There’s a certain peace, isn’t there, in knowing that something, anything, will continue to function regardless of the general state of collapse? I used to feel that way about my grandmother’s cuckoo clock. Predictable. Reliable. Now, I’m pinning my hopes on dividend stocks. It’s less charming, more financially pragmatic, but the principle is the same: a little reward for simply existing. Or, in this case, for owning a sliver of a company that continues to exist. And let’s be honest, after a particularly harrowing tax season, a little predictable income feels…necessary.

The key, I’ve discovered, isn’t chasing the flashiest returns. It’s finding companies that seem stubbornly determined to not disappear. The kind that could probably survive a zombie apocalypse, or at least offer a discount to the undead. Which brings me to Walmart and Coca-Cola. Both are “Dividend Kings,” a title that sounds suspiciously regal for a supermarket and a sugary beverage company, but apparently means they’ve been steadily increasing their annual dividend for half a century. Fifty years. My houseplants haven’t managed that.

1. Walmart: The Retail Fortress

Walmart. It’s everywhere. You can’t swing a cat without hitting one, though I wouldn’t recommend trying. It’s not a particularly glamorous place, admittedly. It smells faintly of regret and bulk cleaning supplies. But it’s a testament to logistical efficiency. They’ve managed to position themselves within ten miles of 90% of the U.S. population. That’s… unsettling. It feels like they’re watching us. But also, convenient. They consistently generate more revenue than any other company on the stock market. Apparently, we’re all buying a lot of paper towels and discounted garden gnomes.

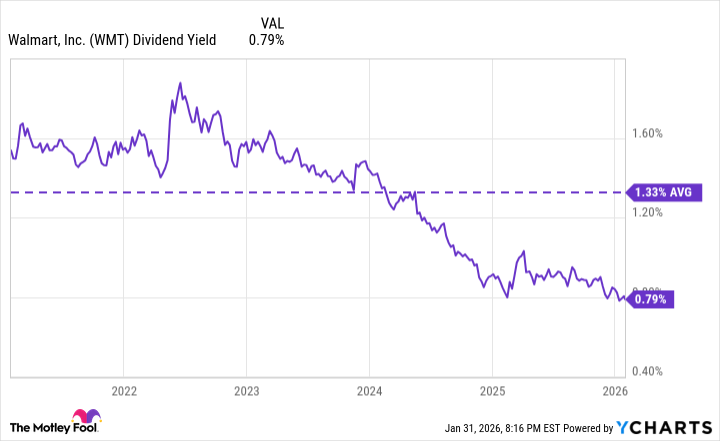

The yield is around 0.8%. It’s not going to make you a millionaire. But it’s…steady. Like a slightly grumpy uncle who always sends a birthday card. They’ve increased their dividend for 52 consecutive years. That’s a level of consistency I aspire to, but consistently fail at. Their financials are solid, which is reassuring. And they’re branching out. Walmart+ (a subscription service, because apparently we need another one) and Walmart Connect (an advertising platform, because everything is an advertisement now). It’s a smart move, I suppose. Higher margins. More flexibility. It just feels…corporate. Like they’re slowly taking over the world, one roll of toilet paper at a time.

I’ve noticed, over the years, that Walmart does particularly well in times of economic hardship. When things are good, people shop at Whole Foods. When things are bad, they descend upon Walmart like locusts. It’s a grim realization, but a profitable one for shareholders.

2. Coca-Cola: The Ubiquitous Fizz

Coca-Cola. It’s practically a cultural artifact. I once tried to go a month without drinking it. It was a dark time. I was irritable, prone to headaches, and developed a strange craving for seltzer water. The company has been increasing its dividend for 63 consecutive years. Sixty-three! That’s longer than I’ve been alive. And the yield is routinely more than double the S&P 500 average. It’s a remarkably effective business, really. Selling sugary water to the masses. It’s almost…villainous.

They’ve managed to distribute their products to nearly every corner of the globe. It’s a logistical marvel, and slightly terrifying. And, remarkably, people continue to buy it, regardless of the economic climate. Recession or boom, the world still craves a Coca-Cola. It’s a testament to branding, I suppose. Or perhaps, a testament to our collective addiction to sugar.

They’re not complacent, though. They’ve been diversifying. Plant-based drinks, zero-sugar options, even alcohol. It’s a smart move. Adapt or die, as they say. They’re trying to appeal to a wider range of consumers, which is sensible. It just feels…calculated. Like they’re anticipating our every whim.

Don’t expect Coca-Cola to be a growth stock. It’s not going to double your money overnight. But it’s a solid income stock. A reliable source of cash. The kind of stock you can hold for the long haul and trust it won’t suddenly vanish. Like a slightly eccentric, but ultimately dependable, aunt.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2026-02-03 10:33