![]()

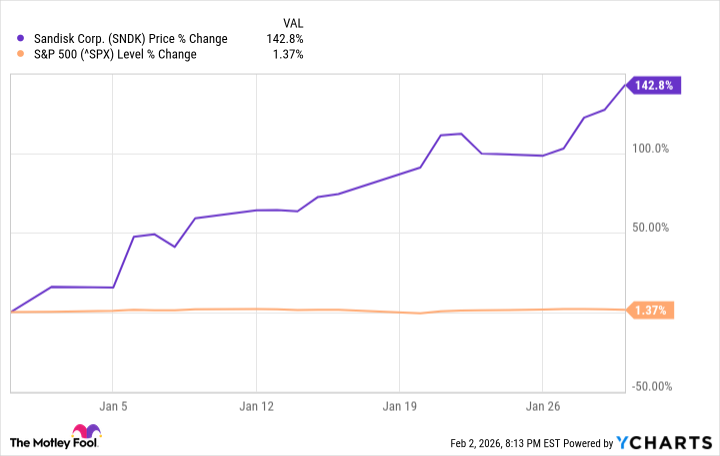

The recent performance of Sandisk – a name, one suspects, more evocative of seaside postcards than cutting-edge technology – has been, to put it mildly, remarkable. Shares ascended by a thoroughly immoderate 143% in January, a figure that rather strains credulity in these generally sensible times. The cause, naturally, is the current, somewhat hysterical, enthusiasm for all things Artificial Intelligence, and the attendant scramble for memory chips. A shortage, you see. A most convenient shortage.

The second-quarter earnings report, released at month’s end, confirmed what the market had already, with its usual impetuousness, priced in. Though, one notes, there was precious little in the way of genuinely new information. Merely confirmation that the rising tide of AI-related expenditure was, indeed, lifting all boats, however ramshackle.

Commentary from the likes of Intel and Apple on their respective earnings calls, hinting at increased memory prices, provided the initial impetus. Several analysts, those ever-optimistic seers, hastened to revise their price targets upwards, seemingly determined to validate the burgeoning bull run. One can’t help but wonder if they weren’t simply swept along by the prevailing euphoria.

The Nvidia Effect

The truly significant surge occurred on January 6th, prompted by remarks from Nvidia’s Jensen Huang. He declared AI storage to be a “completely unserved market,” a statement that, while perhaps hyperbolic, clearly resonated with investors. TrendForce, ever eager to corroborate a good story, predicted a 33%-38% increase in NAND flash contract prices for the first quarter. A most fortuitous coincidence.

Nomura, not to be outdone, subsequently announced that Sandisk would double the price of its high-capacity 3D NAND memory devices. A bold move, one might observe, but perfectly timed. The analysts, predictably, responded with renewed enthusiasm, and Sandisk, with a commendable lack of modesty, validated their predictions with its earnings report.

Revenue rose by 31% sequentially and 61% year-over-year, reaching $3.03 billion – a figure comfortably exceeding expectations. Adjusted earnings per share soared from $1.23 to $6.20, reflecting the aforementioned price increases and a corresponding jump in gross margin from 32.5% to 51.1%. CEO David Goeckeler, with a touch of self-congratulation, highlighted the “critical role” played by Sandisk’s products in powering this artificial intelligence frenzy. One suspects the products are merely along for the ride.

A Transient Boom?

The forecast for the third quarter – revenue of $4.4 to $4.8 billion and adjusted earnings per share of $12 to $14 – suggests this momentum will continue, at least for the time being. However, memory markets are notoriously cyclical. A correction is inevitable. The question is not if, but when.

Nevertheless, as long as prices continue to rise and Sandisk’s profits remain buoyant, there is a case to be made for further gains. A speculative one, perhaps, but not entirely without foundation. One might even venture to suggest that, in the current climate of irrational exuberance, Sandisk’s ascent could continue for a few more quarters. Though, as a portfolio manager, I would advise a degree of caution. After all, bubbles, however attractively inflated, have a habit of bursting.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Top Actors Of Color Who Were Snubbed At The Oscars

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

2026-02-03 05:22