The pursuit of yield, gentle readers, is a spectacle most diverting. Observe, if you will, the throngs of investors, each convinced their chosen share shall rain dividends upon them, whilst others wither on the vine. We present today three companies, each a player in this financial drama, offering a glimpse into the follies and, dare we say, the occasional wisdom of the market. Let us begin, shall we, with a study of steady, if somewhat predictable, affections.

Act I: Realty Income – The Prudent Landlord

Behold Realty Income (O +1.47%), a purveyor of properties, and a master of the lease. This company, with a clientele including such esteemed establishments as Home Depot, Dollar General, and even the glittering Wynn Resorts, has cultivated a most agreeable arrangement: tenants assume the burden of upkeep, leaving Realty Income to reap the rewards. A most sensible division of labor, wouldn’t you agree?

With nigh on 15,500 properties under its wing, and an occupancy rate approaching perfection, this landlord appears secure in its position. It has, for decades, dispensed a monthly dividend – a practice as regular as the rising sun. Indeed, it has increased this bounty each year since 1994, a feat worthy of commendation, if not astonishment.

Currently, this yield stands at 5.3%, a figure exceeding the common herd of the S&P 500 (^GSPC 0.84%) by a considerable margin. Recent declines in interest rates, like a gentle breeze filling the sails, promise to further enhance its prospects. The company’s valuation, at a mere 15 times its free cash flow, suggests a bargain for the discerning investor. A prudent choice, perhaps, for those seeking a steady, if unexciting, income.

Act II: Target – The Retailer in Disguise

Target (TGT +1.61%) presents a more complex character. With nearly 2,000 locations scattered across the land, it boasts a proximity to the populace that is, frankly, inescapable. Yet, despite this advantage, it finds itself embroiled in a most peculiar predicament. Its attempts to appeal to a more discerning clientele, coupled with a regrettable tendency to wade into the turbulent waters of political discourse, have left it alienated from both the left and the right. A most unfortunate state of affairs.

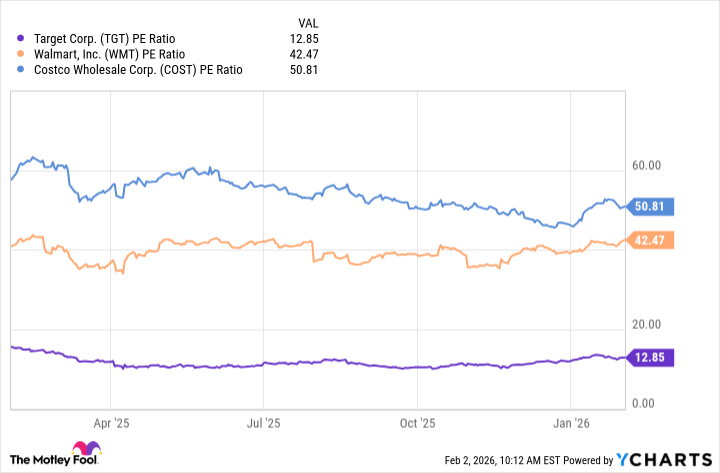

This has, predictably, resulted in a decline in its fortunes, and a corresponding reduction in its share price. Its price-to-earnings ratio now languishes far below that of its rivals, Walmart and Costco. However, do not dismiss this company entirely. It is, after all, a Dividend King, having increased its dividend for 54 consecutive years. Such a record is not to be sneezed at, even by the most cynical observer.

The appointment of Michael Fiddelke as CEO, coupled with a planned investment of $5 billion in store renovations and infrastructure, offers a glimmer of hope. When combined with its low valuation and generous dividend yield, Target appears increasingly attractive to those willing to take a calculated risk. A gamble, perhaps, but one that could yield a handsome reward.

Act III: Clorox – The Cleanser of Fortunes

Clorox (CLX +1.49%), a name synonymous with cleanliness, finds itself in a rather ironic predicament. While its products are designed to banish dirt and grime, its own fortunes have been somewhat tarnished of late. The waning obsession with hygiene following the pandemic, coupled with a cyberattack and a disruptive enterprise resource planning project, have conspired to dampen investor enthusiasm.

This has resulted in a decline in its share price, and a corresponding increase in its dividend yield to 4.4%. Its price-to-earnings ratio now hovers near a multiyear low. The company’s long history of dividend increases offers a degree of reassurance, suggesting that this downturn may be temporary.

The implementation of its new ERP system, while initially disruptive, should eventually lead to increased efficiencies and improved profitability. Furthermore, the enduring loyalty to established brands like Clorox, even in the face of inflationary pressures, suggests that the company is well-positioned to weather the storm. A steady, if unspectacular, performer, offering a degree of stability in a volatile world.

Thus concludes our little drama. Each of these companies, in its own way, offers a glimpse into the absurdities and occasional triumphs of the market. Let the investor choose wisely, and may fortune smile upon their endeavors.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- MercadoLibre: A Dividend Hunter’s Golden Goose

2026-02-04 11:43