The matter before us – the disposition of capital in the realm of artificial intelligence – resembles nothing so much as a palimpsest. Layers of expectation, of declared intent, obscure the true topography of value. One reads of Intel, a name once synonymous with the very logic of computation, receiving accolades – and funds – as though a generous endowment might restore a fading cartography. A curious proposition. Perhaps the government, in its wisdom (or its predictable lack thereof), mistook the instrument for the idea.

The chronicles speak of a decline. Intel, it appears, has been tracing a downward spiral since the year 2021 – a mere blink in the geological timescale of technology, yet an eternity in the feverish present. Projections for the first quarter of 2026 offer little solace: earnings hovering at the null point, a void mirroring the company’s apparent trajectory. A factory in Ohio, intended as a locus of renewal, remains a phantom, its opening date receding into the mists of 2030, or perhaps even 2031 – a delay that suggests not logistical challenges, but a fundamental miscalculation.

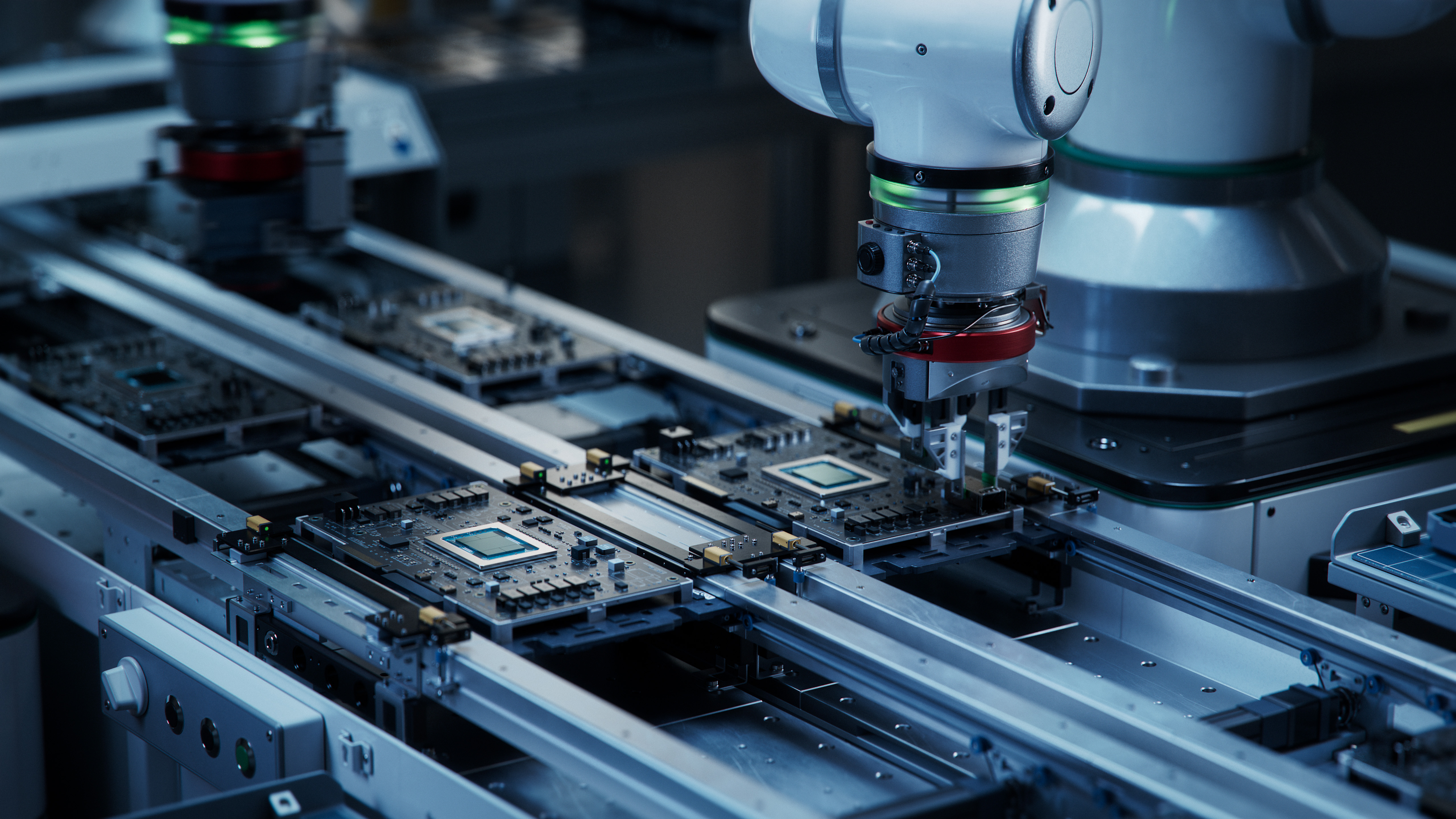

The true locus of power, it seems, lies elsewhere. Not in the grand pronouncements of established empires, but in the quiet industry of a Californian entity: Broadcom. A name that, to the uninitiated, might evoke images of silicon and assembly lines, but which, upon closer inspection, reveals a subtle orchestration of influence. They are the artisans of the Tensor Processing Unit, the engine upon which Alphabet – that modern Library of Babel, ceaselessly indexing the world – runs its Gemini program.

Consider this: Alphabet, a creature of software, has found itself reliant on the hardware of another. A dependency, perhaps, but one strategically positioned. Broadcom, a master of application-specific integrated circuits, designs and manufactures these essential components, quietly amassing a portfolio of influence. Their revenue, in the fiscal year 2025, reveals a startling statistic: half derived from AI-related endeavors. A growth rate of 24% overall, a net income increase of 42%, and an earnings per share surge of 40%. Figures that speak not of mere commerce, but of a shifting tectonic plate.

One might envision the market as a labyrinth, its corridors lined with competing claims and obsolete technologies. Nvidia, for years, has held the key – controlling approximately 85% of the AI chip market. But even the most formidable dominion is subject to erosion. Alphabet, recognizing this vulnerability, has forged a closer alliance with Anthropic, aiming to deploy a million TPU chips by 2026. A bold maneuver, suggesting a deliberate decoupling from Nvidia’s control.

The implications are clear. Broadcom, through its partnership with Alphabet, is not merely a supplier, but an architect of the future. Its debt, though substantial at $65 billion, appears less daunting in the face of such exponential growth. The company’s success is not accidental, but the result of a calculated strategy, a subtle understanding of the currents that shape the technological landscape.

To observe Intel’s decline and Broadcom’s ascent is to witness a familiar pattern: the erosion of established power and the emergence of a new order. It is a reminder that in the realm of technology, as in the annals of history, the future belongs not to those who cling to the past, but to those who embrace the inevitable currents of change. And that, perhaps, is the most unsettling truth of all.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Here Are All the TV Shows Coming to Disney+ This Week, Including ‘Limitless’

2026-02-02 21:32