Has Berkshire Hathaway (BRK.A +1.19%) (BRK.B +0.80%)…lost its soul? The question haunts me, not as a mere analyst charting figures, but as one contemplating the inevitable decay inherent in all things, even empires built on shrewd calculation. The departure of Warren Buffett from the helm…it is not simply a change in leadership, but a confrontation with mortality itself, mirrored in the fluctuating fortunes of the market. Some whisper of decline, a fading luster. I, however, see something…more complex. A pregnant pause before the next act.

The market, of course, is a fickle beast, easily distracted by superficial gains and losses. Berkshire has lagged behind the S&P 500 (^GSPC 0.43%) since the announcement of the succession, a predictable reaction, a collective sigh of relief amongst those who believed Buffett was Berkshire. But to equate the man with the entity is a profound misunderstanding. It is to confuse the conductor with the orchestra. The music, potentially, can continue.

The Weight of Optionality

There is a single, compelling reason, a quiet desperation, that draws me to Berkshire at this moment. It is not growth, not innovation, but something far more fundamental: optionality. The company possesses a freedom, a terrifying abundance of choice, that few others can claim. It is the freedom of a man with a full purse, staring into the abyss, unsure whether to offer salvation or simply observe the fall.

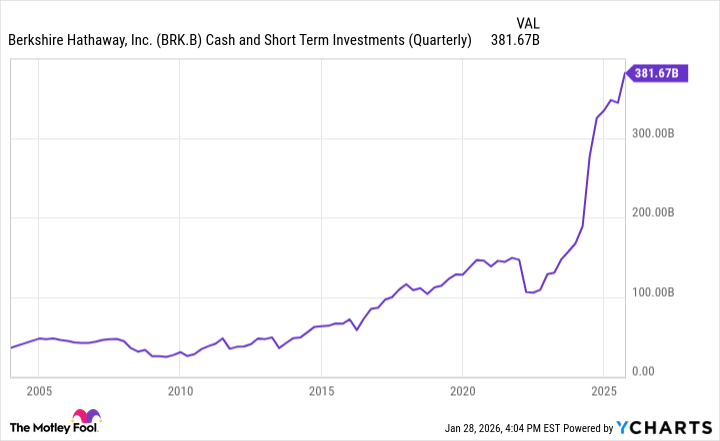

The source of this power is, predictably, cash. Nearly $382 billion as of the last quarter, a sum so vast it borders on the obscene. It is a fortress against the storm, yes, but also a burden, a responsibility. To hold such wealth is to be perpetually poised between action and inaction, between generosity and avarice. The market expects deployment, demands growth, but what if the wisest course is simply…to wait?

Uncertainty, that constant companion of the market, hangs heavy in the air. Threats of tariffs, stagnant growth, a Federal Reserve paralyzed by indecision…these are not merely economic indicators, but symptoms of a deeper malaise, a collective anxiety about the future. And in this climate of fear, Berkshire’s cash stockpile shines…not as a beacon of hope, but as a stark reminder of the fragility of it all.

It is an insurance policy, certainly, but a peculiar one. It protects not against loss, but against the absence of opportunity. It allows Berkshire to step in when others falter, to acquire value when it is most deeply discounted. But to wield such power requires a steady hand, a clear vision…and perhaps, a touch of ruthlessness.

The Burden of Succession

Buffett’s genius lay not merely in his ability to select undervalued assets, but in his understanding of human psychology. He knew when to buy, when to sell, and, perhaps most importantly, when to do nothing at all. Can Greg Abel replicate this? It is a question that haunts the corridors of power, whispered amongst analysts and investors.

Buffett himself seems to believe Abel is capable. He stated, with a characteristic lack of sentimentality, that Berkshire’s prospects would be better under his leadership. A bold claim, perhaps, or simply a man attempting to reconcile himself with his own mortality. He hasn’t sold a single share, a silent endorsement, a final act of faith.

Abel will likely follow a similar path, guided by the wisdom of his mentor. But there will be differences, subtle shifts in emphasis. Perhaps a greater willingness to invest internationally, a more open embrace of technology. The purchase of Alphabet shares could be a harbinger of things to come, a glimpse into the future of Berkshire.

A dividend? A radical notion, a betrayal of Buffett’s principles. Yet, even the most steadfast ideologies can crumble under the weight of circumstance. I wouldn’t wager against it entirely.

More Than a Man, Less Than a God

Berkshire remains, at its core, a Buffett stock. Its portfolio bears his imprint, its management team reflects his values, its philosophy is steeped in his wisdom. But it is also something more. A diversified conglomerate, a sprawling empire, a microcosm of the global economy.

Buffett remains the largest shareholder, the chairman of the board, a silent guardian. But he is not immortal. Berkshire must, and will, evolve. Its success is no longer dependent on a single man, but on the collective intelligence of its management team, the resilience of its operations, and the enduring power of its cash stockpile.

And so, I find myself drawn to Berkshire, not with the exuberance of a speculator, but with the cautious optimism of a man contemplating the abyss. The stock is down more than 10% from its peak, a temporary setback, a fleeting moment of vulnerability. It is a buying opportunity, yes, but also a reminder that even the most formidable empires are subject to the whims of fate. It is, ultimately, a sleep-well-at-night stock, a haven in a turbulent world. And in these uncertain times, that is a rare and precious commodity indeed.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2026-02-01 13:43