Now, gather ’round, if you please, and let me tell you a tale about a little company called Micron. They ain’t sellin’ snake oil, mind you, but memory chips – the sort of thing that keeps all this newfangled “artificial intelligence” from sputterin’ out like a damp firecracker. Without these chips, this AI hullabaloo wouldn’t get past the notion stage, and frankly, that might be a mercy.

Micron, you see, is one of the biggest suppliers of these memory bits, not just for those colossal data centers where all the brainy folks are conjurin’ up these digital ghosts, but also for your everyday contraptions – the pocket calculators with pictures, and the parlor machines. They’ve been doin’ right well for themselves, makin’ a pretty penny off this AI craze. In fact, last year, their stock jumped higher than a frog in a heatwave – a 239% increase, if you’re keepin’ score. And this year? Well, they’re at it again, already up another 29% in January alone. Folks are askin’ if this climb can continue, and that, my friends, is the question of the hour.

A Rush on the Shiny Bits

Now, these “graphics processin’ units” – what they call GPUs – they’re the workhorses of this AI operation. They do the heavy liftin’, but they need a steady supply of information, like a fella needs water in the desert. That’s where Micron comes in with their high-bandwidth memory – HBM, they call it. It’s like a private express lane for data, keepin’ those GPUs fed and happy. Without it, those GPUs would be stallin’ and complainin’, and that wouldn’t do at all.

Micron’s HBM3E chips hold 50% more data than the competition, and use 30% less electricity. That’s a powerful combination, and both Nvidia and Advanced Micro Devices are grabbin’ ’em up as fast as Micron can make ’em. They’re even preparin’ to unleash HBM4E, which promises another 60% capacity boost and 20% energy savin’s. The entire supply for this year is already spoken for – a sight that’d make a banker weep with joy.

Micron’s CEO, a fella named Mehrotra, reckons the market for this data center HBM will triple by 2028, to over $100 billion a year. That’s a heap of money, enough to build a town, or maybe even two. But there’s also a good bit to be made in memory chips for your everyday gadgets, as more and more AI trickles down to your pocket calculators and parlor machines.

Last quarter, 59% of the flagship smartphones needed at least 12 gigabytes of memory just to run these AI applications. That’s more than double what it was last year. Seems folks are demandin’ more and more from their pocket contraptions, and Micron is there to supply the bits and bytes.

Profits Bloom Like Desert Flowers

Micron’s total revenue soared 56% to a record $13.6 billion last quarter. Their cloud memory segment – that’s where they sell these HBM chips – brought in about $5.3 billion, twice as much as last year. It’s a good time to be in the memory business, let me tell you.

There’s a shortage of HBM, and Micron’s supply is sellin’ out so fast they can hardly keep up. That gives ’em a powerful advantage, allowin’ ’em to charge a pretty penny for their wares. Their earnings jumped 175% to $4.60 a share, and they’re predictin’ even faster growth ahead.

They’re forecastin’ revenue to rocket up another 132% to $18.7 billion next quarter, with earnings climbin’ to $8.19 a share. That’s a sight that’d make a Wall Street broker dance a jig. Investors are re-evaluatin’ Micron in light of these projections, and that’s why the stock’s been climbin’ like a mountain goat.

How High Can This Foolish Ride Go?

The semiconductor industry has always been a bit like a seesaw – boom and bust, feast and famine. Companies would spend a fortune buildin’ factories, then sit idle for years waitin’ for the next upgrade cycle. But this AI business is different. These data centers need constant upgrades, buyin’ new chips every year. It’s a perpetual motion machine, at least for now.

Micron’s stock is positioned to keep climbin’ as long as this cycle continues. Nvidia’s CEO, a fella named Huang, believes infrastructure spendin’ will keep growin’ for years, with data centers potentially investin’ up to $4 trillion a year by 2030. That’s a tailwind that’d fill the sails of any ship, and Micron’s right in the path of it.

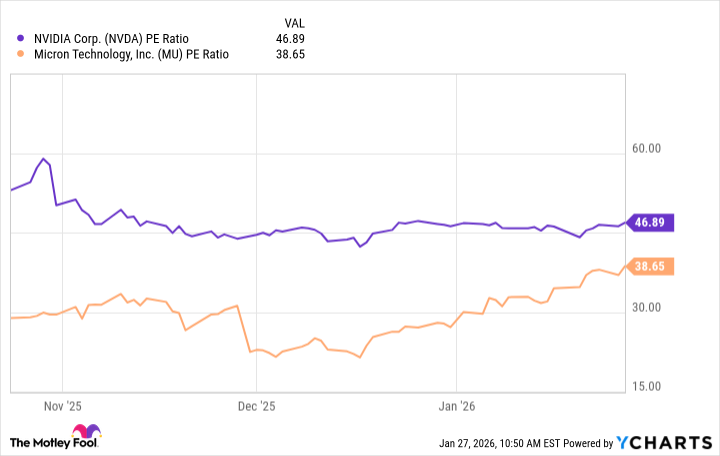

Based on their earnin’s over the last year, Micron’s stock is tradin’ at a price-to-earnin’s ratio of 38.6. That’s not too bad, but Nvidia’s tradin’ at 46.8. Seems folks are willin’ to pay a premium for the hot hand.

But look closer. Wall Street expects Micron’s earnin’s to soar to $33.17 a share next year, givin’ it a forward price-to-earnin’s ratio of just 12.2. From that perspective, it looks like a bargain. Shares would have to triple just to maintain the current price-to-earnin’s ratio.

Now, I ain’t sayin’ that’s likely to happen. Wall Street knows no company can grow at this pace forever, and investors might want to temper their expectations. But even if Micron’s stock doesn’t triple this year, it’s still likely to outperform the market, just like it did last year. It’s a foolish ride, to be sure, but a profitable one, at least for the time bein’.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢【Browndust2 at SDCC 2025】Meet Our Second Cosplayer!

2026-02-01 19:33