The matter of Nvidia [NVDA 0.72%] is, at first glance, a simple accounting. A progression from a hopeful enterprise to a dominant entity, culminating in a valuation that now dwarfs entire nations. One recalls, with a certain bureaucratic detachment, the pre-pandemic assessment of approximately $150 billion. This figure, meticulously recorded and filed, now seems… quaint. The current valuation hovers around $4.5 trillion. A discrepancy that demands, though does not receive, explanation.

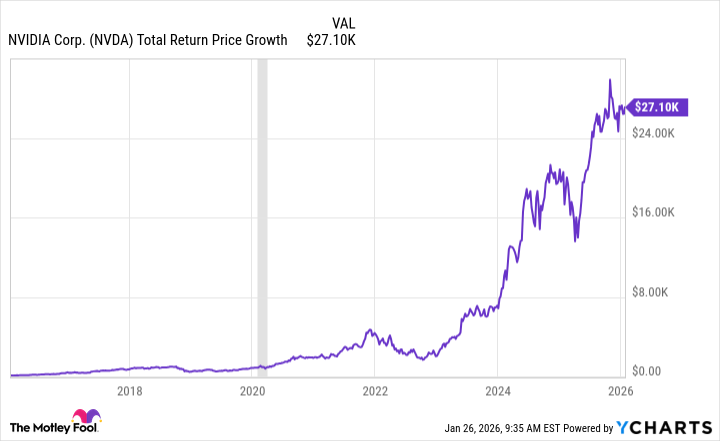

Shareholder returns, of course, are the official justification. The paperwork is extensive. But to focus solely on profit is to miss the underlying… arrangement. The stock did not ascend in a linear fashion, naturally. It suffered setbacks. A minor contraction in 2018, attributed to vague anxieties concerning economic cycles. The price diminished, predictably, by more than half. A corrective measure, one assumes, though the rationale remains elusive.

The pandemic introduced a temporary disruption, a fleeting descent followed by an equally swift recovery. But the true test arrived with the bear market of 2022. A descent of over 60%. A significant loss, meticulously documented in quarterly reports. And yet, the stock rebounded. It always does. A curious resilience, reminiscent of a perpetually renewing bureaucratic form, endlessly circulated and approved despite its inherent emptiness.

A ten-year investment, commencing a decade prior to January 23rd, yielded an increase exceeding 27,000%. An astonishing figure. A mere $100, diligently preserved and reinvested, would have blossomed into $27,100. A transformation that feels less like financial acumen and more like… a procedural inevitability. The system functions, though its purpose remains obscured.

The expectation of replicating such gains in the coming decade is, naturally, unrealistic. The AI revolution, while promising, remains in its nascent stages. Development continues, a labyrinthine process of incremental adjustments and perpetually deferred breakthroughs. Nvidia, having established a leading position, is poised to continue its trajectory. A continuation, not a revolution. A predictable outcome in a system designed for predictable outcomes.

One anticipates, with a detached resignation, that the dividends will continue to accrue. Small comforts in a world governed by forces beyond comprehension. The paperwork, of course, will be voluminous. And the cycle will continue, endlessly, precisely, and without discernible meaning.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢 2.5th Anniversary GLUPY LIVE Rewards 🎁

2026-02-02 11:52