Mr. Bitcoin, as it were, is currently in the possession of the market at the sum of $78,162, possessing a market capitalization of a most formidable $1.56 trillion, and a 24-hour trading volume that has surged to an impressive $54.86 billion. A most unremarkable range, yet fraught with the most profound indecision.

Bitcoin Chart Outlook

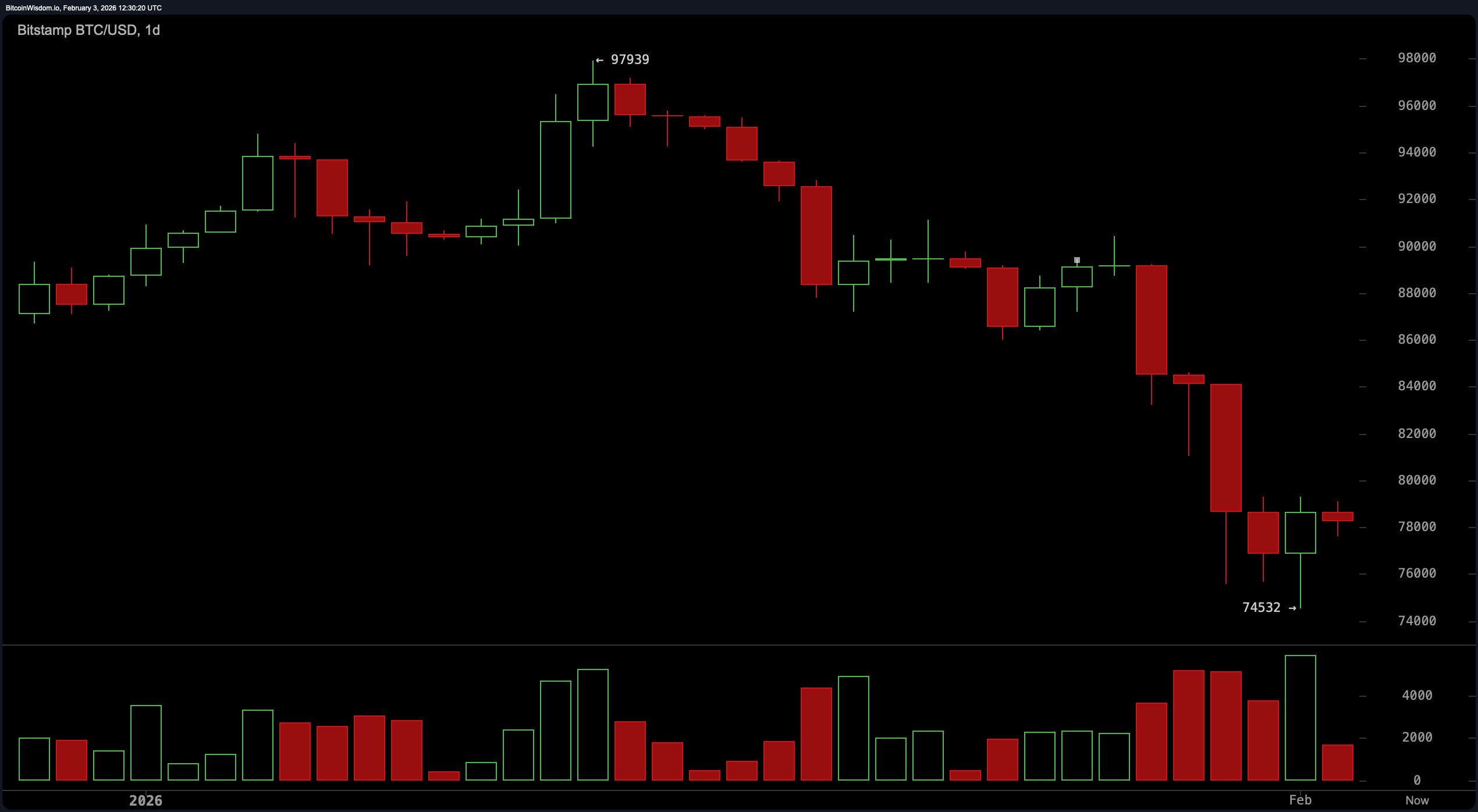

Bitcoin’s daily chart reveals a market still in the throes of recovery after a most ignominious descent from the lofty heights of $97,900, only to find itself at the nadir of $74,532. The subsequent rebound, though, was not a triumph of Olympian proportions, but rather a timid shuffle upwards.

