January showed a little green – up 1.4% for the S&P 500. Not a landslide, but enough to make a man pause and consider the angles. Forty years of looking at these numbers tells you something, and it usually isn’t good news. It’s a faint signal, sure, but in this business, you learn to listen to whispers. Especially when they concern where the dividends are headed.

They call it the January Barometer. A fancy name for a simple idea: how the month goes, so goes the year. Some folks chase these things like they’re looking for a lost paycheck. I don’t put much stock in luck, but I do pay attention to patterns. Especially when those patterns might fatten a portfolio.

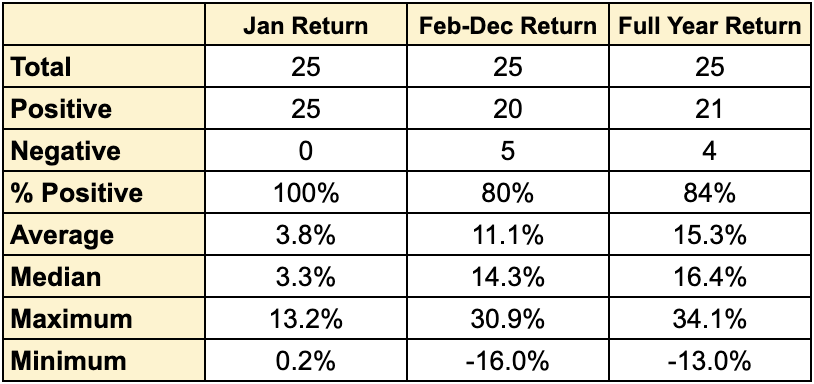

Over the last four decades, January’s been right about 80% of the time when it opened positive. That’s a better hit rate than most brokers I’ve met. A solid January usually meant the rest of the year delivered around 11%, with the median pushing past 14%. That’s a comfortable cushion, enough to let a dividend hunter sleep at night.

The last time January smiled, and the year turned sour? 2018. A quick bear market, a nasty surprise. Before that, you’d have to dig back to 2011. These things don’t happen often. Not unless someone’s been greasing the wrong palms.

Now, let’s talk about a January that goes south. That’s when things get interesting. And not in a good way.

A negative January? That’s a warning. The next eleven months only managed a positive return about 73% of the time, averaging a measly 6%. The years that started bad and stayed bad – 2022, 2008, 2002, 2000 – they stick in your memory like a bad debt. They remind you that the market doesn’t care about your plans.

Over forty years, a positive January meant an average full-year return of around 15%, hitting positive returns 84% of the time. A negative January? A pathetic 2-3%, with only 60% of the years finishing in the green. The numbers don’t lie. They just stare back at you, cold and unforgiving.

So, what does it all mean for 2026? January gave us a nod. A small one, but a nod nonetheless. It doesn’t guarantee anything, of course. The market’s a fickle dame. But it suggests a decent year for those of us who hunt for dividends. It’s a long game, this. And January just dealt us a hand. It’s not a royal flush, but it’s enough to keep me in the game. And that, my friend, is all you can ask for.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢 2.5th Anniversary GLUPY LIVE Rewards 🎁

2026-02-02 10:33