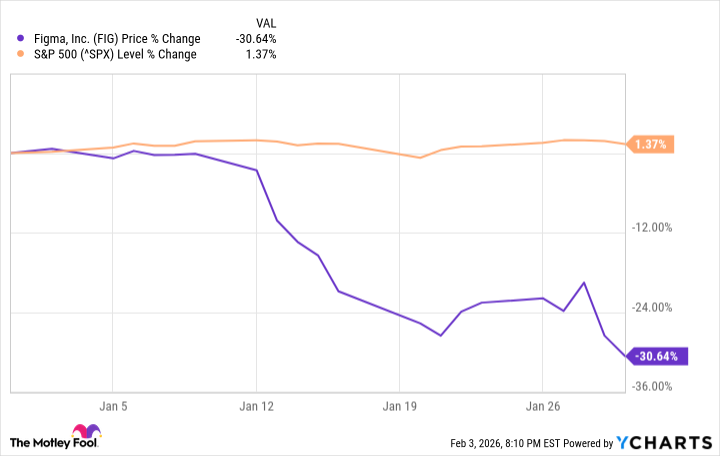

The ticker tape whispers of Figma [FIG], a name once touted as the future of design. Last month, it didn’t whisper; it groaned, shedding thirty-one percent of its value. Little news emerged from the company itself, which is often the way of things. The rot, you see, isn’t always at the source; sometimes, it’s in the very air the market breathes.

The fear, like a persistent cough, centers on this artificial intelligence. They say it will swallow the work of designers whole, render their skill a quaint relic. The giants – Microsoft, ServiceNow, SAP – stumbled with their earnings reports, and the tremor shook the entire sector. A predictable cascade, really. The market, ever the fickle beast, doesn’t reward foresight; it punishes uncertainty.

Analysts, those scribes of speculation, offered their usual pronouncements. Wells Fargo, with a flourish of optimism, upgraded the stock. “Leadership,” they called it. “Efficient growth.” Fine words, but they don’t fill the pockets of the designer now staring at a shrinking freelance budget. The truth is, these upgrades are often just attempts to stem the tide, to convince themselves – and others – that the ship isn’t sinking.

The earnings reports, though largely in line with expectations, revealed a nervousness beneath the surface. Microsoft’s increased capital expenditure? A gamble, a desperate throw of the dice. The market doesn’t care for uncertainty, and it certainly doesn’t reward those who bet on a future they can’t guarantee. Adobe [ADBE] fared little better, losing sixteen percent. It wasn’t about Figma, specifically. It was a sector-wide realization: the valuations had grown detached from reality.

The trouble with these software companies is their habit of pricing themselves as if they’ve already conquered the world. Ten, twenty times sales? A fantasy. Even after this recent bruising, Figma still trades at twelve times sales. A third of its IPO price. Eighty-five percent off its peak. It’s a reckoning, a return to something resembling sanity.

Oversold, perhaps. But don’t mistake a temporary dip for a fundamental shift. This is still a business that grows, that generates profit. And knowing how to wield Figma is a skill still in demand. The tools may change, but the need for someone to create remains. The question isn’t whether AI will disrupt design, but how quickly, and who will bear the cost of that disruption.

The disruption, if it comes, will be slow, grinding. Years, not months. We’ll learn more on February 18th, when they report earnings. Analysts expect $293.2 million in revenue and $0.06 per share. Numbers. They mean little to the designer struggling to make rent. But the market will hang on every decimal point, searching for a sign, a justification for its own capricious behavior. A trader watches the numbers. A realist watches the people.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- TON PREDICTION. TON cryptocurrency

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- Is Kalshi the New Polymarket? 🤔💡

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

2026-02-04 05:34