The shares of Robinhood Markets, that most democratic of brokerages, experienced a rather predictable dip on Monday, falling nearly nine per cent by the afternoon. One scarcely needs a crystal ball to discern the cause. The weekend’s disquiet in the cryptocurrency markets, a realm best left to those with a taste for the speculative, proved contagious.

Robinhood, you see, has cultivated a clientele unusually enthusiastic for these digital baubles and, indeed, for options trading—a pastime akin to wagering on the colour of a roulette wheel. When the froth dissipates from these ventures, a sympathetic decline in the brokerage’s fortunes is practically guaranteed. A most unedifying spectacle, but scarcely unexpected.

A Casino with a User Interface

The third quarter revealed that transaction-based revenue reached $730 million, a sum derived, in no small part, from the aforementioned digital speculations – thirty-seven per cent from cryptocurrency and forty-two per cent from options. Selling, of course, generates revenue in the short term, but a dwindling asset base rarely inspires confidence. The market, one observes, possesses a memory.

This weekend’s rout, triggered by the prospective appointment of Mr. Warsh to the Federal Reserve—a gentleman whose views on monetary policy are, shall we say, not universally embraced by those who profit from easy money—has likely induced a certain hesitancy amongst Robinhood’s clientele. A prudent pause before further ventures into the realms of high finance. One hopes.

The cause, whatever it may be, proved devastating to commodities—from gold and silver to the more ephemeral cryptocurrencies. Higher interest rates, naturally, tend to discourage investment in assets that offer no yield and benefit from a devalued currency. A simple principle, yet so often overlooked.

Volatility: The Price of Admission

In theory, Robinhood should be somewhat insulated from the fluctuations of the underlying assets. The brokerage profits from trades, not necessarily from the success of those trades. Margin lending contributes, but is not extended to these digital novelties. A distinction without a difference, perhaps, but one worth noting.

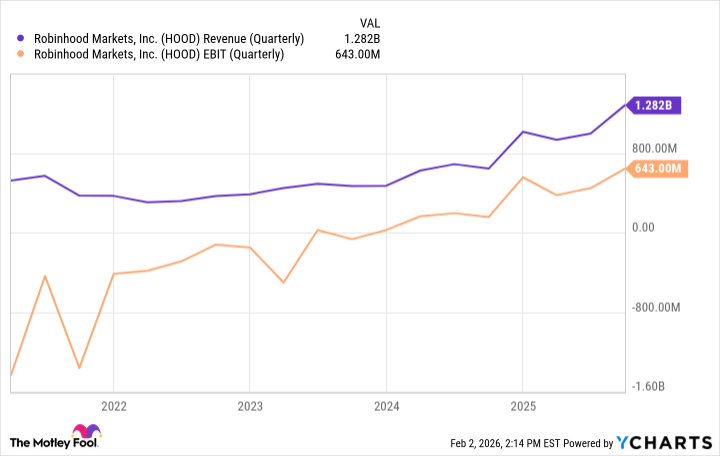

Over the long term, Robinhood has demonstrated a consistent, if unremarkable, growth in both revenue and earnings. A cryptocurrency crash may temporarily dampen enthusiasm, but as long as the brokerage continues to attract new users—those eager to participate in the great game—investors may eventually see a return. Though one suspects the definition of ‘eventually’ will be stretched to its limits.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Here Are All the TV Shows Coming to Disney+ This Week, Including ‘Limitless’

2026-02-02 22:45