Now, last year was a bit of a muddle for these ‘Initial Public Offerings’ – fancy name for companies showing their faces to the public. But Figma, a clever little design company (Figma, FIG 10.88%), caused quite a stir. It popped onto the scene on July 31st at $33 a share, then zoomed upwards like a startled jackrabbit to $122. A glorious, fleeting moment! But alas, it’s tumbled down, down, down, landing at a rather bruised $24 as of February 2nd. A proper wallop, wouldn’t you say?

The question is, should you, a sensible investor, poke your nose into this bargain bin? Or is this a case of dazzling hype hiding a rather ordinary business? Let’s have a look-see, shall we?

What Does Figma Actually Do?

Think of Google Docs, but for drawing pictures on screens. Before, designing things meant sending files back and forth like carrier pigeons. A dreadful, messy business. Figma lets teams build and tinker together, in real-time, up in the cloud. Seems simple, doesn’t it? Yet even the grumpy old giants like Adobe couldn’t quite master this trick. They’re still fiddling with it, you know, muttering about ‘legacy systems’ and ‘proprietary workflows’. Pah!

Figma’s become the go-to bridge between the artistic designers and the number-crunching developers. It’s a clever bit of magic, making everyone slightly less grumpy.

A Growing Crowd of Customers

The real test for any business is whether people actually keep using it. Plenty of folks try things, but sticking around is what matters. It’s like trying a new sweet – delicious at first, but does it keep you coming back for more?

As of September 30th, Figma had 1,262 customers spending at least $100,000 a year – a whopping 385 more than last year! And 12,910 spending at least $10,000. A rather impressive throng, wouldn’t you say? The really interesting bit is that 30% of those big spenders were fiddling with Figma Make (Figma’s AI tool) every week. That’s like giving them a little extra sugar rush, keeping them hooked.

Numbers and Nonsense

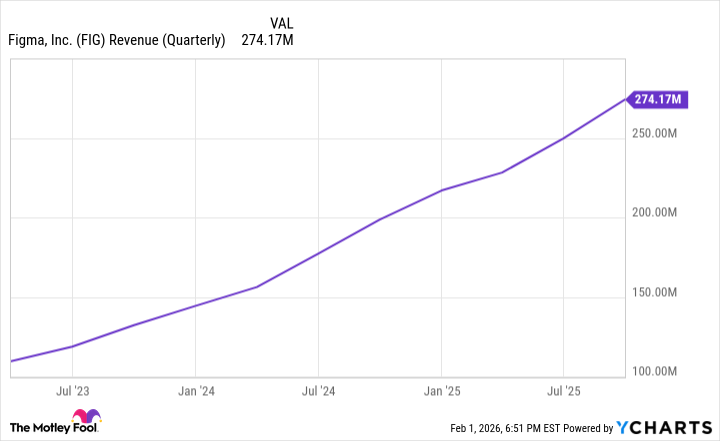

All this customer fuss translated into some rather handsome numbers. Revenue popped up 38% to $274.2 million. And their annual revenue run rate – that’s the quarterly revenue multiplied by four – finally broke the billion-dollar mark. A proper milestone, though the bean counters are still flapping their wings about it.

They had an operating loss of about $1.1 billion, but most of that was down to a rather extravagant $975.7 million spent on stock-based compensation. It’s what happens when a new company goes public – the executives and early employees get their pockets lined. A bit greedy, perhaps, but that’s the way of things.

Figma is still pouring money back into the business, so making a profit isn’t the immediate goal. What matters is that they don’t run out of cash. A bit like a child with a jar of sweets – you want them to enjoy it, but you don’t want it all gone in a flash.

Should You Buy the Dip?

As we start February, Figma is trading at a rather lofty 70 times its projected earnings. It’s a far cry from the giddy heights of $329 in 2025, but still rather expensive. Compare that to Nvidia at 25, Amazon at 29, and Meta Platforms at 24. A rather stark difference, wouldn’t you say?

We’ve seen fancy software stocks trade at premiums in recent years (Zoom, Snowflake, to name a couple), and most of them have taken a bit of a tumble. Being down 80% might mean Figma has already had its ‘great reset,’ but there could still be a bit further to fall. You don’t want to invest simply because a pricey stock is a bit cheaper. That’s like picking up a slightly bruised apple – it might still be tasty, but it’s not a bargain.

Figma certainly has a good product. The proof is in its growing customer base and their loyalty. However, given that Figma’s stock remains richly valued, I’m putting it in the ‘wait-and-see’ category. Let’s watch it for a bit, shall we? Perhaps it will sprout a few more leaves, or perhaps it will wither away. Only time will tell.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

2026-02-04 13:53