Coca-Cola (KO +2.54%). The name itself suggests a certain… inevitability. A fizzy, sugary inevitability, to be precise. But even inevitabilities, it turns out, require regular maintenance. Specifically, the maintenance of a dividend, which, in Coca-Cola’s case, has been consistently increasing for 63 years. Sixty-three! That’s… well, it’s a lot of years to keep giving people money. (It’s rather like trying to balance an infinite number of teacups on a particularly unstable spacetime continuum – theoretically possible, but requiring an almost unreasonable degree of precision.) As of December 2025, they were one of only 56 companies globally to achieve “Dividend King” status. A rather regal title, when you think about it, for a company that essentially sells flavored water.

Now, management doesn’t offer specific forecasts for dividend growth – a tactic I suspect involves a complex algorithm designed to confuse both investors and the very fabric of reality. However, signs suggest a substantial increase is on the horizon. Perhaps even in the double digits. The last time they dared to venture into double-digit territory was back in 2007. (A time when, if memory serves, trousers were considerably wider and the prevailing philosophical question was whether or not to add glitter to everything.)

Why Coca-Cola’s Dividend Might Actually Roar (A Little)

For the last decade, Coca-Cola’s dividend growth has averaged a modest 3.94% annually. Perfectly adequate, certainly, but lacking the sort of exuberant upward trajectory one might expect from a company whose products are, let’s face it, practically synonymous with global civilization. (Or, at least, a significant percentage of its sugar intake.) It’s kept pace with inflation, which is something, but it hasn’t exactly been setting the financial world alight.

| Year | Coca-Cola Dividend Hike | Inflation Rate |

|---|---|---|

| 2021 | 2.4% | 4.7% |

| 2022 | 4.8% | 8% |

| 2023 | 4.5% | 4.1% |

| 2024 | 5.4% | 2.9% |

| 2025 | 6.2% | 2.7% |

But let’s rewind a bit. Before the era of… tempered enthusiasm, Coca-Cola’s dividend growth was considerably more spirited. Take the period from 1994 – the year Berkshire Hathaway (under the discerning eye of Warren Buffett) began accumulating a rather substantial 400-million-share position – through 1998.

| Year | Coca-Cola Dividend Hike | Inflation Rate |

|---|---|---|

| 1994 | 14.7% | 2.6% |

| 1995 | 12.8% | 2.8% |

| 1996 | 13.6% | 2.9% |

| 1997 | 12% | 2.3% |

| 1998 | 7.1% | 1.6% |

Over those five years, Coca-Cola’s payouts increased by a rather astonishing 76%, leaving inflation trailing in the dust like a discarded bottle cap. Compare that to the 25.5% cumulative dividend growth since 2021 – barely keeping pace with the 24.3% inflation experienced during that same period – and you begin to appreciate the extent to which this company’s dividend momentum has… diminished. (It’s a bit like watching a particularly energetic penguin gradually slow down after a long swim.)

However, there are reasons to believe Coca-Cola’s dividend might be poised for a resurgence. First, earnings are soaring. The company recently reported adjusted quarterly earnings growth of 29.8%, a significant jump from the 5% growth seen a year prior. Second, Coca-Cola’s operating margin has ballooned to 32%, up from 21.2% the previous year. This means they’re keeping a far larger percentage of revenue as profit, freeing up cash for… well, for pretty much anything. (Mergers, acquisitions, share buybacks, dividends… the possibilities are, frankly, terrifying.)

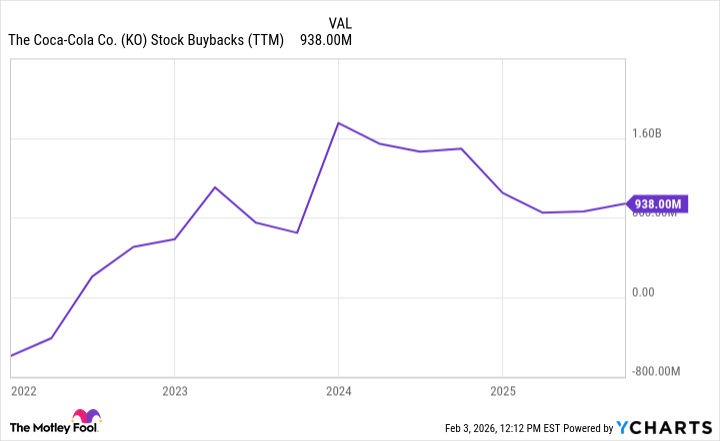

And speaking of share buybacks, management has repurchased nearly $1 billion in shares over the last year. This reduces the number of outstanding shares, making each remaining share more valuable and, crucially, requiring fewer shares to be paid a dividend. (It’s a bit like shrinking the guest list for a party – everyone gets a larger slice of cake.) This, combined with soaring earnings and stronger operating margins, suggests that Coca-Cola could be preparing to deliver a rather emphatic message when it announces its (anticipated) 64th dividend increase in the coming days. (A message that will likely involve a press release, a conference call, and a significant amount of carefully worded optimism.)

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2026-02-03 20:42