The pursuit of doubling one’s capital within a given timeframe – a mere two years, in this instance – is, naturally, a vulgar ambition. One suspects most who embark upon it are destined for disappointment, and a rather unseemly scramble to recoup losses. Still, a certain degree of speculation is unavoidable in the modern world, and one must occasionally cast a wary eye upon the more… optimistic offerings of the market. The present note concerns one such offering.

I propose, with a degree of detached curiosity, a consideration of The Trade Desk (TTD 6.49%). It is, at first glance, a thoroughly unremarkable concern, dealing as it does in the placement of advertisements – a trade generally associated with the shadier corners of commerce. Yet, it possesses a peculiar combination of growth and, dare one say, value, that warrants a closer inspection. Whether it will, in fact, double your money by the end of 2026 is, of course, a matter for the gods of speculation to decide. But the conditions, as they stand, are not entirely unfavourable.

The Market’s Peculiar Blindness

The recent performance of The Trade Desk has been, shall we say, uninspired. The stock has suffered a decline of approximately 80% from its previous peak – a rather precipitous fall, even in these volatile times. It has, in effect, become something of a pariah, shunned by the more fashionable investors. This, however, may prove to be its salvation. The market, as a rule, is prone to fits of irrational exuberance and equally irrational panic. And it is in these moments of collective hysteria that true bargains can be found.

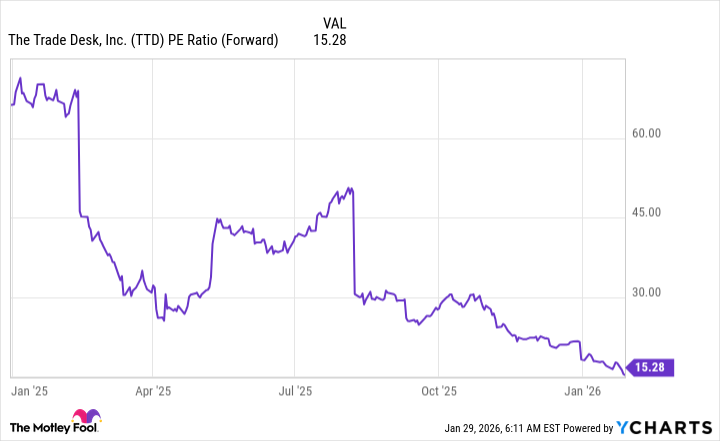

At a price-to-earnings ratio of a mere 15, The Trade Desk appears almost… cheap. A valuation typically reserved for companies on the brink of collapse, rather than one still exhibiting a degree of growth. Which brings us to the matter of that growth. The company, despite the prevailing gloom, continues to expand at a respectable rate.

In the third quarter of 2025, revenue increased by 18%. Not a spectacular figure, certainly, but hardly indicative of a failing enterprise. The absence of substantial political advertising – a rather predictable consequence of the electoral cycle – undoubtedly dampened the results. One anticipates a more robust performance in 2026, when the politicians, predictably, resume their profligate spending. Wall Street, with its customary perspicacity, seems to have taken note of this possibility.

Analysts project a 16% increase in growth next year, with earnings per share expected to reach $2.09. The more optimistic among them venture as high as $2.40. A figure, one suspects, arrived at after a particularly generous luncheon.

Does this, then, constitute a compelling case for a doubling of the stock price? The question, naturally, is fraught with uncertainty. But let us indulge in a moment of speculative fancy. The S&P 500, that monument to mediocrity, currently trades at a multiple of 22.2 times forward earnings. Let us, for the sake of argument, adopt a slightly more generous multiple of 23. If we apply this to the high-end earnings projection for 2026, and assume another 16% increase in 2027, we arrive at an earnings per share of $2.78. A stock trading at this valuation, with a multiple of 23, would yield a price of $64.

The Trade Desk currently trades at $32 per share. A doubling, therefore, is not entirely beyond the realm of possibility. These projections, admittedly, are based on a degree of optimism. But even if they prove to be somewhat exaggerated, one suspects The Trade Desk will still prove to be a reasonably sound investment in 2026. It is, after all, a company that actually does something, rather than merely existing as a vessel for speculative excess.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2026-02-03 19:02