So, Aerovironment (AVAV +5.63%). Drones. It’s like someone took remote control cars and decided national security depended on them. Last month was… a ride. Up, down, mostly sideways, like a toddler trying to operate a joystick. The stock soared initially, then mostly gave back its gains. Honestly, predicting the market is about as reliable as predicting what Kim Kardashian will name her next child.

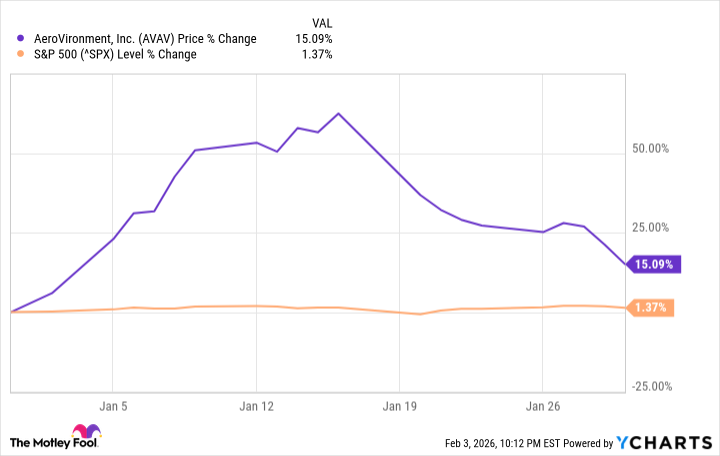

It started with Trump, naturally. A social media post proposing a military budget expansion. Because what says “fiscal responsibility” like throwing more money at things that fly and occasionally explode? Then the FCC briefly flirted with banning Chinese drones. Which, let’s be real, is just geopolitical tech drama. AV got a little boost, but then the government had a change of heart, proving that Washington operates on a different plane of reality than the rest of us. The stock finished January up 15%, which, in this market, is basically a win. It’s like showing up to work in pants – a low bar, but still commendable.

What Happened with Aerovironment

After a 2025 fueled by general drone enthusiasm (apparently, everyone wants a flying robot now), Aerovironment started January strong. It gained in the first seven sessions, jumping 8% on Trump’s budget post. Because, again, drones. But then, plot twist! A stop-work order for some antenna systems. Apparently, even drone companies have to deal with bureaucracy. It’s like finding out Santa Claus has to fill out HR forms.

Towards the end of the month, it got caught in a broader tech sell-off. Because, you know, everything must eventually fall. It’s the circle of life… or, in this case, the circle of quarterly earnings reports.

What’s Next for Aerovironment

Look, as a dividend hunter, I like a company that makes things and makes money. Aerovironment is attempting both. It’s an emerging tech growth play, which means it’s inherently risky. But it also has a history of profitability, which is nice. They reported 21% organic revenue growth in the last quarter, plus another chunk from the BlueHalo acquisition. That’s a lot of revenue, even if half of it is just for tiny cameras and propellers. Bookings of $1.4 billion are also promising, which means they’re not just selling dreams; people are actually buying the drones.

They’re the leader in unmanned aerial systems for the military, and the BlueHalo acquisition should solidify that position. It’s like becoming the undisputed queen bee of the drone hive. Drone technology has a bright future, assuming we don’t all get too creeped out by the idea of robots watching us from above. At a $14 billion market cap, there’s potential upside. But they need to execute. And by “execute,” I mean actually deliver on those bookings and keep the profits coming. Because, let’s be honest, a drone company with no profits is just a very expensive hobby.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- ‘The Conjuring: Last Rites’ Tops HBO Max’s Top 10 Most-Watched Movies List of the Week

2026-02-04 07:12