Nvidia, a name now spoken with a kind of reverence in the silicon valleys and trading floors, isn’t just building chips. It’s building a future, one calculation at a time. These aren’t mere components; they’re the engines of a new age, humming with the potential to reshape everything from medicine to the mundane. And like any good farmer gauging the season, Nvidia has been watching where the rain falls – where the money flows in this new digital landscape. They’ve put a considerable portion of their harvest – over 85% of their stock portfolio, to be exact – into a single field: CoreWeave.

It’s a gamble, of course. All investments are. But this isn’t a blind toss of the dice. It’s a considered planting, a belief that this particular patch of earth holds the promise of a bountiful yield. The question for the rest of us, the smallholders and the hopefuls, is whether we should follow suit. Should we place our own seeds in the same ground?

An AI Cloud, Rising from the Dust

CoreWeave isn’t building chips; they’re building access. They understand that the power of these AI engines isn’t in the metal and glass alone, but in the ability to put that power into the hands of those who can use it. They offer a kind of digital sharecropping, renting out Nvidia’s GPUs to those who can’t afford to build their own infrastructure – a costly and time-consuming undertaking. It’s a service, a necessity, in a world hungry for processing power.

They were first to offer the latest Nvidia creations – Blackwell and Blackwell Ultra – to the wider world. It’s a position of privilege, a first taste of the future. And with that access has come a surge in revenue – a doubling, a tripling, a growth that speaks of a deep and growing demand. Revenue jumped to $1.3 billion in the latest period – numbers that hum with the energy of a market on the move.

Nvidia’s investment, a substantial $2 billion injection, isn’t simply a financial transaction. It’s a commitment, a partnership. They envision a network of AI factories, reaching a capacity of 5 gigawatts by 2030. It’s a scale that’s almost difficult to comprehend, a promise of a future powered by artificial intelligence.

Nvidia’s Hand on the Scale

Back in September, Nvidia made a move that could ease some of the anxieties surrounding CoreWeave’s ambitious expansion. They agreed to purchase any unsold capacity through 2032. It’s a safety net, a guarantee that even if demand falters, CoreWeave won’t be left with a field of fallow circuits. It’s a gesture that speaks volumes about Nvidia’s confidence in the long-term prospects of this partnership.

Nvidia, with its deep understanding of the AI landscape and its constant communication with customers, has a unique vantage point. They can see the orders coming, the demands growing. They’ve identified a potential winner, and they’re backing it with their resources. But does that mean we should blindly follow their lead?

CoreWeave is delivering impressive growth, and the message from the AI world is clear: the demand for capacity is strong. But they face competition from the giants – Amazon, Alphabet, the behemoths who dominate the cloud landscape. Yet, CoreWeave’s specialization – its focus solely on AI workloads – gives it a certain edge. The larger players offer a broad range of services; CoreWeave is laser-focused, a specialist in a world that increasingly demands expertise.

The Weight of the Future

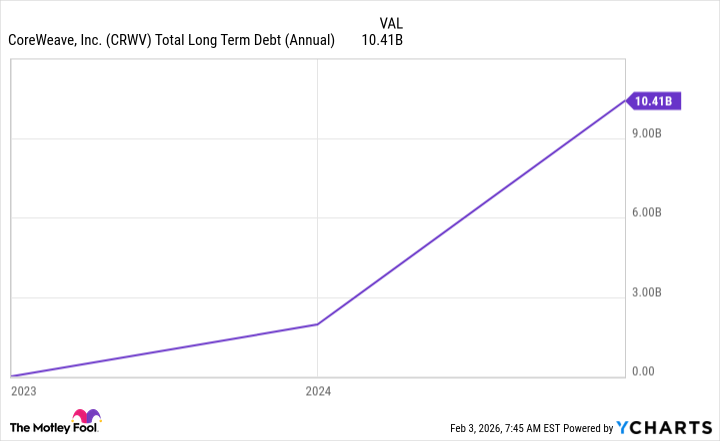

The biggest risk facing CoreWeave isn’t a lack of demand; it’s the weight of its own ambition. To fuel its rapid expansion, it’s taking on debt. And while Nvidia’s investment provides a significant boost, it’s not enough to reach the 5 gigawatt goal. Taking on more and more debt to serve future demand always carries a risk, especially for a company that isn’t yet profitable.

Cautious investors might think twice before adding CoreWeave to their portfolios. It’s a gamble, a bet on a future that isn’t yet certain. But for aggressive investors, those willing to take on a little more risk, it could be a rewarding one. Most of us shouldn’t follow Nvidia and put all our eggs in one basket, but a small stake in CoreWeave could be a worthwhile addition to a diversified portfolio. It’s a chance to participate in the growth of a new industry, to plant a seed in the fertile ground of artificial intelligence. It is a venture into a future that, like all futures, remains unwritten.

Read More

- Gold Rate Forecast

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- ‘The Conjuring: Last Rites’ Tops HBO Max’s Top 10 Most-Watched Movies List of the Week

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- New Sci-Fi Movies & TV Shows Set to Release in December 2025

2026-02-05 02:12