The price structure, as observed, is corrective rather than impulsive, suggesting that the bulls are merely flexing their sore muscles, rather than charging forth with unyielding confidence. A formidable resistance persists between the sum of $88,000 and $90,000, while the support at $74,500 to $76,000 serves as the market’s emotional support blanket, if such a thing exists. Unless bitcoin regains the $90,000 threshold with the vigor of a true champion, the overall sentiment remains neutral to bearish.

On the 4-hour chart, the scene is akin to a most dramatic soap opera-plenty of intrigue, yet little genuine progress. Lower highs persist, a clear indication of the waning ambition among the buyers. Price is bouncing inside a narrow band between $76,000 and $79,500, suggesting traders are playing hot potato rather than building conviction. Volume backs up this narrative: a substantial sell-side activity at the lows, followed by a recovery of the most limp and unimpressive nature. Any clear move above $80,000, with momentum and volume in tow, might shift the mood. But for now, it’s all just side-eye and hesitation.

Zooming into the 1-hour chart, we see momentum, as it were, running on the fumes of a most depleted tank. After topping out near $79,301, bitcoin has slipped into a pattern of lower highs-never a good look on the runway of intraday trends. Volume has dwindled during this sideways stretch, signaling confusion rather than the conviction one might hope for. The microstructure screams of stalling momentum, which often heralds either a sharp pop or an unceremonious flop. Traders watching for breakouts should temper expectations until bitcoin picks a side with volume to match.

Now to the oscillators-the real heartbeat of technical analysis. The relative strength index ( RSI) languishes at a modest 29, a level that dares to flirt with oversold territory, yet lacks the vigor to produce reliable signals. The stochastic oscillator has descended to a mere 17, while the commodity channel index (CCI) has plummeted to −138, both suggesting possible exhaustion on the downside. However, the momentum indicator and moving average convergence divergence ( MACD) are posting figures of −10,920 and −3,235 respectively-hardly the stuff of a bullish fairytale. These indicators suggest that the bounce is as lacking in depth as it is in direction.

As for moving averages, bitcoin stands as a most contradictory figure to every major trend line. From the 10-period exponential moving average (EMA) at $82,452 to the 200-period simple moving average (SMA) at $103,541, all indicators are trailing far above current price, flashing the kind of alignment that would make trend-followers wince. This blanket of resistance from short to long time frames hints at a macro environment that has yet to forgive the recent fall. Until bitcoin claws its way back above at least the 50-period averages, its technical backdrop will likely remain on the defensive.

Bottom line? bitcoin isn’t dead, but it sure isn’t dancing. The market is ensnared in a volatility-driven tug-of-war, where conviction is as scarce as a well-timed joke. Until it decisively conquers $82,000 or loses its grip on $74,500, it’s wise to view this chart with a side of skepticism and a whole lot of patience.

Bull Verdict:

If bitcoin can muster the strength to breach $80,000 with the conviction of a true hero-ideally clearing $82,000 on strong volume-momentum could shift rapidly. A move like that would break the current range and potentially invite trend-followers back into the ring, especially with oversold signals stacking up across multiple oscillators.

Bear Verdict:

Unless bitcoin reclaims key moving averages and shatters the $82,000 ceiling, the path of least resistance remains downward. The current bounce lacks both structure and strength, and the technical landscape is still littered with lower highs, heavy overhead resistance, and limp momentum.

FAQ ❓

- What is bitcoin’s current price today?

bitcoin is trading at $78,162 with a 24-hour range between $77,642 and $79,130. - Is bitcoin in an uptrend or downtrend?

The broader trend remains down, with resistance stacked above $80,000. - What are key levels to watch now?

Support sits around $74,500-$76,000, while resistance looms near $80,000-$82,000. - Are technical indicators bullish or bearish?

Most oscillators and moving averages suggest continued weakness in the short term.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2026-02-03 16:57