | Investment Value |

|---|---|

| 10 | $4,045 |

| 15 | $8,137 |

| 20 | $16,366 |

| 21 | $18,821 |

| 25 | $32,918 |

Key Considerations & Potential Downside Risks

Several factors warrant careful consideration. Firstly, regulatory headwinds surrounding data privacy and antitrust enforcement represent a significant, and potentially escalating, risk. Secondly, increased competition from emerging technology platforms, particularly in the cloud computing and artificial intelligence sectors, could erode market share and pricing power. Finally, macroeconomic volatility and shifts in consumer spending patterns introduce inherent uncertainty.

- Competition: The competitive landscape is evolving rapidly. Sustaining growth requires continuous innovation and strategic acquisitions.

- Regulation: Increased regulatory scrutiny could constrain Alphabet’s ability to monetize its data assets.

- Macroeconomic Factors: Economic downturns invariably impact advertising revenue, a primary driver of Alphabet’s earnings.

While Alphabet possesses considerable financial resources and a strong track record of innovation, maintaining a 15% CAGR for the next two decades is far from assured. A realistic assessment necessitates acknowledging the inherent risks and tempering expectations accordingly. Investors should approach projections with a degree of skepticism, recognizing that past performance provides no guarantee of future outcomes.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Top Actors Of Color Who Were Snubbed At The Oscars

- ‘The Conjuring: Last Rites’ Tops HBO Max’s Top 10 Most-Watched Movies List of the Week

- New Sci-Fi Movies & TV Shows Set to Release in December 2025

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

2026-02-05 02:42