The market, like a vast estate, is divided into holdings, some substantial, others merely promising. Nine American companies now boast valuations exceeding a trillion dollars, yet only a select few have breached the rarefied atmosphere of the three-trillion-dollar mark. Nvidia, with a commanding presence, stands at $4.6 trillion, followed by Alphabet at $4.1, Apple at $3.8, and Microsoft, a solid presence at $3.2 trillion. One observes this hierarchy with a certain detachment, a recognition that even in the bustling marketplace, the truly exceptional remain stubbornly few.

Meta Platforms, currently valued at $1.8 trillion, appears poised to join this exclusive company. It is not merely a question of growth, but of a subtle, almost imperceptible shift in the very fabric of engagement. The relentless march of artificial intelligence, woven into the architecture of Facebook and Instagram, is reshaping the landscape of social interaction, and, consequently, bolstering Meta’s financial performance. An investor, with a patient disposition and a keen eye for value, might reasonably anticipate a 67% return should Meta indeed ascend to the $3 trillion threshold.

The Allure of the Algorithm

Nearly 3.6 billion souls now partake in the digital communion offered by Meta’s networks, a number approaching half the planet’s population. Such ubiquity presents a peculiar challenge. Growth, once a torrent, has slowed to a trickle. The company, recognizing this, has pivoted. It is no longer sufficient to simply attract users; one must hold their attention. And here, the algorithms come into play. AI, like a diligent estate manager, learns the predilections of each individual, curating a stream of content designed to prolong their engagement. More time spent online translates, inevitably, to increased advertising revenue – a predictable, if somewhat unromantic, equation.

The third quarter of 2025 witnessed a 30% increase in time spent watching Reels on Instagram, a testament to the efficacy of this strategy. But Mark Zuckerberg, a figure driven by a singular vision, aspires to something more profound. He envisions a future where each user possesses a personalized AI agent, an extension of their own consciousness, capable of anticipating their desires and tailoring their digital experience accordingly. This, one suspects, will transform social networks from mere platforms for connection into immersive entertainment ecosystems, a subtle but significant evolution.

A Year of Numbers and Nuances

In 2025, Meta generated $200.9 billion in revenue, a 22% increase over the previous year. Earnings, however, experienced a slight contraction, shrinking by 2% to $23.49 per share. This decline, it should be noted, was largely attributable to a one-time tax provision, a consequence of policies enacted during a previous administration – a curious footnote in the annals of corporate finance. Adjusted for this anomaly, earnings would have actually grown by 26% to $30.16 per share, a figure more indicative of the company’s underlying strength.

Of particular interest to the discerning investor is Meta’s capital expenditure, which reached a record $72.2 billion in 2025, an 84% increase over the previous year. Such a substantial investment in data centers, chips, and components signals a clear commitment to AI and a confidence in its potential to generate future returns. Indeed, the company intends to increase this expenditure further in 2026, forecasting between $115 billion and $135 billion. One might interpret this as a barometer of ambition, a willingness to gamble on the future.

The Path to Three Trillion: A Calculation

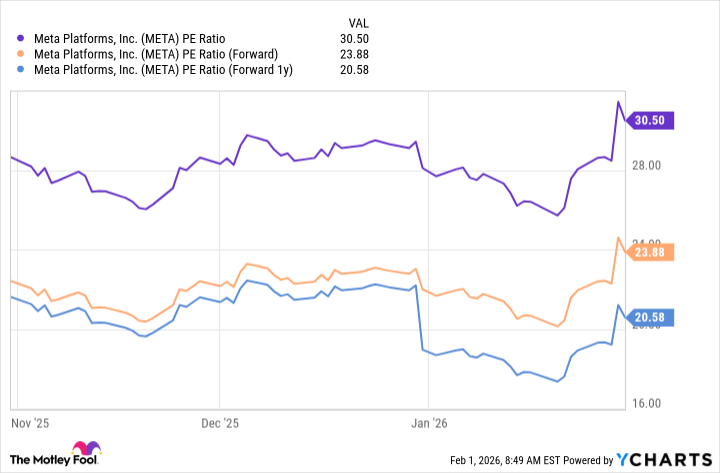

Based on Meta’s 2025 earnings of $23.49 per share, the stock currently trades at a price-to-earnings ratio of 30.5. This represents a slight discount to the Nasdaq-100, which boasts a P/E ratio of 32.9. One might argue, therefore, that Meta is currently undervalued relative to its peers. Wall Street analysts, in their collective wisdom, project earnings of $29.56 per share in 2026, followed by $34.30 in 2027. This would translate to forward P/E ratios of 23.9 and 20.6, respectively, suggesting a potential for significant appreciation.

To maintain its current P/E ratio of 30.5, Meta’s stock would need to rise by 48% before the end of 2027, propelling its market capitalization to $2.66 trillion. Should the P/E ratio align with that of the Nasdaq-100, the stock would need to climb by 60%, reaching $2.88 trillion – tantalizingly close to the coveted $3 trillion milestone. A modest earnings growth of 4.2% in 2028 would be sufficient to breach this threshold. However, should Wall Street’s forecasts prove accurate, investors may begin to price in this upside during 2027, accelerating the company’s ascent.

In conclusion, one suspects that Meta’s inclusion in the exclusive $3 trillion club is not a matter of if, but when. A patient investor, attuned to the subtle currents of the market, might find this a particularly opportune moment to consider a long-term position.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 39th Developer Notes: 2.5th Anniversary Update

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

2026-02-04 17:35