Right. So, the first month of 2026 is… gone. Vanished. Like a perfectly good cup of tea left unattended near a physicist. And the one trend that refuses to be politely ignored? Artificial Intelligence. It’s going to be… everywhere. (Which, when you think about it, is rather unsettling. One expects trends to at least try to be subtle. But no.) Predicting the future is, of course, notoriously unreliable – roughly on par with predicting which way a startled wombat will run – but the current projections suggest AI will be a significant factor for the next five years. Possibly longer. (Though, honestly, what does ‘longer’ even mean in the grand scheme of things? It’s all relative, isn’t it? Especially when discussing the lifespan of a silicon chip.) This means, naturally, that investing in the companies building the bits and bobs that make it all happen isn’t necessarily a bad idea. Specifically, the companies building the computing infrastructure.

By investing in these computing companies, you’re acquiring a stake in something that’s demonstrably making money now. (A refreshing change, wouldn’t you agree? So much investment relies on the vague promise of future profitability. It’s like betting on a snail race.) You’re not entirely dependent on the speculative whims of generative AI taking over the world (though, let’s be honest, it’s a distinct possibility). Investors won’t fully grasp the implications of generative AI for years – decades, even – and by that time, a frankly alarming amount of money will have flowed towards Nvidia, Broadcom, and Taiwan Semiconductor. (Which, in a way, is reassuring. It proves someone knows what they’re doing.)

Therefore, these three represent, at the very least, a moderately sensible allocation of capital this month. Consider loading up. (Though, naturally, do your own research. We’re just offering a slightly informed opinion here. And a healthy dose of existential dread.)

Nvidia and Broadcom: Two Sides of the Same Silicon Coin

Nvidia and Broadcom both design computing units, but they approach the problem from slightly different angles. Nvidia specializes in Graphics Processing Units (GPUs), which are remarkably versatile. (Think of them as the Swiss Army knives of the computing world. Though slightly less useful for opening jars of pickles.) Broadcom, on the other hand, focuses on custom AI chips, designed for specific tasks. (More like a highly specialized scalpel. Excellent for one thing, less so for everything else.) Both companies are experiencing rapid revenue growth. Nvidia’s data center division, which encompasses its AI-focused products, grew at a 66% pace in the third quarter of fiscal year 2026. Broadcom’s AI semiconductor division is doing even better, rising at a 74% pace. (Which, statistically speaking, is quite impressive.)

As clients continue to expand their computing capacity, demand for their products will likely remain strong. This makes them both worthy investments. A roughly even split between the two seems… prudent. (Prudence, of course, being a vastly underrated virtue in the financial world.)

While Nvidia GPUs are designed for broader applications, they won’t be easily displaced. AI training often requires diverse datasets in unstructured formats, which GPUs handle with relative aplomb. Broadcom’s strength lies in the inference side, where streamlined computing approaches are favored for common prompts and responses. (It’s a bit like the difference between a general-purpose toolbox and a dedicated screwdriver. Both have their uses.)

Regardless, both companies are competing for a massive market opportunity. Nvidia estimates that global data center capital expenditure will reach $3 trillion to $4 trillion by 2030, up from $600 billion in 2025. (A truly staggering amount of money. Enough to build a small moon, probably.) This includes construction costs and computing costs, regardless of the provider. It’s a multiyear opportunity, and both Broadcom and Nvidia are vying for a piece of the action. (A perfectly reasonable thing to do, really.)

Taiwan Semiconductor Manufacturing: The Foundry of the Future

Nvidia and Broadcom design the chips, but they don’t make them. That falls to Taiwan Semiconductor Manufacturing (TSMC), the world’s leading chip foundry. They hold a substantial market share and generate significantly more revenue than any competitor. (A position they’ve earned through years of relentless innovation and a slightly unsettling level of efficiency.)

TSMC is also diversifying away from its base in Taiwan, constructing massive facilities in the U.S. and elsewhere. This reduces the risk of a single point of failure, making the stock seem far less precarious than some might believe. (A sensible precaution, given the geopolitical climate. And the general unpredictability of everything.)

TSMC is bullish on the AI build-out, predicting that AI chips will grow at a compounded annual growth rate (CAGR) of nearly 60% between 2024 and 2029. However, they also manufacture chips for non-AI applications, which slightly dampens their overall growth rate. They expect a growth rate of nearly 30% in U.S. dollars this year, suggesting they’re poised to outperform the market. (A promising sign, wouldn’t you say?)

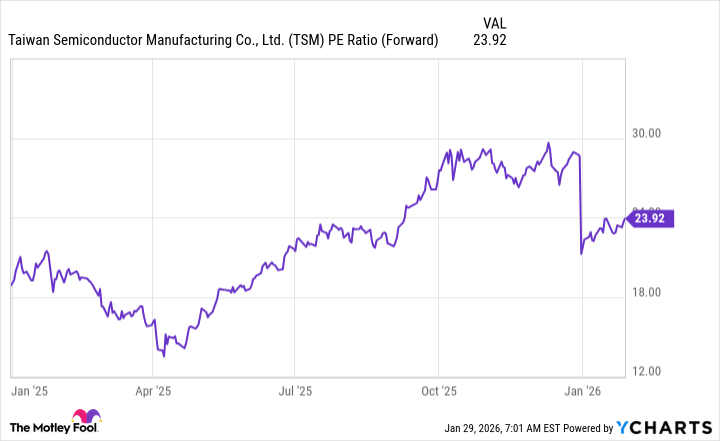

With the stock trading at 24 times forward earnings, it appears reasonably valued. (Relatively speaking, of course. Value is a subjective concept, like beauty or the proper way to brew tea.)

Combining all three companies provides a solid way to play the AI space. Consider scooping them up this month. The AI race will continue throughout 2026, and this trio represents a reasonably probable investment. (Though, naturally, nothing is ever truly certain. Except, perhaps, death and taxes. And the eventual heat death of the universe.)

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Brad Pitt Rumored For The Batman – Part II

2026-02-03 15:02