People keep asking me if the market’s going to crash. It’s a question I usually deflect with a comment about the weather, or the surprisingly aggressive pigeons in my neighborhood. Not because I don’t have an opinion, but because admitting you spend your days staring at charts feels…unseemly. Like confessing to a fondness for taxidermy. Still, I do stare at charts. And lately, they’ve been giving me a twitch.

The current worry, of course, is artificial intelligence. It’s everywhere. My aunt Mildred thinks her new smart toaster is plotting against her. And the stock market seems convinced these algorithms are the future. Which, logically, means the price has gotten…enthusiastic. I’m not saying it’s a bubble, exactly. Bubbles imply a certain lightness, a whimsical quality. This feels more like a slow, creeping dread.

Are We All Just Playing Pretend?

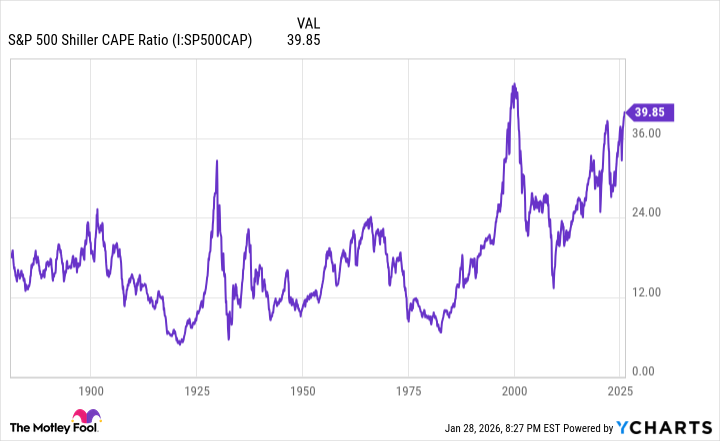

The CAPE ratio – that’s the Cyclically Adjusted Price-to-Earnings ratio, for those of us who enjoy acronyms – is hovering around 40. Which, if you glance at a historical chart (and I do, far too often), suggests a level of optimism not seen since the dot-com era. Back then, we were convinced Pets.com would revolutionize pet supplies. Now, it’s AI that’s going to solve all our problems. The specifics change, but the human tendency to get carried away remains remarkably consistent.

My colleague, Barry, keeps insisting that this time it’s different. He’s a bright man, Barry. A little too fond of power suits, but bright nonetheless. He argues that AI is a true paradigm shift. I just nod and try to remember if I’ve paid the water bill.

A Slightly Less Exuberant Approach

So, what do you do? Well, you could try timing the market. But that’s like trying to catch a greased pig. It’s messy, and you’ll probably end up covered in something unpleasant. I prefer a more…grounded approach. Which, in this case, means looking for companies that are actually, you know, making things. Real things. Like medicine.

Pfizer, for example. It’s lost some of its luster in recent years, which has, predictably, made it less popular with the stock-picking crowd. They’ve had some setbacks, patent expirations looming, the usual corporate dramas. But they’re still developing new drugs, tackling serious diseases, and, crucially, trading at a reasonable price. It’s not glamorous, but it’s solid. Like a sensible pair of shoes.

They’re also, quietly, incorporating AI into their operations. Not to replace doctors, thankfully, but to streamline processes and reduce costs. It’s a practical application of the technology, not a breathless embrace of the future. And, at nine times forward earnings, compared to the healthcare sector average of 18.6, the valuation is…tempting. It’s like finding a perfectly good sweater at a consignment shop.

Will Pfizer soar to the moon if AI stocks continue their ascent? Probably not. But if – or when – the market corrects, I suspect it will hold up considerably better than those companies built on hype and hope. It’s a matter of prudence, of building a portfolio that can withstand the inevitable storms. And, frankly, of avoiding the feeling that you’ve been duped by a toaster.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Cardi B gets playful ahead of Saudi Arabia’s Soundstorm festival

2026-02-04 07:22