It is a truth universally acknowledged, amongst those who traffic in the ephemeral currents of the market, that a prodigious rise rarely occurs without a corresponding descent. And yet, the story of Sandisk, lately sprung forth anew as a public entity in the year 2025, presents a spectacle that compels observation. A fifteen-fold increase in valuation within a single year – a phenomenon more akin to the fevered imaginings of alchemists than the sober calculations of commerce. One cannot help but ponder the weight of such expectation, and the fragility of fortunes built upon it.

For those who entered this venture in its nascent stages, a considerable reward has undoubtedly been secured. But for the latecomer, the hesitant soul considering participation now, the matter is far more complex. To acquire shares at this elevated price is to assume a burden of anticipation, a demand for continued, almost miraculous growth. It is akin to purchasing a painting already hailed as a masterpiece, hoping it will somehow become even more so.

The Currents of Demand

The source of this extraordinary ascent lies, as with so many modern marvels, in the insatiable appetite of artificial intelligence. Sandisk, it appears, provides the very foundations upon which these digital minds are built – the storage, the filing cabinets, if you will, for the vast oceans of data they require. Without such capacity, the training of these intelligences would be a task not merely difficult, but impossible. It is a service, then, of no small consequence.

And, as is often the case, a scarcity of supply has exacerbated the situation. Demand now exceeds the ability of Sandisk to fully satisfy it, allowing them to dictate terms, to raise prices, and to attract the eager attention of investors. This is the natural order, of course, yet it is a dangerous one. To rely solely on the scarcity of a commodity is to build a castle upon sand.

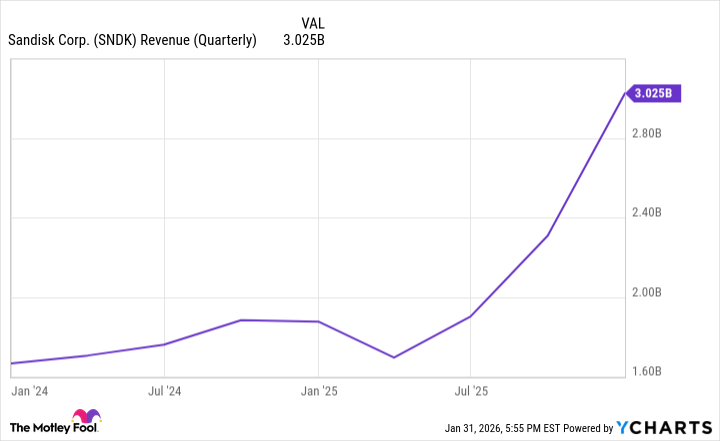

The Numbers Tell a Tale

The reports from the second fiscal quarter of 2026 are, on the surface, impressive. Revenues have increased by sixty-one percent, exceeding expectations by a considerable margin. Earnings per share have soared, a testament to the company’s success. But numbers, like all outward displays, can be deceiving. They reveal only the what, not the why, and certainly not the what next.

It is said that much of this growth stems from companies actively constructing and expanding their AI infrastructure. A virtuous cycle, perhaps, but one that carries with it the inherent risk of overextension. To invest heavily in a technology still in its infancy is to gamble on a future that remains, at best, uncertain.

A Word of Caution

As February dawns, I find myself hesitant to recommend participation at the current valuation. It is not that Sandisk’s business is flawed – far from it. Rather, it is that the price of admission has become exorbitant. Too much optimism, too much expectation, is already baked into the stock. The slightest imperfection, the smallest setback, could trigger a swift and substantial correction.

Investing in a sound company at a reasonable price is a prudent course. Investing in a soaring stock, already inflated by speculation, is a different matter entirely. It is akin to chasing a phantom, convinced that the ascent will continue indefinitely. And yet, history teaches us that all ascents, eventually, must yield to gravity. There are, at this moment, other avenues for capital, other enterprises that offer a more balanced risk-reward proposition. Let the wise investor consider them carefully.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2026-02-04 04:22