In the world of Ethereum, the plot thickens like a foggy British lane on a damp morning. The price has slapped aside the idea of calm rendezvous at $3000 and lurched into a bearish mood, as if the markets woke up grumpy and decided to spray debate all over the carpet. The bid to cling to a crucial band around $2300 has become a stubborn obstacle course, while the bulls fling themselves against the wall at $2,150 with all the gusto of someone trying to open a stubborn jar. A reversal is whispered about, and then the grown-ups-Ali, in particular-remind us that the bottom remains on the far horizon, possibly waving from behind a hedge of uncertainty.

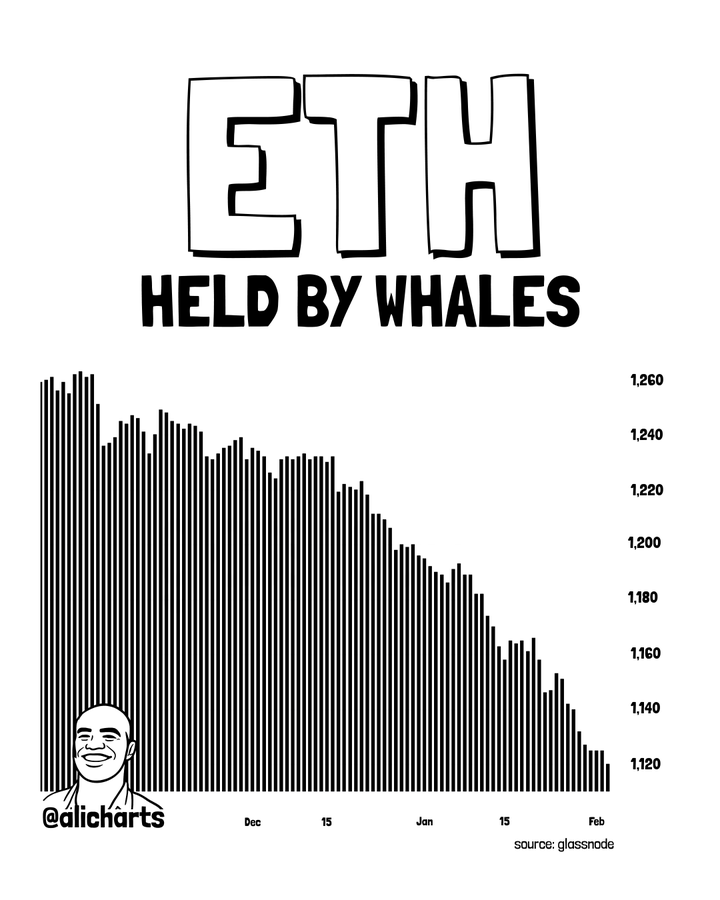

Large Holders Remain in Disbelief

The big players look about as convinced as a tourist in a passport office-distributing rather than accumulating, as if they’ve suddenly decided to take a long lunch and forget to come back. Glassnode’s data tell the tale: Ethereum whales have been lightening their load, possibly migrating their treasures to other tokens, or perhaps just enjoying the suspense of the moment. A bit like watching a parade where the marching bands decide to take a break and let the drum major improvise.

The number of wallets holding more than 10,000 ETH has slipped from 1,262 to 1,120. It’s not a crash so much as a quiet shuffle-a supply rotation, if you want to sound clever at the dinner table. No one is rushing in with heroic purchases; buying pressure is fading like a good chorus after the final note. The upshot? Upside momentum looks a little sleepy, and the price may prefer to lurk in a tight, unremarkable range rather than leap into the spotlight.

