It has come to my attention – and indeed, to the attention of anyone who bothers to glance at the ledgers, which, admittedly, is a dwindling number these days – that the shares of Uber Technologies (UBER 1.98%) have experienced a… shall we say, a slight wobble. A momentary lapse in composure, as it were. They ascended, briefly, to a height of $101.99 in September of the year 2025, a respectable altitude for a conveyance built on promises and digital maps. But then, a descent began, precipitated by a rather curious increase in capital expenditures. A sum of $98 million, to be precise, more than double the paltry amount expended in the previous year. One begins to suspect the company is attempting to pave the roads themselves, a task best left to municipal authorities and, perhaps, a small army of disgruntled peasants.

This, however, is not a cause for alarm, but rather, an opportunity. A chance to acquire shares in a company that seems determined to reinvent the very notion of transport, even if it requires a substantial investment in… well, in everything. The increase in expenditures, you see, is not profligacy, but foresight. A recognition that the future of movement lies not in the clatter of hooves or the belch of steam engines, but in the silent glide of autonomous vehicles. The CEO, a Mr. Khosrowshahi, has declared that they are building for tomorrow while delivering today. A perfectly reasonable sentiment, though one wonders if he has actually seen tomorrow. It’s usually quite crowded.

Uber’s Dance with the Automatons

The company once attempted to construct these self-propelled carriages themselves, a hubristic endeavor that ended, quite predictably, in a tangle of wires and broken dreams. They have since adopted a more… diplomatic approach. A series of alliances, partnerships, and veiled agreements with various purveyors of automated technology. Alphabet’s Waymo, a shadowy British firm called Wayve, and a Chinese giant named Baidu, all contributing to a grand scheme to populate the world with driverless vehicles. It’s a bit like commissioning a cathedral from a committee of architects, each with their own eccentric vision, but one can’t deny the ambition.

The latest development involves a collaboration with Nvidia, a titan in the realm of artificial intelligence. They intend to combine Nvidia’s technology with Uber’s platform, creating a global ecosystem of robotic and human drivers. A harmonious blend, one might say, though I suspect the human drivers will have something to say about being replaced by metal contraptions. Stellantis and Lucid, other manufacturers of these automated curiosities, are also involved, promising fleets of robotaxis that will seamlessly integrate into Uber’s marketplace. It’s a network of interconnected carriages, each vying for passengers, each guided by an unseen hand. A perfectly modern spectacle, really.

The Expanding Empire

Uber, it seems, is no longer content with merely transporting people. They have extended their reach into the realm of delivery services, a perfectly logical step, and now, they are venturing into the uncharted territory of artificial intelligence solutions. They call it “Uber AI Solutions,” a division dedicated to assisting businesses in building high-quality AI models. It’s as if they are attempting to become the central nervous system of the modern world, connecting everything and everyone through a network of algorithms and data streams.

They will connect companies constructing AI with professionals to test and validate these digital creations. A perfectly sensible idea, though one wonders who will validate the validators. The revenue from ride-hailing grew by 20% to $7.7 billion, and delivery sales jumped by 29% to $4.5 billion in the third quarter of 2025. Overall revenue grew by 20% to $13.5 billion. A respectable performance, though one suspects the numbers are inflated by a small army of accountants and optimistic projections.

