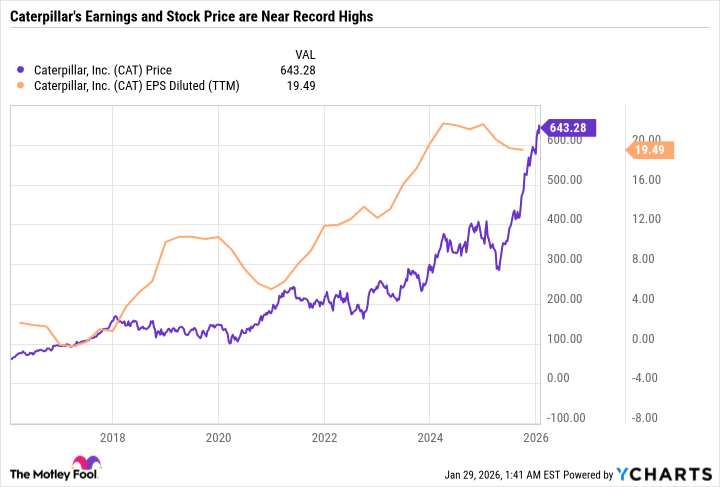

Now, listen closely, because this is a tale of a rather large machine-maker called Caterpillar. Last year, they were the star of the Dow Jones show, zooming upwards like a particularly enthusiastic beetle. And, wouldn’t you know it, they’ve kept on zooming. A truly frightful success, some might say. But success, my dears, is a slippery thing, often hiding a nasty surprise.

This Caterpillar, you see, isn’t building just diggers and bulldozers, oh no. They’re involved in something rather modern and mysterious – these “data centers.” Imagine enormous sheds, crammed with blinking, whirring boxes. These boxes, they say, are the brains of the future, and they need a lot of power. And who provides the power? Our Caterpillar, naturally. They make these giant, rumbling generators, and even clever battery contraptions, to keep the boxes buzzing. A most peculiar business, if you ask me.

They’ve also started fiddling with “AI,” which sounds like a nasty sort of insect, but is apparently something to do with making machines even cleverer. They’ve partnered with a company called Nvidia, who make these tiny, glittering chips, to make the machines think for themselves. It’s all very futuristic, and frankly, a little bit unsettling.

And then there’s the mining. Apparently, all this new technology requires mountains of metal – copper, gold, silver – dug out of the earth by, you guessed it, Caterpillar’s enormous machines. A most profitable arrangement, wouldn’t you say? They’re practically shoveling money into their pockets.

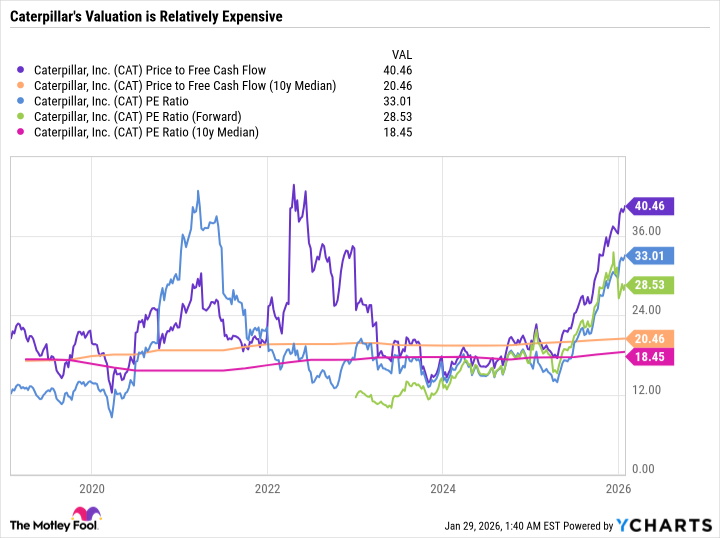

Now, the clever money says Caterpillar will keep on winning. They predict earnings will climb even higher next year. But here’s where things get interesting. The price of Caterpillar has gone up so fast, it’s starting to look a bit… precarious. Like a tower of building blocks, wobbling in the breeze. It’s gone a bit mad, hasn’t it? They’re charging a premium for every digger and generator, and frankly, it’s starting to feel a bit greedy.

Don’t misunderstand me, Caterpillar is a clever beast. They’ve benefited from all sorts of things – factories coming back home, oil prices going up – it’s all been rather convenient. But the market is not stupid. It knows a good thing when it sees it, and it’s already priced it in. The low-hanging fruit, as they say, has been plucked.

A Watchful Wait

So, what’s an investor to do? Well, I wouldn’t rush to buy Caterpillar right now. It’s not a screaming bargain, not by a long shot. I’d keep it on your watchlist, perhaps. A bit like keeping an eye on a particularly mischievous monkey. They’ve been handing out dividends for thirty-one years, which is admirable, but the yield is rather paltry. It’s like offering a crumb to a giant.

If you’re looking for a company that’s truly innovating, a company with real growth potential, you might want to look elsewhere. There are other pickaxes and shovels in this AI gold rush, and some of them might be a bit sharper, a bit more reasonably priced. Caterpillar is a fine machine, no doubt, but it’s starting to look a little… overstuffed.

Remember, my dears, the best investments are often the ones that nobody else has noticed yet. The hidden gems, the overlooked treasures. And sometimes, the most impressive machines are the ones that are quietly getting on with the job, without all the fuss and fanfare.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Here Are All the TV Shows Coming to Disney+ This Week, Including ‘Limitless’

2026-02-03 00:33