Listen up, folks! You want dividends? You want ’em steady? You want ’em without having to become a stock-picking guru who spends all day muttering about price-to-earnings ratios? Good! Because frankly, most of you would pick a losing horse just to feel something. That’s why we’re talking about the Schwab U.S. Dividend Equity ETF (SCHD 0.03%). It’s not glamorous, it’s not going to make you a billionaire overnight, but it might just keep you from eating cat food in your golden years. And that, my friends, is a victory.

What Does This Thing Actually Do?

Okay, so here’s the deal. This ETF, it doesn’t invent anything. It doesn’t overthrow governments. It simply follows an index – the Dow Jones U.S. Dividend 100 Index. Think of it as a very obedient puppy. Now, that index… that’s where the magic (or, you know, moderately sensible financial engineering) happens. It starts by sniffing out companies that have been reliably handing out dividends for at least ten years. Ten years! That’s longer than some marriages! We’re looking for consistency, people! And they throw out the REITs. Apparently, real estate is too… complicated. Who knew?

Then, they concoct a “composite score.” A score! Like in bowling! This score considers things like cash flow (because you can’t pay dividends with hopes and dreams), return on equity (is the company good at making money?), dividend yield (duh), and dividend growth (are they getting better at giving you money?). It’s all very scientific. Or, at least, it looks like it is. Honestly, they could be using a Magic 8-Ball and we’d probably be in the same boat. But the math looks impressive!

They take the top 100 scorers, weight them by size (bigger companies get more say, naturally), and voila! You have an ETF. It’s updated annually, so it’s not like they set it and forget it. Though, let’s be honest, most fund managers are probably playing golf half the time.

A Generally Rising Price and a Generally Rising Dividend (No Guarantees, Folks!)

With 100 stocks, this thing is about as diversified as a buffet. You could make this your only equity investment, and you wouldn’t be completely insane. And the expense ratio? A measly 0.06%! That’s less than the cost of a decent cup of coffee these days. Seriously, you’re paying peanuts for a reasonably competent financial robot.

Now, let’s talk returns. The dividend yield is around 3.8% right now, which is more than three times what you get from the S&P 500 index. Three times! That’s the difference between a polite clap and a standing ovation! You could find higher-yielding ETFs, sure, but they’re usually filled with companies that are one bad quarter away from bankruptcy. This one feels… safer. Like a slightly overcooked chicken. Not exciting, but unlikely to kill you.

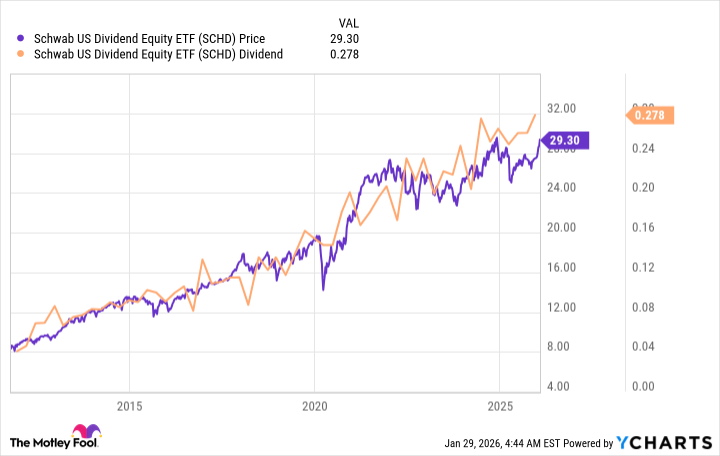

And the price and dividend have both been steadily climbing over time. Capital appreciation and income? It’s like finding a twenty-dollar bill in your old coat! A powerful combination that should please just about all dividend lovers… and anyone who doesn’t want to live under a bridge.

A Good Mix of Yield and Growth (Or, How to Avoid Being a Financial Disaster)

Look, nothing is perfect. This ETF isn’t going to turn you into Warren Buffett. It’s actually lagged the market recently, because those fancy tech stocks with no dividends are all the rage. But if you want a steady stream of cash flow without having to become a stock-picking savant, this ETF could be the perfect fit. A $500 investment will buy around 17 shares. That’s 17 little soldiers working for you, day and night. Well, during market hours, anyway. They need weekends off, too.

So, there you have it. A reasonably sensible, low-cost ETF that might just help you avoid financial ruin. It’s not glamorous, it’s not exciting, but it’s… reliable. And in this crazy world, folks, that’s worth a lot. Now, if you’ll excuse me, I’m going to go find a good deli. All this talk of dividends has made me hungry.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

2026-02-02 18:14