![]()

fortunes are made not by those who

invent

, but by those who are

first

to capitalize on the invention. And now, a new frenzy stirs, a gold rush for the discerning – or, more accurately, for those with access to the right kind of memory.

For years, the focus has been on brute computational force. The more transistors, the faster the processing. But the AI, that insatiable beast, has begun to demand more. It isn’t simply power it craves, but recall. The bottleneck isn’t the muscle, but the memory. And in this realm of fleeting electrons and vanishing bits, a new contender emerges: Micron Technology. It’s a name that doesn’t quite resonate with the same fanfare as Nvidia, but believe me, the shadows are lengthening.

Goldman Sachs, in a fit of almost reasonable forecasting, suggested $500 billion in capital expenditures for AI infrastructure in 2026. A conservative sum, I assure you. Meta Platforms alone intends to spend up to $135 billion this year. The air is thick with investment, with promises of sentient algorithms and self-driving carriages. Everyone is clamoring for the latest GPUs, the fastest accelerators. But it’s the supporting cast, the unsung heroes, that will truly benefit. The memory chips. The humble DRAM and NAND, suddenly imbued with the power to dictate fortunes. TrendForce predicts price increases of 60% and 38% respectively. A quiet revolution, unfolding in the darkened halls of fabrication plants.

These new AI creations – agentic systems, autonomous robots, the inevitable rise of the automated bureaucrat – require more than just processing power. They demand a vast, reliable memory. A digital hippocampus, if you will. The developers, those frantic alchemists of the modern age, cannot simply throw money at general-purpose chips. They need specialized solutions, enhanced memory, and storage. Micron, with its high-bandwidth memory (HBM), is poised to become the provider of this essential ingredient. It’s a bit like selling shovels during a gold rush, only the gold is data, and the rush is eternal.

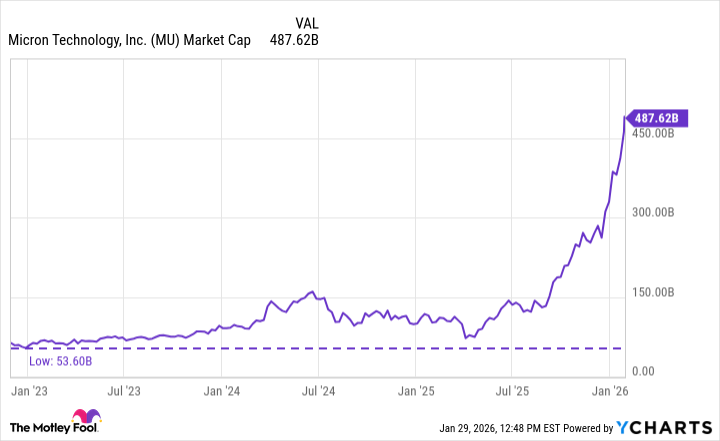

Three years into this AI revolution, Micron’s market capitalization has risen almost tenfold. A respectable climb, certainly, but the most dramatic ascent has occurred in the last six months. One begins to suspect a touch of the supernatural. Even after such a meteoric rise, its valuation remains…reasonable. A forward price-to-earnings multiple of just 14. Compare that to its peers, trading at double or triple that figure. It’s as if the market hasn’t quite grasped the significance of what’s unfolding. Or perhaps, they simply haven’t seen the ghost in the machine.

One can’t help but draw comparisons to Nvidia, back when ChatGPT first stirred. But perspective is crucial. Micron’s stock has already experienced a significant run-up. It may not surge tenfold again. It may not become the “next Nvidia.” But given the secular tailwinds fueling its growth, I suspect it is on the cusp of having its own “Nvidia moment.” A breakout. A surge. A fleeting glimpse of immortality in the silicon age. Though, as any seasoned observer of human folly knows, even the most brilliant flash can be extinguished by a sudden power outage. Or, perhaps, by the whims of a capricious demon.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Top Actors Of Color Who Were Snubbed At The Oscars

- Is Kalshi the New Polymarket? 🤔💡

2026-02-03 04:32