People keep asking me what I’m buying. It’s a tiresome question, like being cornered at a potluck and asked to detail your digestive process. I usually mumble something about sensible shoes and high-yield savings accounts. But lately, I’ve been accumulating shares of Nvidia. Which feels…wrong. Like secretly enjoying a commercial for denture adhesive.

Nvidia. The graphics card people. They’re huge, of course. The largest company by market cap. Which is precisely why everyone should be suspicious. I’ve learned that the truly exciting investments are always found in the dusty corners of the market, run by men named Earl who wear short-sleeved shirts and smell faintly of motor oil. Not sleek, Silicon Valley behemoths.

But here we are. The thing is, everyone’s talking about artificial intelligence, and apparently, AI runs on Nvidia’s chips. It’s a rather unsettling thought, isn’t it? That the future of humanity hinges on a company that once made things to make video games look prettier. My nephew, bless his heart, tried to explain it to me. Involved terms like “parallel processing” and “tensor cores.” I nodded and pretended to understand, then excused myself to check the expiration date on the cottage cheese.

The Inevitable, and Slightly Annoying, Growth

They make these things called GPUs – graphics processing units. Originally for gaming, which I’ve always found a bit frantic. All those explosions and pixelated dragons. But these GPUs, it turns out, are also good at…well, everything. Engineering simulations, drug discovery, even mining those digital coins my brother-in-law keeps rambling about. But AI is where the real money is. And Nvidia has a stranglehold on that market.

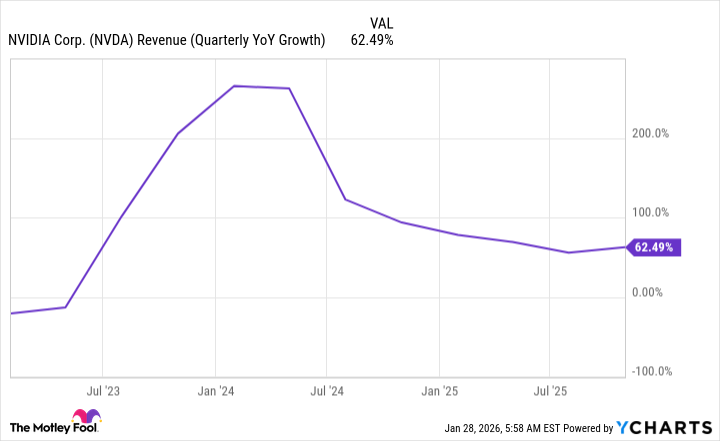

I keep waiting for the bubble to burst. For some brilliant engineer to announce a revolutionary new chip that renders Nvidia obsolete. But it hasn’t happened. And the numbers, frankly, are ridiculous. They’ve been growing at an absurd rate since 2023. I saw a chart the other day. It looked like a hockey stick. Which is never a good sign. It means someone, somewhere, is about to be very disappointed.

Apparently, they grew 63% year-over-year. Which sounds impressive, until you remember that’s a percentage. A meaningless abstraction. Still, analysts expect another 67% jump in revenue for Q4 and 52% for fiscal year 2027. It’s enough to give a sensible person hives.

The truth is, I suspect they’re not done growing. Which is precisely why I’m buying. It feels…unprincipled. Like exploiting a tragedy for personal gain. But that’s the market, isn’t it? A vast, indifferent machine that rewards those who are willing to look past their discomfort.

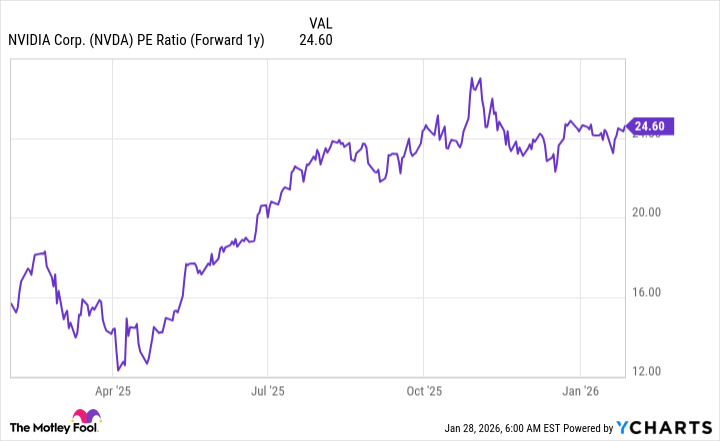

Right now, the stock trades for 24.6 times FY 2027 earnings. Which, in this climate, feels almost…reasonable. Compared to other tech giants trading at 30 times forward earnings, it’s practically a bargain. Like finding a slightly dented can of peaches at the back of the pantry.

The S&P 500 trades for 22 times forward earnings, so you’re paying only a slight premium for a company that’s expected to grow at 50% or greater. It’s a small price to pay for being at the center of this whole artificial intelligence frenzy. I just hope my nephew doesn’t start calling me for stock tips.

It really doesn’t get much better than this. A solid company with incredible prospects trading at a fair price. I think Nvidia is a steal. A perfectly reasonable panic buy. And if it all goes south, well, at least I’ll have a good story to tell.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Here Are All the TV Shows Coming to Disney+ This Week, Including ‘Limitless’

2026-02-02 22:44