It has come to pass, as it always does, that the markets are seized by a fever. This time, the delirium takes the form of ‘Artificial Intelligence,’ a phrase that rolls off the tongue with the same hollow resonance as ‘New Economic Policy.’ Everyone speaks of it, few understand it, and even fewer will profit from it in the long run. The air, I assure you, is thick with speculation, and the scent of burning money is almost palpable.

Nvidia, of course, is the current darling. A magnificent engine of excess, churning out the silicon deities demanded by this new age. But let us not mistake the present for the eternal. Even the most formidable of engines sputter and stall. AMD, a persistent shadow, gains ground, and the whispers of in-house solutions – a nation building its own digital fortress – grow louder. TSMC, the foundry king, remains dominant, yet even kings are vulnerable to the vagaries of fortune – and a resurgent Intel, flush with billions and a desperate ambition. Taiwan, perched on the precipice of geopolitical storms, adds a certain… piquancy to the investment. It’s a grand, slightly terrifying ballet, isn’t it?

A Saner Path, Perhaps

For those of us who prefer not to gamble on individual deities, there exists a more… pragmatic approach. Exchange-Traded Funds. A collective, a chorus, if you will, rather than a solitary, potentially delusional soloist. These funds, bless their bureaucratic hearts, invest in a range of stocks, guided by a theme, a sector, a fleeting hope. It lacks the romanticism of picking a winner, certainly, but it offers a measure of… survival.

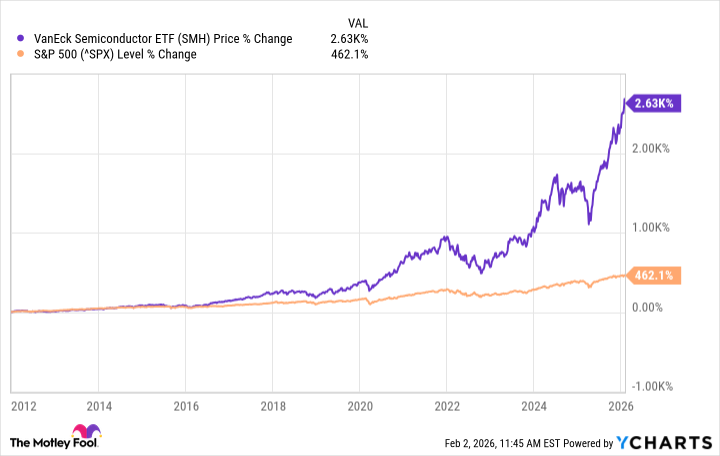

The VanEck Semiconductor ETF (SMH) has proven itself a capable performer, a reliable workhorse in this digital stampede. Since 2011, it has consistently outperformed the broader market, a feat that should not be dismissed lightly. Observe the chart, if you dare. It demonstrates a clear trajectory, a widening gap that has accelerated with the advent of this AI mania. The numbers, while cold and impersonal, do possess a certain… persuasive power.

A glance at the ETF’s holdings reveals a familiar cast of characters. Nvidia, naturally, occupies a prominent position, followed by TSMC, Broadcom, Micron, ASML… a pantheon of silicon gods. The top four, I confess, have been delivering returns that border on the… indecent. Even ASML, the manufacturer of the tools that create these gods, has experienced a renaissance, defying those who prematurely declared its reign over. It’s as if the boom itself is capable of resurrecting the lagging, a phenomenon worthy of further study, perhaps by a team of bewildered theologians.

| Stock | % of Net Assets |

|---|---|

| Nvidia | 19.3% |

| Taiwan Semiconductor Manufacturing | 10.2% |

| Broadcom | 7.2% |

| Micron Technology | 6.6% |

| ASML | 5.9% |

| Lam Research | 5.8% |

| Advanced Micro Devices | 5% |

| Texas Instruments | 5% |

| Applied Materials | 4.9% |

| KLA Corp | 4.8% |

| Intel | 4.8% |

A Long-Term Perspective, Perhaps?

The current frenzy, fueled by the promise of AI, may prove to be a bubble, a transient delusion. But even if it bursts, the underlying demand for semiconductors will persist. Technology marches on, relentlessly, insatiably. Appliances, automobiles, infrastructure… all are increasingly reliant on these tiny, miraculous chips. Data centers, already straining under the weight of our digital obsessions, will only grow larger. And who knows what unforeseen advancements await us? The future, as always, remains shrouded in mystery, a vast, unpredictable landscape.

The SMH ETF, with a trailing price-to-earnings ratio of 46, may appear expensive. But consider the blistering growth rates of its top holdings. Nvidia’s revenue soared 62% in the last quarter. Micron’s earnings per share are expected to quadruple this year. These are not mere accounting tricks; these are signs of genuine innovation, of a sector in the throes of transformation. And on a forward basis, the ETF appears significantly more attractive.

Finally, the SMH ETF offers diversification, providing exposure to international stocks like TSMC and ASML, which are not included in the S&P 500. A small advantage, perhaps, but in the world of finance, every fraction of a percentage point counts.

If you seek to diversify your AI holdings, or simply to gain exposure to this transformative sector, the VanEck Semiconductor ETF is a sensible, if not entirely exhilarating, choice. It lacks the glamour of picking a winner, but it offers a measure of stability, a refuge from the madness. And in these uncertain times, my friends, a little bit of sanity can be a most valuable asset.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- TON PREDICTION. TON cryptocurrency

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- Is Kalshi the New Polymarket? 🤔💡

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

2026-02-04 05:33