The pursuit of predictive advantage in the markets resembles, perhaps, the cartography of a shifting desert. We chart the dunes, believing we discern patterns, only to find the landscape altered by the very act of observation. Recent inquiries into the infrastructure supporting the burgeoning intelligence of machines—a phenomenon some scholars, in a fit of anachronistic enthusiasm, term ‘Artificial’—suggest a curious concentration of potential within a seemingly unremarkable entity: Marvell Technology. This is not a proclamation of certainty, merely a note from the edge of the possible, transcribed from a series of probabilistic simulations.

The conventional wisdom directs attention toward the more visible constellations—Nvidia, Broadcom, TSMC, Micron—each a luminous body in the digital firmament. But the true architecture of power often resides in the supporting structures, the hidden conduits that channel the flow. Marvell, it appears, is constructing such a conduit, specializing in application-specific integrated circuits (ASICs). These are not the general-purpose engines of computation, but bespoke instruments, crafted for a singular purpose: accelerating the processes of machine learning. Consider them the specialized lenses through which the digital eye perceives the world.

The market for these custom ASICs, as estimated by certain…reliable sources within the Bloomberg archive, is projected to expand at a compound annual rate of 27% through 2033, culminating in a revenue stream of $118 billion. Marvell, if these projections hold—and such projections, like all attempts to capture the future, are inherently fragile—is poised to capture a significant portion, perhaps 20 to 25 percent. This would translate into an annual revenue of $23.6 to $29.5 billion, a figure that dwarfs their recent performance. It is a transformation worthy of the alchemists, though achieved through the more mundane, yet equally mysterious, process of semiconductor fabrication.

Their advantage, it seems, lies in established relationships with the hyperscalers—Amazon and Microsoft, among others. But it is not merely a matter of patronage. Marvell does not simply provide the processors; they furnish the entire nervous system—the networking and storage components that bind the data centers together. They envision an addressable market growing at 35% annually, reaching $94 billion by 2028. This is not a linear progression, but an exponential curve, a fractal unfolding of possibility. They currently supply 18 custom processor designs to these clients and anticipate expanding that number to over 50. The implications are self-evident.

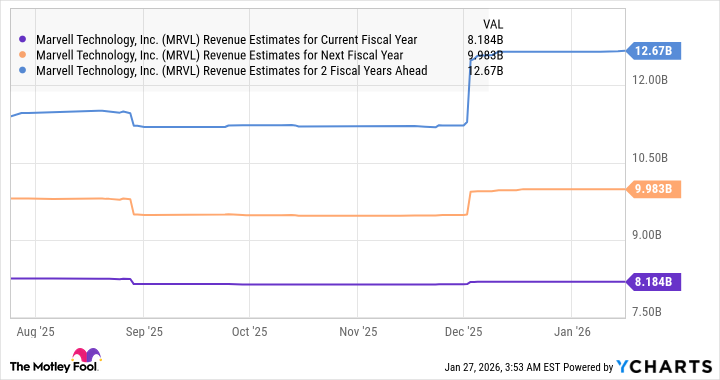

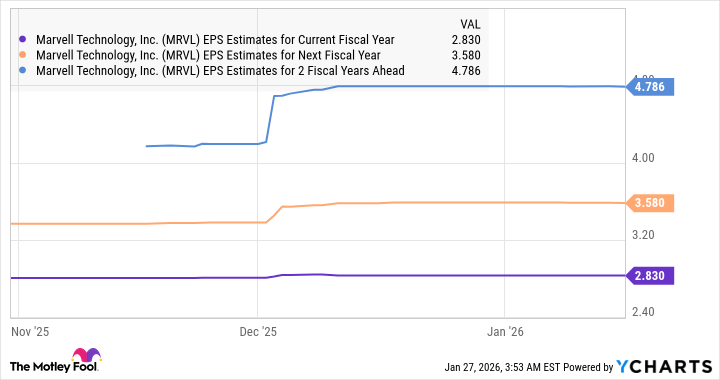

The valuation, at 22 times forward earnings, presents a momentary respite from the prevailing exuberance. A slight discount to the Nasdaq-100’s multiple of 26. This is not a guarantee of future performance, but a point of relative attractiveness in a market increasingly divorced from fundamental reality. Earnings are projected to increase by 80% in the current fiscal year, followed by sustained growth. It is a pattern, a repetition of success, a faint echo of order within the chaos.

One is reminded of the Library of Babel, Borges’s infinite repository of all possible books. Within its countless volumes lie not only nonsense, but also the seeds of truth. Marvell, in this analogy, is not the author of a single, definitive text, but the architect of the shelving system, the one who ensures that the relevant volumes are accessible. It is a subtle distinction, but one that may prove crucial in the years to come. Whether this proves to be a prescient observation or merely another phantom in the data stream remains to be seen. The desert, after all, is always shifting.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- ‘A Charlie Brown Thanksgiving’ Tops Apple TV+’s Top 10 Most-Watched Movies List This Week

2026-02-02 03:12