Ethereum is Yet to Reach the Bottom

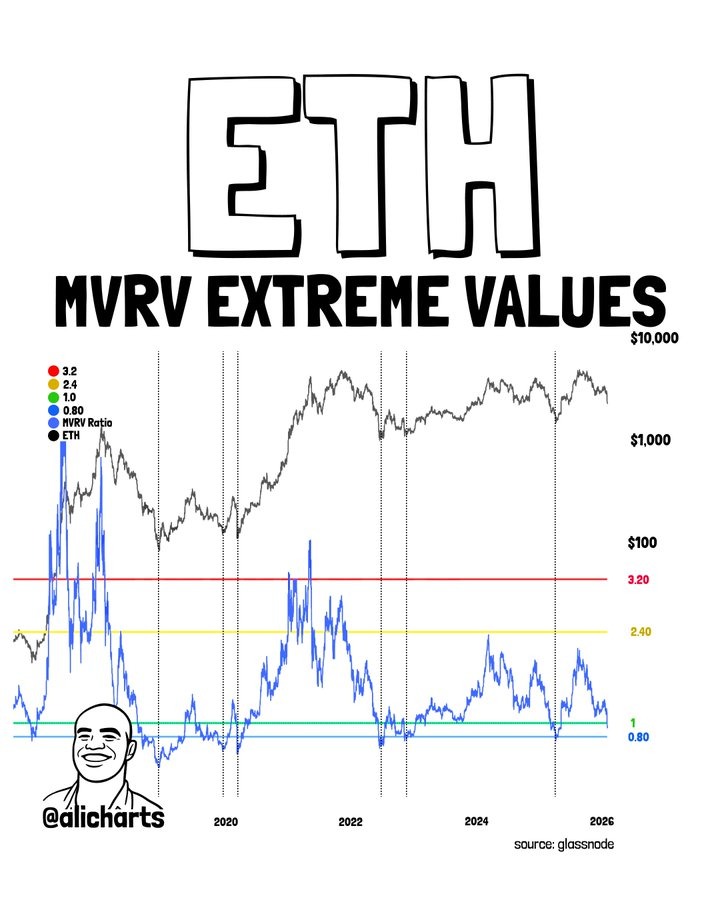

If you want to tell whether ETH is underpriced or merely misunderstood by the traffic cops of market value, you should glance at MVRV-the mood ring of on-chain data. The chart below shows ETH’s MVRV dance, with red zones signaling near-overheated tops and green zones hinting at long, patient bottoms. When MVRV hovers around 3.2 in the red, profit-taking tends to crash the party; when it sinks toward 0.8-1.0 in the green, cycles often find their footing and long-term accumulation begins to look like a reasonable hobby.

Right now, MVRV is rubbing its nose against the lower edge of the chart-no red-hot greed, but not exactly a stampede towards bargain-basement bliss either. Historically, the bottom arrives when MVRV dips below 0.8. Today it sits at 0.96, which suggests the fabled bottom hasn’t fully settled in yet. It’s the cryptic equivalent of a cliffhanger in a novel you can’t put down, even though you’d rather be reading something lighter.

ETH Price May Plunge Below $2000

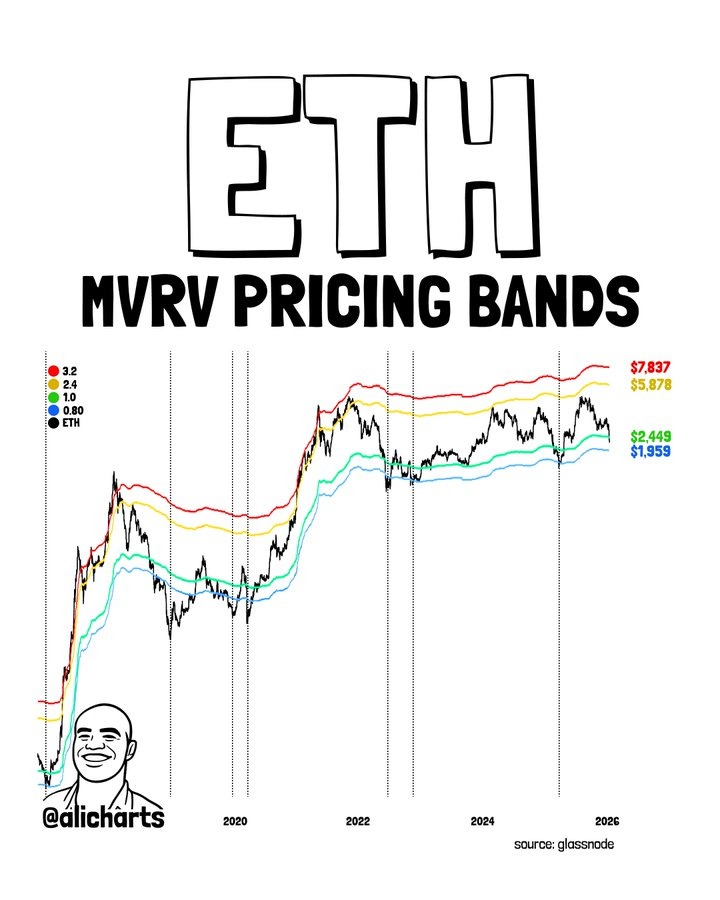

The second-largest token has enjoyed some upward pressure recently, but the $2000 floor held more stubbornly than a mule with a stubborn streak. The MVRV pricing bands, however, hint that ETH could forge a bottom below that psychological mark. MVRV bands map where ETH tends to be undervalued, fairly valued, or overheated, based on on-chain data rather than mere price action. A bit like using your backpack to guess the weather, but in a marginally nerdier way.

Historically, when ETH hovers near the lower blue/green bands (0.8-1.0 MVRV), accumulation zones and cycle lows appear to be the order of the day. By contrast, straying toward the yellow and red bands (2.4-3.2 MVRV) tends to line up with tops, where prices feel stretched and profit-taking becomes a social activity. At present, ETH sits above the lower bands but well below the red zone, meaning it’s not deeply undervalued and far from euphoric territory. In other words, there’s room to wander downwards, and this model even suggests a cycle bottom could form below $1,959. It’s not a prophecy so much as a map with a few encouraging asterisks.

Wrapping it Up

Ethereum has long played the role of the steadier asset in a marketplace given to drama, yet even the heartiest ETH bulls are currently swimming in red ink. BitMine, guided by Tom Lee, sits on an estimated loss of nearly $6.8 billion. Meanwhile, prominent crypto whale Garrett Jin has faced losses around $770 million, including a $195 million ETH long liquidation. And Jack Yi, founder of Capital Inc., is said to have lost close to $680 million. It’s a grim memoir, but not one that should surprise those who know how the crypto weather tends to behave-unpredictable, stormy, and occasionally comic in its own savage way.

The broader market mood remains fear-fueled amid volatility that would delight a rollercoaster designer, while buying pressure is a rare guest. A sustained move above $3,500 would be the kind of confirmation signal that makes even the most cautious investor nod and murmur, “Yes, the trend might be turning.” Until that happens, the downside risk remains very much in play-like a suspenseful chapter that’s not yet ready to give up its secrets.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

2026-02-03 19:37