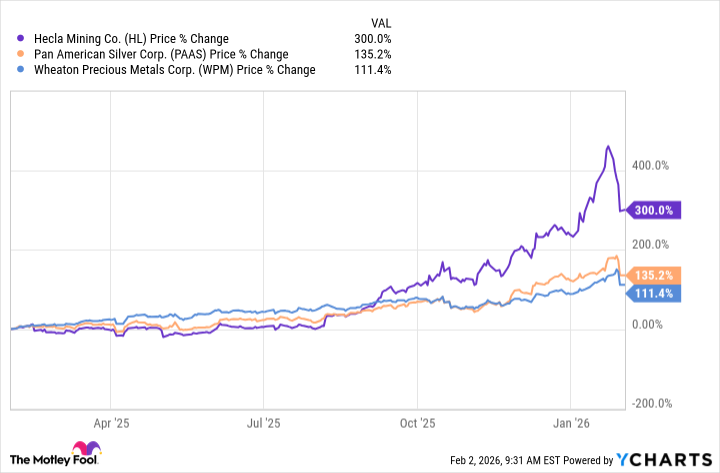

The recent performance of Hecla Mining (HL 4.31%), a surge of approximately 290% in the last fiscal year, is not, perhaps, a matter for celebration, but rather a curious anomaly within the broader, increasingly opaque system of resource extraction. The company’s focus on precious metals – silver, primarily, but also gold, lead, and zinc – merely reflects the anxieties of a world perpetually bracing for the next undefined crisis. To suggest a direct correlation between geopolitical instability and shareholder returns feels… insufficient. It is as if the market, itself a vast, impersonal bureaucracy, rewards not prosperity, but the appearance of preparedness for decline.

What Hecla Does (Or Appears To)

Hecla, like so many entities engaged in the excavation of the earth’s resources, does not confine itself to a single commodity. Silver constitutes roughly 48% of its revenue stream, followed by gold at 37%, the remainder allocated to base metals. This diversification, however, feels less like strategic planning and more like an attempt to distribute risk across multiple, equally unpredictable variables. The fluctuating prices of silver and gold, naturally, exert a disproportionate influence on Hecla’s financial performance, a dependency that feels less like empowerment and more like a perpetual state of vassalage to the whims of global markets.

The reported 67% increase in sales during the third quarter of 2025, while superficially impressive, obscures the underlying circularity of the process. The company transitioned from a state of near-equilibrium to a modest profit of $0.15 per share, a transformation rendered meaningless by the sheer scale of the operations involved. To express this improvement as a percentage feels almost… mocking.

The period of rising silver and gold prices, while beneficial to Hecla’s bottom line, raises the unsettling question of allocation. What, precisely, is being done with this influx of capital? The answer, it seems, is not a bold expansion or a generous return to shareholders, but a cautious reinvestment in the maintenance of existing operations and a slow, methodical reduction of debt. A prudent course, perhaps, but one that feels… profoundly unsatisfying.

The Illusion of Control

The current dividend policy – a negligible $0.015 per share annually – appears to be subject to the arbitrary discretion of the Board of Directors. Some companies, such as Pan American Silver (PAAS 1.78%) and Wheaton Precious Metals (WPM +0.26%), have attempted to link their dividend payouts to commodity prices or overall financial performance. This feels like a transparent attempt to project an illusion of responsiveness, a gesture that, while superficially appealing, does little to alter the fundamental power dynamics at play. Hecla, however, remains steadfastly opaque, its dividend policy a black box, its decisions inscrutable.

A Waiting Game, Perhaps For Nothing

At this juncture, investors would be unwise to anticipate a significant dividend payout from Hecla Mining. This expectation is further diminished by the recent decline in precious metal prices, a reminder that even seemingly stable commodities are subject to unpredictable fluctuations. The volatility inherent in these markets suggests that any attempt to derive consistent income from them is, at best, a precarious undertaking. To seek dividends in this environment is to chase a phantom, a fleeting illusion of security in a world defined by its inherent instability. Even the variable dividend policies of Pan American Silver and Wheaton Precious Metals offer no true respite, merely shifting the risk from the company to the investor, a subtle but significant distinction. The system, as always, persists.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Top Actors Of Color Who Were Snubbed At The Oscars

- Is Kalshi the New Polymarket? 🤔💡

2026-02-03 04:52