The current enthusiasm for Artificial Intelligence, you see, has been quite the thing. A dashedly clever notion, empowering machines to do the thinking for us – though one does wonder if they’ll start demanding tea and biscuits next. It’s swept through the investment world like a particularly brisk breeze, and naturally, everyone’s been scrambling to find the best seat on the bandwagon. Now, Palantir Technologies, a name that sounds suspiciously like a character from a Russian novel, has found itself rather prominently positioned in this digital drama.

While Nvidia, with its graphics processing units, gets a good deal of the spotlight – a perfectly understandable situation, as blinking lights always attract attention – a strong argument can be made that Palantir, specializing in the rather mysterious art of data mining, is actually the top dog in this particular arena. The company’s shares, since the beginning of 2023, have performed a most energetic jig, leaping upwards by a staggering 2,300% – a performance that would make even a seasoned acrobat blush. Investors, you see, have latched onto what they perceive as a sustainable advantage and eye-popping growth, and who can blame them?

However, despite this rather dazzling display, Palantir’s shares have recently taken a bit of a tumble, falling 27% from their peak on November 3rd, 2025. Some may view this as a buying opportunity – a chance to scoop up shares at a slightly reduced price. But I, as a humble observer of the market’s whimsical ways, suspect this is merely the opening act of a considerably more dramatic downward performance.

A Moat Most Admirable, But Even Moats Have Their Limits

Before we delve into the potential difficulties, let’s acknowledge the foundations of this company’s success. The source of all this excitement, you see, is Palantir’s rather impressive competitive edge. Their two main platforms, Gotham and Foundry, don’t have a great many rivals, which means their cash flow tends to be remarkably predictable – a comforting thought for any investor.

Gotham, the more mature of the two, is particularly useful to the U.S. government and its allies in matters of military planning and data analysis. A most serious undertaking, naturally, and one that generates a healthy stream of revenue. Foundry, on the other hand, is a subscription-based platform designed to help businesses make sense of their data. It’s a promising venture, though currently serving only 742 clients – a rather modest number, considering the size of the business world, but one that suggests considerable room for expansion.

Investors appreciate the predictability and transparency of Palantir’s operating model. Government contracts with Gotham tend to span four to five years, and Foundry’s subscription service does a splendid job of keeping clients happy and returning for more. And let’s not forget the company’s balance sheet, which is, shall we say, in rather robust condition. With over $6.4 billion in cash and no debt, CEO Alex Karp and his board have the luxury of investing in innovation while rewarding shareholders – a most agreeable arrangement.

Expectations, My Dear Fellow, Are a Perilous Business

But when things seem too good to be true on Wall Street, they usually are. Palantir Technologies, despite its advantages and healthy balance sheet, may struggle to live up to the lofty expectations that have been set. You see, every revolutionary technology, over the last three decades, has experienced a bubble-bursting event during its early expansion. The internet, in the mid-1990s, is a perfect example. Businesses embraced it with open arms, just as they’ve adopted artificial intelligence, but it took years to understand how to optimize this technology. Despite all the excitement surrounding AI infrastructure, we’re still years away from companies truly mastering its potential.

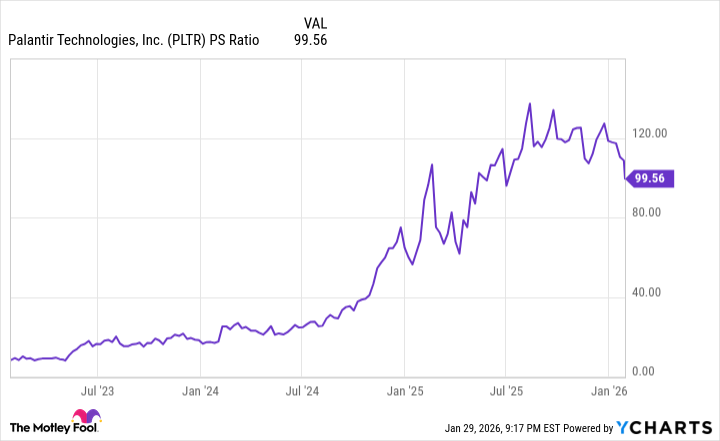

History suggests that AI is unlikely to be the exception. If the past is any guide, the leading companies in this revolution, such as Palantir, could be among the hardest hit. And then there’s the matter of valuation. While beauty, as they say, is in the eye of the beholder, the price-to-sales (P/S) ratio doesn’t leave much room for argument. Companies at the forefront of a new trend, with P/S ratios of 30 or higher, have historically indicated the presence of a bubble.

Palantir entered 2026 with a P/S ratio of over 110! Even after a 27% decline in its share price, it stood at roughly 100 on January 29th. Historical data suggests that P/S ratios above 30 aren’t sustainable over the long term – let alone a triple-digit ratio. It’s a bit like trying to build a castle on quicksand, you see.

And finally, one must consider that continued high levels of U.S. government defense spending aren’t guaranteed. While Gotham is currently benefiting from the prevailing political climate, midterm elections and the 2028 presidential election could change the trajectory of this core operating segment in an instant.

To be perfectly clear, Palantir isn’t a bad company. It’s a solid business with a sustainable moat and the potential for double-digit growth. But expecting its stock to maintain its current premium or to hold up if/when the AI bubble bursts is, shall we say, a bit optimistic. The 27% decline we’ve seen so far looks to be just the beginning of a considerably larger downward move in 2026. A spot of bother, perhaps, but one that a discerning investor should anticipate.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

2026-02-02 13:13