Nvidia, one gathers, has enjoyed a rather profitable few years. From 2023 to 2025, the shares ascended with a vigour that might have alarmed the more sensitive souls on the exchange. Though, like all ascensions, this one appears to be losing a little puff. A mere 39% increase in 2025 hardly suggests a company poised to colonise the heavens.

The question, of course, is whether this represents a pause for breath, or the inevitable plateau before a rather unpleasant descent. Wall Street, ever optimistic, anticipates revenue growth of 63% for the fiscal year 2026. A perfectly respectable figure, certainly, but one wonders if the market has already priced in this bounty. The shares, one observes, have not exactly mirrored this exuberance.

A Modest Proposal

One is often told to ‘load up’ on such promising ventures. A vulgar phrase, naturally, but it conveys the sentiment. If one were inclined to speculate – and, in this business, one rather is – now would seem a reasonable moment to accumulate a position. The continued expansion of their graphics processing units, these ‘GPUs’ as they are called, suggests a demand that is, at least for the moment, undiminished. Nvidia itself assures us this ‘artificial intelligence computing megatrend’ will persist, at least until 2030. One assumes they have a vested interest in saying so.

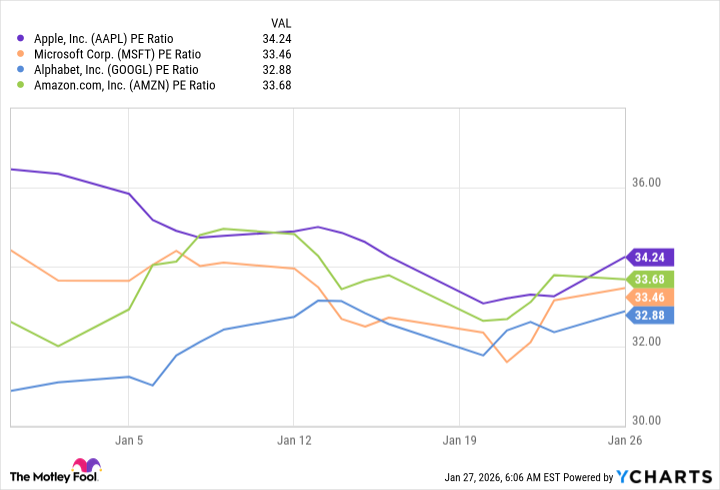

Analysts, those reliable soothsayers, predict earnings per share of $7.66 next year. A tidy sum, though one must always approach such projections with a degree of skepticism. The crucial question, naturally, is valuation. The usual suspects – the large, established technology companies – trade at roughly similar price-to-earnings ratios. A multiple of 33 times earnings seems, on the surface, a fair assessment.

Applying this multiple yields a price of $253 by the end of the fiscal year. A gain of 35%, which, while respectable, hardly qualifies as a revolution. However, to value Nvidia on par with its peers would be, frankly, a mistake. None of them, after all, are experiencing quite the same velocity of growth. The current price-to-earnings ratio of 46, while seemingly extravagant, appears, in this context, almost… justified.

Maintaining this multiple would value the shares at $352, representing a return of 87%. A rather more compelling proposition. One is presented, therefore, with a floor of 35% and a ceiling of 87%. A most agreeable range, wouldn’t you agree? It is this, then, that leads one to believe Nvidia warrants consideration. A strong buy, perhaps, though one should always remember the cardinal rule: never risk more than one can afford to lose. Especially when dealing with such… volatile enterprises.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- Gold Rate Forecast

2026-02-02 04:34