A sum exceeding twenty billion dollars—a staggering weight of expectation, a veritable mountain of capital—is to be poured into the Tesla enterprise. And for what? Not merely for the fabrication of automobiles, those metallic extensions of our earthly desires, but for a future…a vision, if you will, of automated conveyance. The question, then, is not simply where will Tesla be in a year, but what will this relentless expenditure reveal about the very nature of progress, of our collective yearning for liberation from the mundane…and the inherent anxieties that accompany such aspirations?

The Spectre of Artificial Intelligence

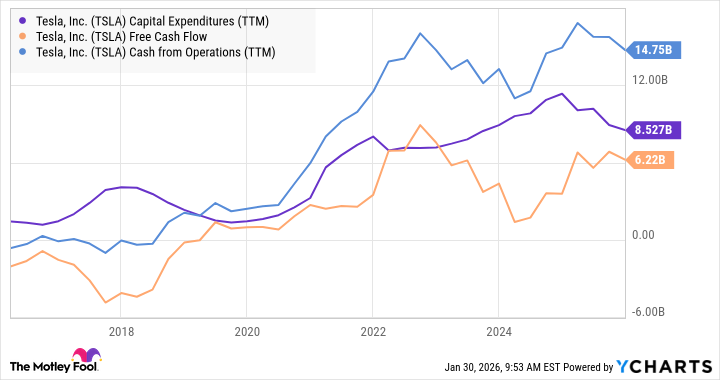

Consider the expenditure over the past decade—a gradual ascent, now culminating in this precipitous leap. It is as if the company, once content to merely build vehicles, has succumbed to a fever dream, a compulsion to engineer not just transportation, but a new form of existence. The burn rate, inevitably, will be considerable. To expect operating cash to sustain this ambition is…naive. It is a gamble, a desperate wager against the cold logic of accounting, driven by a conviction bordering on the messianic.

The Factories of the Future, and Their Moral Cost

The six factories—each a cathedral dedicated to this new industrial religion—speak volumes. A lithium refinery in Corpus Christi, a battery plant in Nevada, the Giga Texas complex…these are not merely production facilities; they are the crucibles in which the future is being forged. The Cybercab, that metallic phantom, haunts the blueprints. The Optimus robot, a mimicry of man, promises efficiency…but at what cost to the human spirit? Even the Semi truck, a workhorse of commerce, seems almost…insignificant, dwarfed by the ambition of automating our very movement.

- To support its lithium refinery in Corpus Christi, Texas.

- To support its lithium iron phosphate battery factory in Nevada, which will reduce reliance on nickel and cobalt and produce batteries suitable for the Cybercab and standard Tesla models.

- To produce its dedicated robotaxi, Cybercab, at Giga Texas in Austin.

- To support production of the Tesla Semi truck in a factory in Nevada.

- To build a new megafactory to produce energy storage units.

- To invest in Optimus robots at Fremont, California, as Tesla repurposes Model S and Model X production lines toward manufacturing Optimus robots.

And beyond the factories, the relentless pursuit of artificial intelligence—a quest to imbue machines with the very essence of thought—looms large. Is this progress, or a descent into a technological hubris that will ultimately consume us?

The Abyss of the Unforeseen

The key takeaway, if one dares to articulate it, is this: Tesla is no longer merely an automotive company. It is an experiment in the automation of existence. To invest in Tesla is not to buy shares in a manufacturer of electric vehicles; it is to place a bet on the future of consciousness itself. If you cling to the notion of Tesla as a car company, you misunderstand the very nature of the beast. If you fear the implications of a world dominated by autonomous machines, then avert your gaze. This is a stock for those who embrace the chaos, the uncertainty, the terrifying beauty of the unknown.

Musk, that enigmatic figure, speaks of Cybercabs outnumbering all other vehicles combined. Moravy, with chilling pragmatism, suggests that soon, most miles driven will be by machines, not men. It is a vision of a world where human agency is diminished, where our freedom of movement is ceded to algorithms. Is this liberation, or a gilded cage?

A Different Order of Things

Tesla, unlike Ford, does not envision a future of individual ownership. It dreams of a fleet of autonomous vehicles, a shared network of transportation. The economics are…compelling. A robotaxi, it is argued, will be cheaper to operate than even an electric car. But at what cost to the human spirit? Will we become mere passengers in our own lives, shuttled from place to place by machines?

The Precipice of a Year Hence

This is a gamble, a desperate roll of the dice. Regulatory hurdles loom large. The approval process for autonomous vehicles is fraught with uncertainty. But Musk, with unwavering conviction, plans to mass-produce Cybercabs in 2026.

An optimistic scenario paints a picture of regulatory approval, renewed EV sales, and a surge in ride-sharing revenue. A more somber outlook envisions sluggish growth, mounting losses, and a market that rejects this audacious vision. This is not a stock for the faint of heart. It is a stock for those who are willing to embrace the abyss, to stare into the void, and to believe, against all reason, in the possibility of a future transformed. It is, in essence, a stock for those who understand that the greatest risks often yield the greatest rewards…or the most spectacular failures.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Brad Pitt Rumored For The Batman – Part II

2026-02-03 15:33