The Ledger Speaks

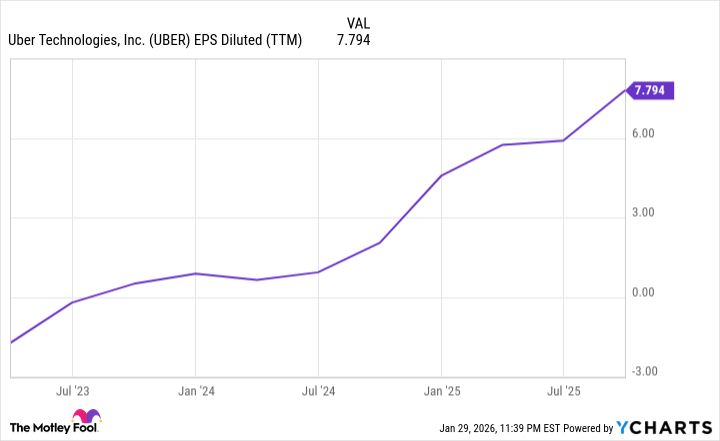

The rising revenue is merely the beginning. Net income attributable to Uber reached $6.6 billion in the third quarter of 2025, up from $2.6 billion in the previous year. Diluted earnings per share soared to $3.11, compared to $1.20. The CFO, a Mr. Mahendra-Rajah, assures us that this is merely the beginning of a sustained period of profit expansion. A bold claim, but one that is supported by the company’s steadily rising diluted EPS.

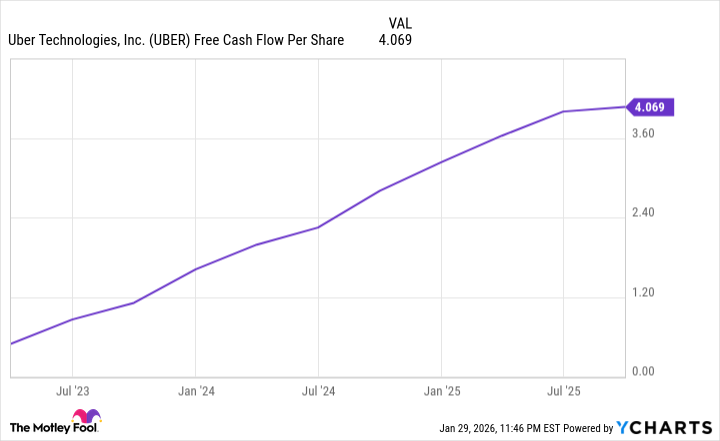

The company is generating more cash than it needs for operations and capital expenditures, signaling robust financial health. This allows them to engage in stock buybacks, a curious practice that involves purchasing their own shares, as if attempting to reassure themselves of their own value.

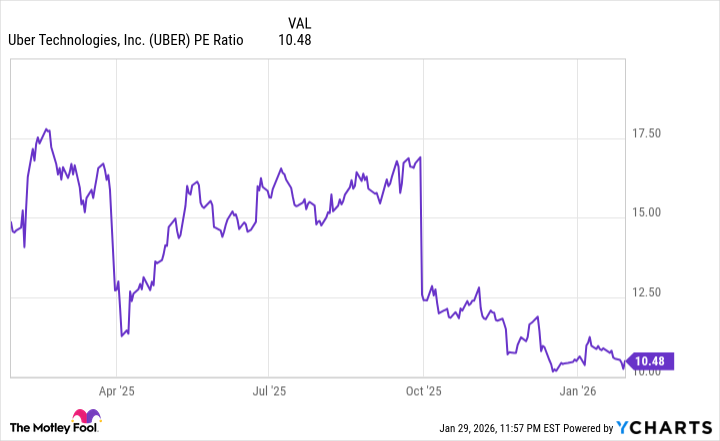

Comparing these excellent financial results against Uber’s share price reveals an attractive valuation. The price-to-earnings ratio is lower now than it was when the Trump administration’s tariff policies caused the stock market to plunge. A clear indication that Uber shares are a great value.

Uber management is thinking beyond ride-hailing and investing accordingly, hence its growth in capital expenditures. They have taken existing strengths in transportation data and married it with the autonomous vehicle industry. Next, they are expanding into the heart of AI technology with Uber AI Solutions. Given Uber’s exciting future and Wall Street’s current shortsightedness, now is a great opportunity to grab Uber shares at a compelling valuation. It is, after all, a carriage ride into the fog, and one must be prepared for whatever lurks within.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢 2.5th Anniversary GLUPY LIVE Rewards 🎁

2026-02-02 05:32