The current infatuation with artificial intelligence, a fever dream of algorithms and escalating valuations, naturally focuses the acquisitive eye. Two names, Taiwan Semiconductor Manufacturing (TSM) and Advanced Micro Devices (AMD), present themselves as potential beneficiaries, each having enjoyed a rather robust 2025 – a year now receding into the gauzy past, like a half-remembered waltz. AMD ascended with a flourish (77%), while TSMC, with a more measured grace, added 54% to its tally. But the past, dear reader, is merely a prologue, a meticulously crafted illusion. The pertinent question, the one that truly exercises the discerning investor, concerns the next five years, perhaps even the decade stretching towards 2030, as the AI spending spree shows no immediate signs of abatement.

A subtle distinction, often overlooked in the breathless rush to categorize, separates these contenders. AMD, you see, is a designer, an architect of silicon dreams. It conceives the blueprints, the intricate logic that powers the modern digital world. But the actual fabrication, the delicate dance of photons and chemicals that transforms those blueprints into tangible reality, is outsourced. TSMC, then, is the artisan, the master craftsman who brings those designs to life. Many a leading computing concern—Nvidia amongst them—entrusts its precious designs to TSMC’s capable hands. It’s a division of labor, a perfectly functional, if somewhat less poetic, arrangement.

This difference in function dictates a difference in clientele. TSMC, with a clientele as established and discerning as a Parisian couturier’s, need not engage in boisterous self-promotion. Its reputation precedes it, a quiet assurance of quality that obviates the need for persuasive argument. AMD, however, finds itself in a rather more crowded arena, vying for attention amidst the clamor of competitors. Nvidia currently reigns supreme, its technological edifice a formidable challenge. Then there’s Broadcom, crafting bespoke silicon solutions for the hyperscalers, those vast digital empires that demand—and receive—tailored service. AMD, alas, is often perceived as a third option, a respectable contender, perhaps, but lacking the immediate luster of its rivals. Management assures us improvements are afoot, and one must concede the possibility of a late surge, but the uphill climb is undeniably steep.

AMD’s recent boast of a tenfold increase in downloads of its ROCm software (November 2025) is, on the surface, encouraging. More developers, it seems, are willing to explore the potentially more affordable AMD hardware. A shrewd observation, certainly, though one wonders if budgetary constraints, rather than pure technological preference, are the primary driver. Management also projects a rather ambitious 60% compound annual growth rate for its data center division, with a company-wide rate of 35%. Lofty projections indeed, and one approaches them with a healthy dose of skepticism. If realized, of course, AMD would become a rather attractive acquisition, or a formidable competitor.

TSMC, meanwhile, offers similarly optimistic guidance. A projected 60% CAGR for AI chips over the next five years (2024-2029), tempered by a more conservative 25% company-wide rate. The difference, one suspects, lies in the inherent stability of TSMC’s business model. It’s a tollbooth operation, dear reader, a steady stream of revenue generated from the relentless march of technological progress. A rather more predictable, and therefore, appealing proposition.

This leads us to a rather elegant dilemma: would you prefer a stock that is currently underperforming, yet possesses a higher ceiling, or one that is delivering solid results today, but lacks the potential for truly explosive growth? That, in essence, is the AMD versus TSMC conundrum. A question of ambition versus assurance, of risk versus reward. A delightful paradox for the discerning investor to ponder.

TSMC: The Prudent Choice

For my part, I find myself leaning towards TSMC. As long as the AI spending continues—and all indications suggest it will—TSMC appears to be a remarkably secure investment. Its chips power the designs of Nvidia, Broadcom, and AMD, and would likely find a home in the products of any new competitor that emerges. It’s about as surefire a bet as one can find in this volatile realm. A rather comforting thought, wouldn’t you agree? AMD, while possessing a certain undeniable potential, carries a significantly higher degree of risk. Until it demonstrates a consistent ability to deliver on its ambitious projections, I remain a skeptic.

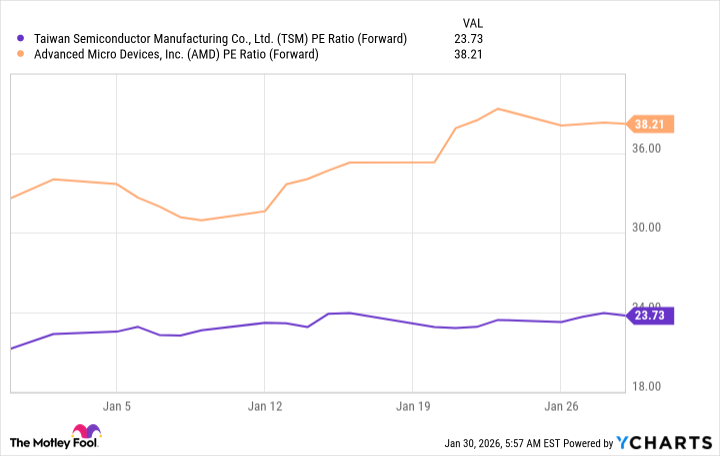

And finally, a rather compelling detail: TSMC’s stock is significantly cheaper than AMD’s. At 24 times forward earnings, compared to AMD’s 38, the valuation discrepancy is rather striking. A bargain, one might say, for a company with such a demonstrably secure position. I anticipate a consistent return, a quiet accumulation of wealth, rather than a fleeting moment of spectacular gain. A preference, perhaps, born of age and a certain aversion to unnecessary excitement.

TSMC, therefore, is my top pick. AMD may well outperform, should everything fall into place. But I prefer the comforting predictability of a surefire bet. A touch prosaic, perhaps, but I find a certain elegance in prudence.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

2026-02-02 12:33