Now, some companies, like this one called The Trade Desk (TTD 1.96%), have had a rather rotten year. A positively dreadful 2025, if you ask me. Its stock tumbled like a sack of old potatoes, nearly 70% down! Made it one of the worst performers in the whole S&P 500. Folks were expecting a bounce in 2026, but it hasn’t quite happened, has it? It’s slouched another 16% at the start of this year, looking rather glum indeed.

Shares are now down nearly 80% from their peak – a proper plummet! The big question is, is this a scrumptious opportunity, or a sticky trap for your hard-earned pennies? A good investment, or a bit of a bother? Let’s have a look, shall we?

Why is The Trade Desk so Down in the Dumps?

First, we must address the elephant in the room – a rather large and grumpy elephant, I might add. Stocks don’t simply fall off a cliff of their own accord. Something mischievous had to happen. For The Trade Desk, it’s a nasty combination of slowing growth and a rather unpleasant rival appearing on the scene.

The Trade Desk operates a sort of advertising platform, a clever little machine that places advertisements in just the right spot. It has connections everywhere – websites, those podcast contraptions, connected TVs, and all sorts of digital nooks and crannies. As advertising becomes more personalized, more targeted, The Trade Desk should be thriving. But something’s gone awry.

It was disrupted, you see, by none other than Amazon (AMZN +1.60%). That enormous, ever-expanding Amazon. Its ad service has been growing at a frightening pace, raking in $17.7 billion in just one quarter! That’s a truly monstrous sum. The Trade Desk, by comparison, managed a mere $2.8 billion over the last 12 months. Amazon, you see, has more optimal advertising space, and it’s using it with a greedy, relentless efficiency.

If you’re trying to sell a widget, would you rather advertise on the dusty margins of some obscure website, or right at the top of Amazon when someone is actively searching for that very widget? The answer, my dear reader, is rather obvious, isn’t it? Advertisers have been flocking to Amazon like moths to a particularly bright, and rather profitable, flame.

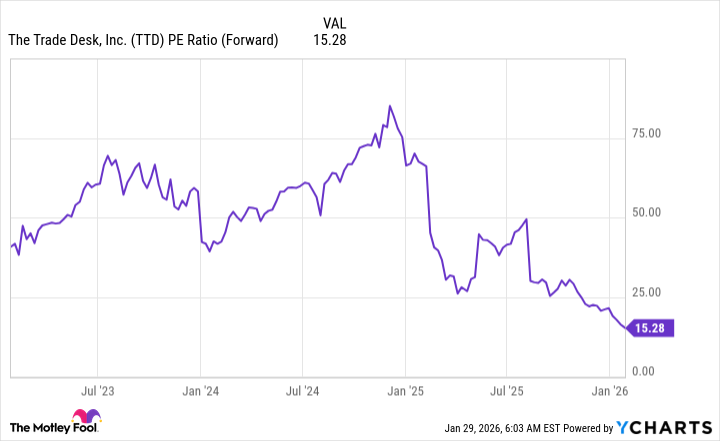

This has caused The Trade Desk’s stock to lose its shiny glow and see its valuation tumble. It used to be a premium stock, boasting a valuation of over 50 times forward earnings. Now? Dirt cheap, at just 15 times forward earnings! The S&P 500, meanwhile, trades for 22.2 times forward earnings. A rather significant difference, wouldn’t you say?

A valuation like that usually indicates a company is shrinking, not growing. The Trade Desk is still growing, thankfully, but not at the breakneck speed investors were hoping for. Now, as a dividend hunter, I find this rather appealing. A temporarily bruised stock, still growing, but available at a bargain price? It smells of opportunity! I think this is a prime time to scoop up shares before the stock returns to a more sensible, market-average valuation. Think of it as rescuing a little lost lamb from a rather nasty storm.

However, there is still a bit of a risk here. The market might not appreciate the stock for some time. It might remain glum and unloved, like a forgotten sock under the bed. But for those with a bit of patience, and a nose for a good deal, The Trade Desk could prove to be a rather delightful addition to your portfolio. Just remember, sometimes the sweetest rewards are hidden beneath a layer of gloom.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2026-02-03 02:43