Nio, the Chinese electric car company. They sold some cars last year. A lot of them, actually. Which is… something. The world keeps spinning, and people keep wanting to get from place to place. It’s a simple story, really. They navigated a price war, tariffs, and the usual supply chain nonsense. So it goes. And they still managed to sell a bunch of vehicles. Impressive, in a way. A tiny spark of optimism in a darkening world.

What’s Going On?

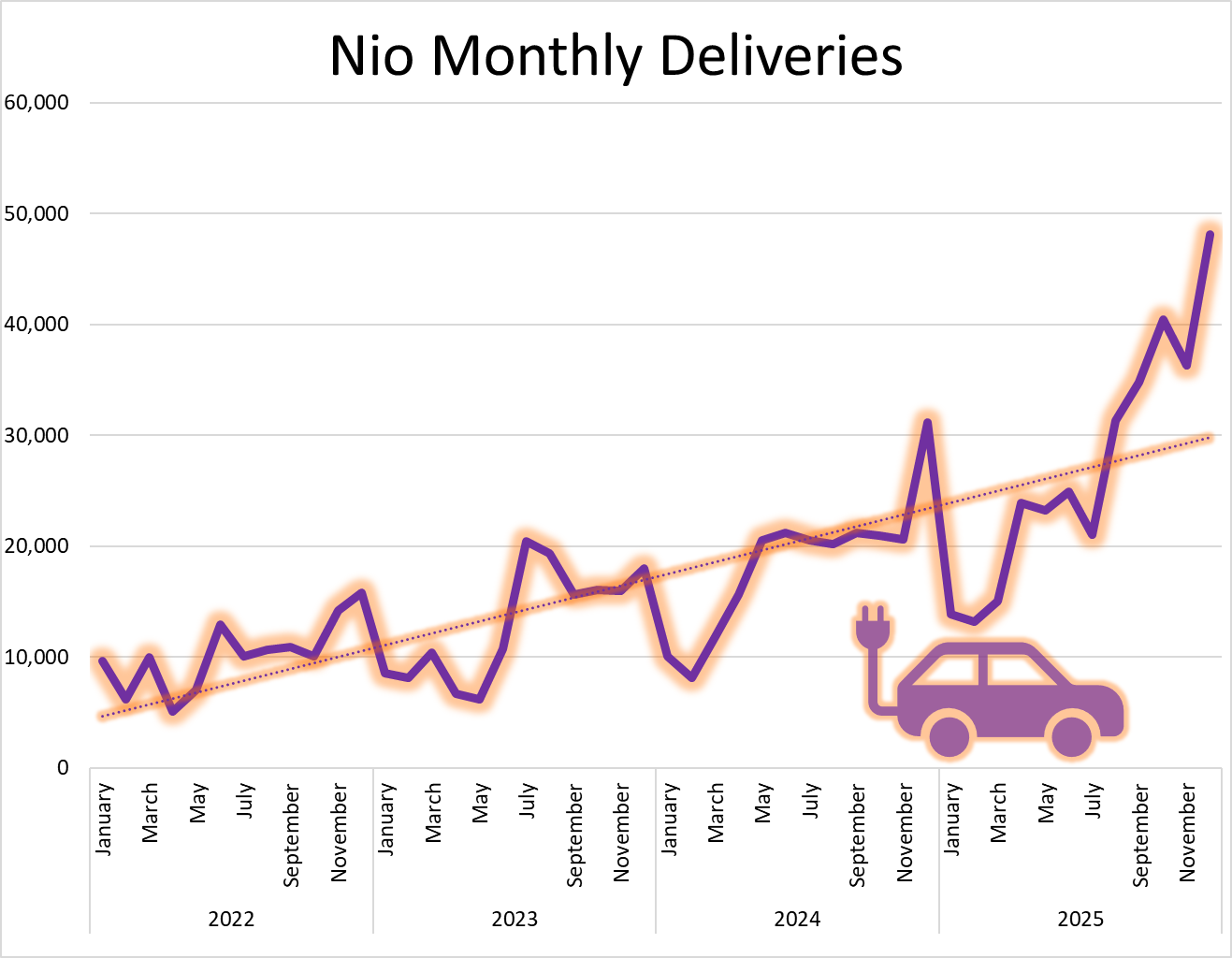

December saw them deliver 48,135 vehicles. A new record. Records are made to be broken, of course. It’s the natural order of things. The fourth quarter was even better, up 71.7% year over year. Numbers. They dance around, signifying… what, exactly? Progress, perhaps. Or just more cars on the road.

Looking at the breakdown, 31,897 were from the Nio brand itself. 9,154 from Onvo, the family-oriented line. And 7,084 from Firefly. They’re spreading their bets, which is sensible. A diversified portfolio of electric vehicles. Who are we to judge? It’s a game of chance, after all.

Onvo and Firefly are still small potatoes, which means there’s room to grow. They’re planning three new SUVs in 2026. More SUVs. The world needs more SUVs, apparently. They’re hoping for 40-50% compound annual growth. Ambitious, but what else are they supposed to say? It’s all a projection, a hopeful guess at the future. So it goes.

Profitable Growth Is Key

Margins are improving. That’s the good news. Investors were worried the cheaper Onvo and Firefly models might hurt profitability. But Nio is cutting costs and building scale. A familiar story. It’s always about cutting costs. They’re targeting a gross margin of 17-18% for the fourth quarter. If they hit it, it’ll be a small victory in a long, complicated war.

Turning the Corner

The fourth quarter and 2026 could be turning points. They’re hoping for their first adjusted EBIT profit. A modest goal, really. To break even. Just to stop losing money. It would be a big deal for them, and maybe for the whole electric vehicle industry. Everyone’s struggling to make a profit. So it goes.

They’re entering 2026 with momentum. Which is nice. But anything can happen. A meteor could fall. The stock market could crash. A new, more efficient electric vehicle could appear. The universe is indifferent to their plans. But they’re trying. And that’s something. Investors should expect more profitable delivery growth. Or maybe not. It’s all just a guess. A hopeful, slightly desperate guess.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2026-02-03 20:14