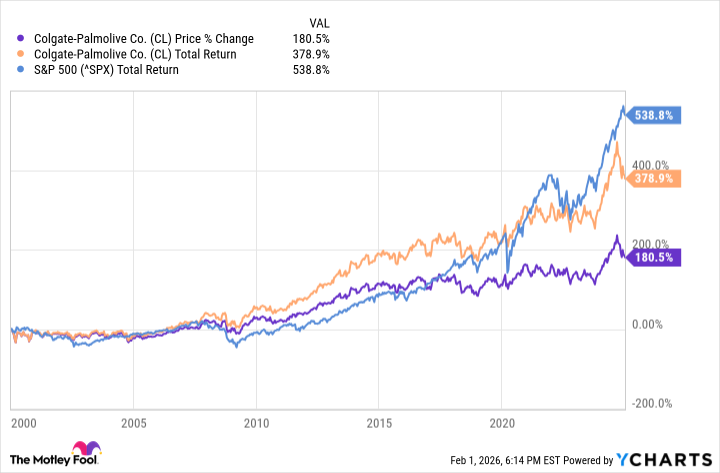

Colgate-Palmolive. Toothpaste, soap, the usual. For a quarter-century, give or take, it was a perfectly… adequate stock. Not thrilling. Not ruinous. Just… there. They raised their dividend, oh, something like 533% over those years. A long time to be giving people a little extra pocket money. Sixty-three years of annual increases, actually. A record. So it goes.

But adequate is rarely remembered. The S&P 500, that restless beast, did better. Much better, actually. 539%. Colgate just sort of… lingered. 2025 wasn’t a banner year. It wasn’t a terrible year, either. Just… unremarkable. History is full of unremarkable years, isn’t it?

Then came 2026. A sudden surge. Up 16.8% so far. The S&P? A mere 2.1%. An eight-to-one beat. A statistical anomaly, perhaps? A brief flicker of defiance against the inevitable entropy of the market? Investors are wondering, naturally. They always wonder. It’s a human condition.

Why the Pop?

Last Friday, the stock jumped. 5%. Sales were up 5.8%. Not a revolution, but a nudge. Higher prices did most of the work, not more people actually buying things. Organic sales, the real stuff, grew 2.2%. A small victory in a world of diminishing returns.

Here’s the curious part. They reported a $5 million loss. A sizable impairment charge, $794 million, related to their skin-health segment. Accountants do what accountants do. Without that charge, they’d have earned $0.95 a share. Analysts expected $0.91. A rounding error, really. But people love a positive number.

And they offered a vague outlook for the year. 2% to 6% growth. Imprecise. Analysts expected 3%. Markets generally dislike uncertainty. But sometimes, a little ambiguity is comforting. It leaves room for hope. Or delusion. It’s hard to tell the difference sometimes.

For four quarters running, analysts have underestimated Colgate’s sales. By three to six percentage points each time. Maybe Wall Street is finally realizing that this company occasionally surprises them. Or maybe they’re just bad at math. So it goes.

Should You Buy?

The stock has surged. They beat sales expectations. They’re a Dividend King, like Coca-Cola. A reliable source of income in a world obsessed with growth. But there are drawbacks. Always drawbacks.

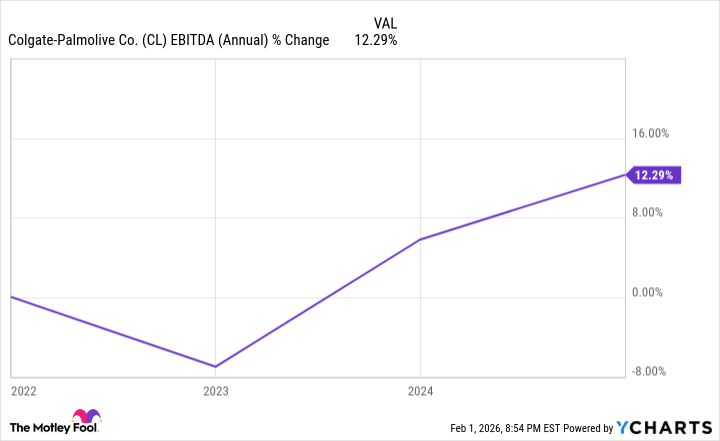

The stock is expensive. A price-to-earnings ratio of over 34. The S&P 500 average is 29.5. A modest premium, perhaps. But expensive stocks need to grow fast. They need to justify their valuation. Earnings grew just 12.3% from 2022 to 2025. Annualized growth of a little over 4%. That doesn’t scream “bargain.”

Colgate-Palmolive might appeal to investors seeking steady income and low volatility. A safe harbor in a stormy sea. But even safe harbors have leaks. There are better options. I’d stay on the sidelines. Watch the rally fade. It always does. So it goes.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- TON PREDICTION. TON cryptocurrency

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- 39th Developer Notes: 2.5th Anniversary Update

- Is Kalshi the New Polymarket? 🤔💡

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

2026-02-04 02:32