My Aunt Carol, who insists on clipping coupons for things she doesn’t need, keeps asking me about dividends. “It’s passive income, dear,” she’ll say, as if I’m unaware of the concept. As if I haven’t spent hours staring at stock charts, trying to convince myself that a slightly upward trend constitutes “growth.” She’s fixated on oil companies, specifically, and I’ve learned to nod and murmur affirmations. It’s easier than explaining that I’m mostly just hoping to break even before the inevitable next recession. But even I have to admit, Chevron seems… sensible. Not exciting, certainly, but sensible. Like a beige cardigan.

The All-in-One Approach

The thing about oil, as anyone who’s ever filled a gas tank knows, is that it’s a bit of a rollercoaster. Boom, bust, repeat. Chevron, though, they’ve tried to hedge their bets. They’re involved in everything – getting the oil out of the ground, shipping it around, refining it into something vaguely usable, even making the plastic bits that end up in landfills. It’s a vertically integrated behemoth, which basically means they’re covering all the bases, hoping something, anything, will be profitable. It reminds me of my brother’s insistence on learning every instrument in the orchestra. He wasn’t particularly good at any of them, but he figured if one failed, he had eleven others to fall back on.

Of course, there are other companies doing the same thing – ExxonMobil, Shell, BP, TotalEnergies. They all seem to be engaged in a polite, yet ruthless, competition for our disposable income. But Chevron, for some reason, just feels…sturdier. Like it’s been around longer, seen more things, and is therefore less likely to suddenly implode.

A Streak of Consistency

They’ve been increasing their dividends for 38 years, which, in the grand scheme of things, is practically an eternity. ExxonMobil has a slightly longer streak, but their dividend yield is a bit lower. It’s a small difference, admittedly, but when you’re talking about money, even fractions of a percent start to feel significant. It’s like finding an extra five dollars in your coat pocket – it doesn’t change your life, but it’s a pleasant surprise.

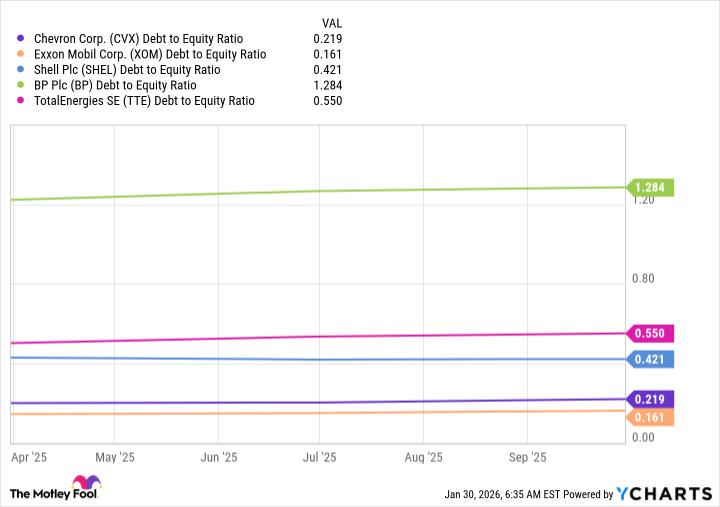

Shell and BP both had to cut their dividends a few years back, during that whole pandemic mess. TotalEnergies didn’t cut theirs, but they also aren’t quite as consistent. And, frankly, they have more debt. Chevron, on the other hand, seems to be fairly responsible with its finances. It’s not flashy, but it’s reliable. Like a sensible pair of shoes.

Apparently, this financial prudence allows them to borrow money during the downturns and then pay it back when things improve. It’s a simple strategy, really, but surprisingly effective. It’s like my grandmother’s habit of saving string – she never knew when she might need it, and, remarkably, she never did.

The Lesser of Several Evils

Look, I’m not saying Chevron is a thrilling investment. It’s not going to make you rich overnight. But it’s a solid, dependable company with a long track record of paying dividends. You could buy ExxonMobil instead, and you’d probably be fine. But Chevron just feels a little bit…safer. Like a slightly less bumpy ride on a rickety rollercoaster. And honestly, in this market, that’s about all you can ask for.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Brad Pitt Rumored For The Batman – Part II

2026-02-03 16:12