The universe, as anyone who’s accidentally glanced at a stock ticker lately knows, is a profoundly baffling place. Most of the attention in the increasingly frantic scramble for artificial intelligence dominance is currently focused on Nvidia, a company that, frankly, seems to be doing rather well for itself. But quietly, almost as if embarrassed by its own competence, Broadcom is starting to gather momentum. Both companies are engaged in the creation of the silicon brains that will, presumably, either save or enslave humanity (the odds are roughly 50/50, depending on who you ask and whether they’ve had their coffee), but Broadcom’s approach is…different. It’s less about building a general-purpose brain and more about crafting bespoke thought-units for specific clients. Think of it as tailoring intelligence, rather than mass-producing it. (Which, incidentally, raises the philosophical question of whether a bespoke intelligence has more existential angst. A question for another time, perhaps, over a very strong cup of tea.)

So, the question is, is it worth parting with a grand—a surprisingly specific sum, when you consider the sheer scale of the cosmos—and investing it in Broadcom right now? Let’s delve in, shall we?

Broadcom’s Peculiar Approach to Thinking Machines

Nvidia, in its wisdom, manufactures graphics processing units (GPUs). These are remarkably versatile devices, capable of rendering photorealistic dragons, mining cryptocurrencies (a pursuit of dubious long-term value), and even, apparently, accelerating drug discovery. Broadcom, however, has opted for a more… focused strategy. They’re designing custom AI chips, application-specific integrated circuits (ASICs), for each of their clients. This means that the chip powering Google’s latest search algorithm will be entirely different from the one helping OpenAI’s bots generate slightly unsettling poetry. It’s a bit like commissioning a tailor to create a suit specifically for your left elbow – wonderfully precise, but perhaps not the most efficient use of resources. (Although, arguably, everything is relative, and the concept of efficiency is merely a human construct imposed on a fundamentally chaotic universe.) Each client benefits because the chip is tailored to their specific workload.

Furthermore, by partnering with Broadcom, companies avoid the rather substantial premium attached to Nvidia’s services. Nvidia’s profit margins exceed 50%, meaning that more than half of the cost of one of their GPUs vanishes into the ether of corporate profitability. AI hyperscalers, those vast data centers humming with the collective intelligence of machines, are acutely aware of this. Getting a comparable result from Broadcom, at a slightly less astronomical price, is proving to be a compelling alternative. It’s a bit like choosing between a solid gold toothbrush and a perfectly functional plastic one. Both clean your teeth, but one doesn’t require you to remortgage your house.

In the first quarter, Broadcom anticipates its AI semiconductor division will double in size year over year. A rather impressive feat, considering the inherent difficulties of doubling anything, especially something as complex as a semiconductor division. (Have you ever tried doubling a particularly stubborn cat? It’s remarkably challenging.)

For context, Nvidia’s data center division, encompassing most of its AI hardware, saw revenue growth of 66%. Impressive, certainly. But Broadcom’s projected doubling is…better. It suggests a shift in the industry, a subtle realignment of power. It makes Broadcom, on the face of it, a worthwhile investment. (Though, of course, the universe has a peculiar sense of humor and often delights in proving even the most carefully considered predictions wrong.)

However, Broadcom isn’t a pure AI play, not yet. AI semiconductor revenue still accounts for less than half of its total revenue. Though, if its current growth rate persists, that could change by the end of the year. It’s like having a remarkably intelligent robot butler who also happens to be a mediocre gardener. The potential is there, but the overall package isn’t quite as focused. This drags the overall growth rate down, although Wall Street analysts still expect over 50% revenue growth for Broadcom during fiscal year 2026.

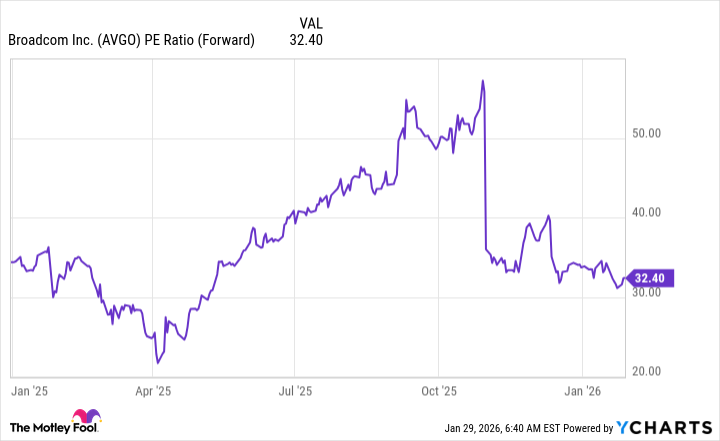

The final consideration is valuation. At 32 times forward earnings, Broadcom isn’t exactly cheap. It’s about where the big tech companies trade, so it isn’t that expensive. Furthermore, the AI spending spree is expected to last through at least 2030, and if Broadcom’s computing units continue to gain market share, this is a reasonable price to pay now.

So, is Broadcom worth a $1,000 investment? After careful consideration, and a thorough review of the available data (and a brief consultation with a particularly insightful garden gnome), I believe it is. It’s a sensible bet, a relatively low-risk opportunity to participate in the ongoing AI revolution. It will be among the best performers in the stock market over the next five years. (Unless, of course, a rogue asteroid decides to pay us a visit. But that’s a risk inherent in all investments, really.)

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

2026-02-02 16:14