Hark, gentle investors! ‘Tis a common ailment, this urge to deploy a meager five hundred crowns – or, in our modern parlance, dollars – into the swirling vortex of the market. One might as well attempt to fill a sieve with water, yet the illusion of control, the phantom promise of riches, proves irresistible. I shall, with a heavy heart and a skeptical eye, present three companies upon which to squander your funds, not with the expectation of gain, but as a study in human folly. Let us proceed, then, as one examines a troupe of players, each with their particular brand of pretense.

Nvidia: The Alchemist’s Dream

First, we have Nvidia (NVDA 0.72%), currently valued at a princely sum of one hundred and ninety dollars per share. This company, it seems, has stumbled upon the modern equivalent of the philosopher’s stone: the graphics processing unit. They claim it powers the artificial intelligence that shall reshape our world. A bold claim, indeed! One might ask, is it genuine progress, or merely a new form of smoke and mirrors? The market, ever susceptible to flattery, has crowned Nvidia the largest company by market capitalization. A fleeting glory, I suspect, built upon the shifting sands of technological hype.

Analysts, those oracles of the obvious, foresee a sixty-seven percent growth in the coming quarter, and a fifty-two percent surge for the year. Such numbers, while impressive to the uninitiated, merely demonstrate the boundless capacity of mankind to inflate bubbles. Should this “AI buildout,” as they call it, falter, Nvidia’s lofty perch will prove most precarious. But let us not dwell on unpleasant possibilities. For now, the music plays, and the players dance.

PayPal: The Diligent Servant

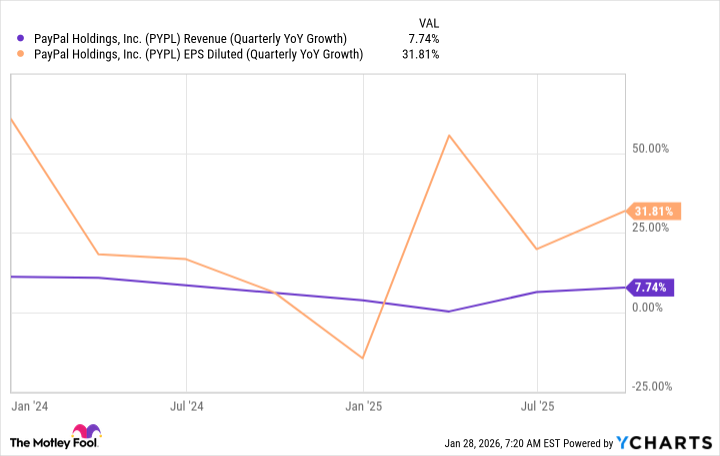

Now, we turn to PayPal (PYPL 0.79%), a company that embodies the virtues of… well, diligent mediocrity. While Nvidia chases the fantastical, PayPal toils in the mundane realm of digital payments, achieving a modest, single-digit growth. A humble existence, to be sure, but not without its merits. Management, recognizing their limitations, employs the age-old tactic of share repurchase, attempting to conjure growth from thin air. A clever trick, perhaps, but one that ultimately masks a lack of genuine innovation.

Despite its unremarkable performance, PayPal’s stock trades at a mere ten times forward earnings. A bargain, they say? Perhaps. Or perhaps a reflection of its limited potential. Still, one cannot fault their dedication to squeezing every drop of value from their enterprise. It is a slow dance, to be sure, but a dance nonetheless.

Amazon: The Grand Merchant

Finally, we arrive at Amazon (AMZN 1.02%), a company that has mastered the art of commerce, and the art of self-promotion. Last year, it underperformed the market, a rare stumble for this behemoth. Yet, the faithful remain convinced that 2026 will bring a resurgence. Their cloud computing business, they claim, is about to accelerate, while their commerce segments continue to thrive. A plausible scenario, to be sure, but one predicated on the relentless pursuit of market dominance.

Amazon, like all powerful empires, is built upon a foundation of ambition and ruthlessness. It is a force to be reckoned with, certainly, but not immune to the vagaries of fate. Should the economy falter, or a rival emerge, even Amazon could find its fortunes reversed. But for now, the company sails onward, a majestic vessel upon the turbulent seas of commerce. We shall see, on February 5th, what the coming year holds for this grand merchant, but I suspect it will be a year of continued, if unspectacular, progress.

Thus concludes our little drama. Five hundred dollars, dispersed among these three players. A modest investment, perhaps, but a revealing one. It demonstrates, once again, the enduring human capacity for hope, delusion, and the unwavering belief that, somehow, we can outsmart the market. A charming folly, indeed.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Elden Ring Nightreign stats reveal FromSoftware survivorship bias, suggesting its “most deadly” world bosses had their numbers padded by bruised loot goblins

2026-02-01 22:22