Old Mr. Buffett, you see, he’s been collecting companies like some folks collect stamps. For sixty years, this rather clever chap steered Berkshire Hathaway, and turned it into a mountain of money – a proper, gigantic pile! He’s hung up his boots now, but the good habits, the clever little tricks, they linger on. If you’re looking for a couple of shares to tuck away for a rainy day, or perhaps a rather splendid holiday, these two investments are worth a peek.

1. Visa: The Everywhere Card

Visa isn’t the biggest sweet in Berkshire’s jar, not by a long shot (a mere 0.9% of the total), but it’s a reliable one. Old Buffett was always going on about ‘moats’ – not the watery kind, mind you, but things that keep the competitors at bay. Visa’s moat is its reach. It’s everywhere!

Two hundred and twenty countries and territories, fourteen thousand five hundred financial institutions trusting it, a whopping one hundred and seventy-five million merchants accepting it… and in the last twelve months, it’s shuffled around 329 billion transactions. That’s a lot of pennies changing hands, wouldn’t you say?

The clever part is this: Visa doesn’t actually make the cards. No, sir. It’s like a magical network that lets other companies – Chase, Wells Fargo, Bank of America – do the dirty work. Visa just takes a tiny little slice from each transaction.

And here’s the really sneaky bit. If some silly sausage can’t pay their credit card bill, it’s Chase who takes the thump, not Visa. They’re the ones left holding the empty bag! It’s a brilliant little arrangement, really. Like a mischievous imp hiding behind a curtain.

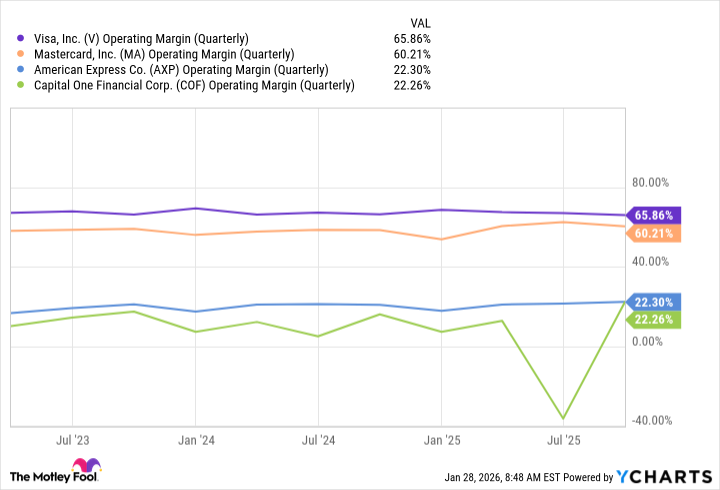

This means Visa can run things with very little fuss, and once that network is humming, adding another transaction costs practically nothing. It’s a bit like a greedy goblin, endlessly collecting shiny coins.

The world is slowly but surely ditching cash and embracing cards and digital payments. And as that happens, Visa will be gobbling up a bigger and bigger share of the pie. More transactions mean more revenue, and it solidifies its position as the king of the payment jungle.

Visa is currently priced at 32.2 times its earnings, which isn’t cheap, but it’s less than usual. It might not shoot for the stars overnight, but it remains a solid long-term investment, a dependable little workhorse.

2. Coca-Cola: The Bubbly Brew

Coca-Cola is one of Berkshire Hathaway’s oldest sweethearts, and I wouldn’t be surprised if it stayed that way for a good long time. It’s a proper, classic investment, like a well-worn teddy bear.

Two things make Coca-Cola special: its brand and its dividend. You could travel to the most remote corner of the earth, and you’d still find a bottle of Coke. That takes serious distribution and decades of clever marketing. It’s practically inescapable!

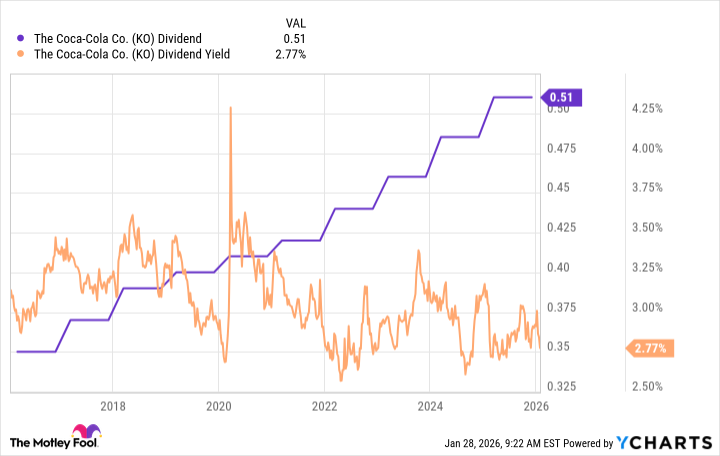

And the dividend? Oh, the dividend! Coca-Cola has been increasing its dividend every year for sixty-three years! That makes it a ‘Dividend King’ – a company that’s been showering its shareholders with goodies for half a century. It’s a testament to its consistency and generosity.

Over the last decade, the dividend has grown by over 45%. It might not sound like much, but for a company that’s been paying a dividend for as long as it has, it’s rather impressive. It’s like a friendly old dragon, steadily accumulating treasure.

You’d be hard-pressed to find a place where you can’t find Coca-Cola products. This wide distribution is thanks to its clever business model. Coca-Cola doesn’t usually sell directly to you and me. Instead, it sells syrups and concentrates to bottling partners around the globe, who then make the finished product and distribute it.

Having local companies handle distribution is much more efficient. They know the local shops, the delivery routes, the little quirks of each market. It’s much harder to manage all that from a corporate office thousands of miles away.

Coca-Cola isn’t an investment you make expecting to get rich quick. It’s a stock you invest in for the income, a steady stream of dividends. It routinely yields more than double the average of the S&P 500. It’s a bit like a comfortable rocking chair, providing a gentle, predictable rhythm.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Elden Ring Nightreign stats reveal FromSoftware survivorship bias, suggesting its “most deadly” world bosses had their numbers padded by bruised loot goblins

2026-02-01 14:22