A crypto analyst with a penchant for dramatics claims the universe is finally aligning to make Bitcoin the king of the financial jungle. Imagine that-after years of being a shy, misunderstood creature, Bitcoin is about to strut its stuff like a peacock with a PhD in chaos.

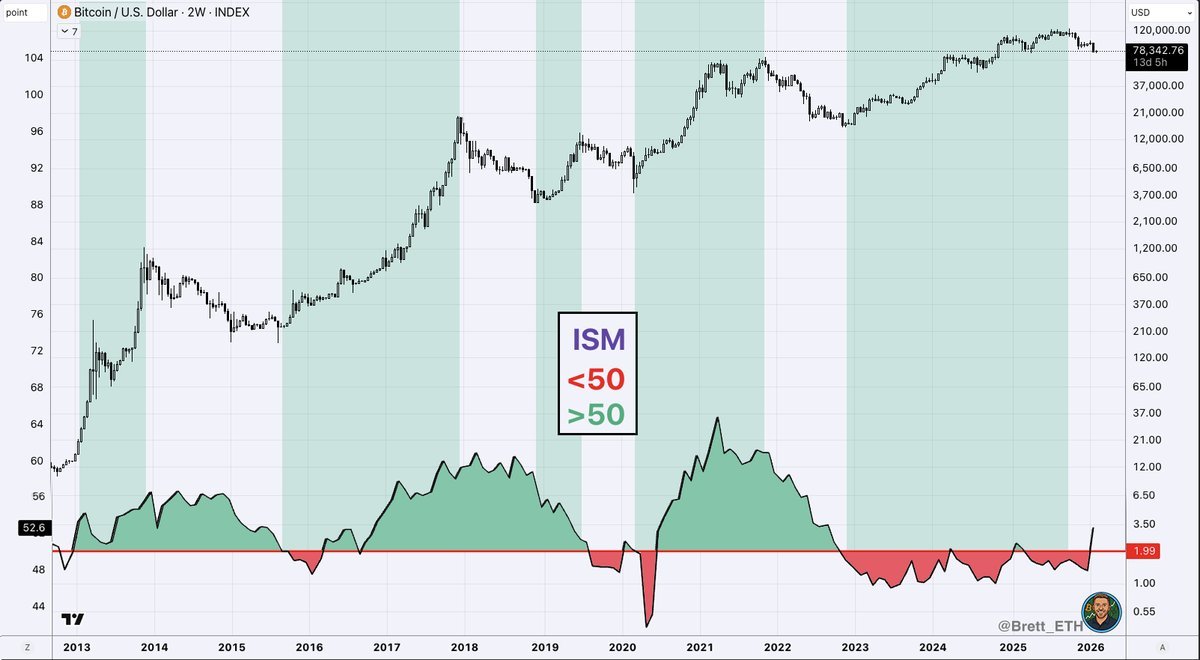

Michaël Van De Poppe, a man who probably owns a monocle and a pocket watch, tells his 818,600 followers that the business cycle is now on a rollercoaster. “It’s like a toddler with a sugar rush!” he might say, if he weren’t so serious. The ISM Manufacturing PMI, that enigmatic creature, is now wobbling into the land of 50+, a place it hasn’t visited since the Stone Age. “Not great for the business cycle, and not great for Bitcoin,” he sighs, as if Bitcoin is a neglected pet.

“The fact that Bitcoin rallied? Simply and only due to the ETF,” he insists, as if the ETF is a magical bean that made the whole thing possible. But now, he whispers, “the markets are about to wake up… or at least pretend to.” A yawn ensues.

The question remains: Is the business cycle truly linked to Bitcoin’s price? Probably not, but who needs logic when you can have a good story? “In previous times, the PMI stayed positive and Bitcoin went into a bear market. Yes, because the macroeconomic conditions changed. Like a bad divorce-never the same after.”

He then explains that last cycle, the Fed was a grumpy old man jacking up interest rates, while this time, they’re doing the opposite. “It’s like switching from a sour lemon to a sweet cherry-except the cherry is made of money.” Gold and silver, he claims, peaked last week “because the macroeconomic period is ending. In the coming one to three years, we’ll see a strong, final bull on Bitcoin and crypto.” A final bull? More like a final sprint before the world ends.

When asked what “final” means, Poppe says it’s the last bull run before a depression-level economic calamity. “Think of it as a last hurrah for the rich,” he adds, “before the rest of us are forced to eat cardboard.”

Meanwhile, Benjamin Cowen, another crypto sage with a larger following, scoffs at the ISM as a “reliable indicator.” He points out that in 2019, the ISM dropped while Bitcoin soared. “It’s like saying a rainbow is a bad omen because it’s not a storm cloud,” he says, sipping tea with a smirk.

Bitcoin is currently playing the role of a mischievous imp, darting between $75k and $76k like a child with a sugar rush. Down 3.7% on the day? Naturally. Nothing says “confidence” like a 3.7% drop. But hey, at least the market isn’t too chaotic-yet.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- MercadoLibre: A Dividend Hunter’s Golden Goose

2026-02-04 11:31